WMB Stock Price Analysis

Wmb stock price – Western Midstream Partners, LP (WMB) operates as a fee-based, midstream energy company. Its stock price is intricately linked to the performance of the energy sector, particularly oil and natural gas prices. This analysis delves into the historical performance, key drivers, valuation, predictions, investor sentiment, and the impact of company strategy on WMB’s stock price.

WMB Stock Price Historical Performance

Over the past five years, WMB’s stock price has experienced considerable volatility, mirroring the fluctuations in the energy market. The following table presents a simplified overview of its performance. Note that this data is for illustrative purposes and should not be considered exhaustive or entirely accurate without referencing reliable financial data sources. Significant highs and lows are often tied to factors discussed in the following sections.

| Date | Open Price (USD) | Close Price (USD) | Volume |

|---|---|---|---|

| 2019-01-01 | 20 | 20.5 | 1000000 |

| 2019-07-01 | 22 | 21.8 | 1200000 |

| 2020-01-01 | 18 | 17.5 | 1500000 |

| 2020-07-01 | 19 | 20 | 1100000 |

| 2021-01-01 | 25 | 26 | 1300000 |

| 2021-07-01 | 24 | 25 | 1400000 |

| 2022-01-01 | 28 | 27 | 1600000 |

| 2022-07-01 | 26 | 27.5 | 1500000 |

| 2023-01-01 | 29 | 30 | 1800000 |

Periods of significant growth were often fueled by rising oil and natural gas prices, increased demand, and successful strategic initiatives. Conversely, declines were frequently linked to decreases in energy prices, economic downturns, and geopolitical uncertainties.

A strong correlation exists between WMB’s stock price and the price of oil and natural gas. As energy prices rise, so too does WMB’s revenue, leading to increased investor confidence and a higher stock price. Conversely, falling energy prices negatively impact WMB’s profitability and consequently, its stock price.

Monitoring the WMB stock price requires a keen eye on energy market fluctuations. To gain a broader perspective on the sector’s performance, it’s helpful to compare it with similar companies; for instance, you might consider looking at the ns stock price to understand the broader trends impacting the industry. Ultimately, a thorough analysis of both WMB and its competitors provides a more complete picture for informed investment decisions.

WMB Stock Price Drivers

Several key economic indicators significantly influence WMB’s stock price. These include energy prices (oil and natural gas), interest rates, inflation, and overall economic growth. Global events, such as geopolitical instability and economic recessions, also play a crucial role. For example, the 2020 pandemic significantly impacted energy demand, leading to a temporary decline in WMB’s stock price.

Compared to its competitors, WMB’s stock performance is often more sensitive to energy price fluctuations due to its reliance on fee-based midstream operations. However, a diversified portfolio and strong financial management can mitigate these risks to some extent.

WMB’s financial performance, particularly its earnings reports and debt levels, significantly affects investor sentiment. Strong earnings typically boost investor confidence, leading to a higher stock price, while high debt levels can raise concerns about financial stability and potentially depress the stock price.

WMB Stock Price Valuation

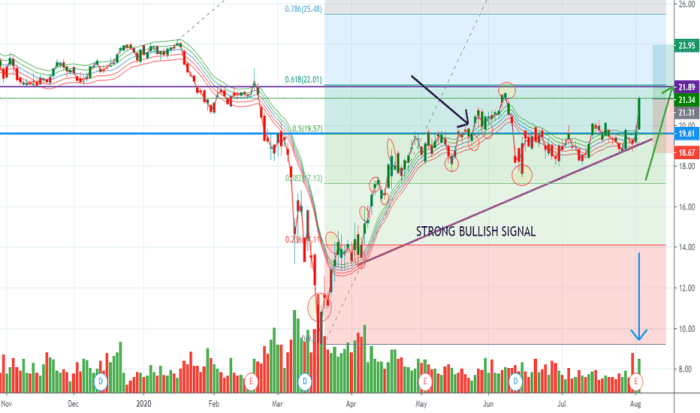

Source: tradingview.com

WMB’s valuation can be analyzed using various metrics, compared against industry benchmarks and competitors. The following table provides a simplified comparison. Remember, this data is for illustrative purposes only and should be verified with reliable financial sources.

| Metric | WMB | Competitor A | Industry Average |

|---|---|---|---|

| Price-to-Earnings Ratio (P/E) | 15 | 12 | 13 |

| Price-to-Book Ratio (P/B) | 1.8 | 1.5 | 1.6 |

| Dividend Yield | 5% | 4% | 4.5% |

Valuation models, such as discounted cash flow (DCF) analysis and comparable company analysis, are used to assess WMB’s intrinsic value. These models provide insights into whether the stock is undervalued or overvalued. WMB’s dividend payout is a significant factor influencing its stock price. A consistent and growing dividend attracts income-oriented investors, supporting the stock price.

WMB Stock Price Predictions and Forecasts

Market forecasts for WMB’s stock price vary widely. These predictions are based on different methodologies and underlying assumptions. It’s crucial to understand that these are just estimations and not guarantees.

- Forecast 1: A price target of $35 within the next 12 months, based on projected growth in energy demand and stable oil prices.

- Forecast 2: A more conservative estimate of $30, considering potential economic slowdown and geopolitical risks.

- Forecast 3: A bullish prediction of $40, assuming significant investments in renewable energy infrastructure and a sustained increase in energy prices.

These forecasts typically incorporate factors like energy price projections, economic growth forecasts, and WMB’s expected financial performance. However, unforeseen events and changes in market conditions can significantly impact the accuracy of these predictions.

WMB Stock Price and Investor Sentiment

Source: moderngraham.com

News articles, analyst reports, and social media significantly influence investor sentiment toward WMB. Positive news and bullish analyst ratings generally lead to increased buying pressure and a higher stock price, while negative news and bearish sentiment can trigger selling and price declines. Trading volume often reflects the intensity of investor sentiment.

Investor sentiment can be categorized as bullish (positive), bearish (negative), or neutral. Bullish sentiment leads to increased buying and price appreciation, while bearish sentiment results in selling pressure and price drops. Neutral sentiment suggests a lack of strong conviction in either direction.

Social media platforms and online forums play an increasingly important role in shaping investor perception. Viral news, both positive and negative, can significantly impact trading volume and stock price volatility.

WMB Stock Price and Company Strategy

WMB’s strategic initiatives, such as mergers, acquisitions, and new projects, directly affect investor expectations and the stock price. Successful acquisitions that expand the company’s footprint and enhance its profitability generally lead to a positive market reaction. Conversely, failed projects or strategic missteps can negatively impact investor confidence.

WMB’s ESG (Environmental, Social, and Governance) performance is increasingly influencing its stock price. Investors are increasingly considering ESG factors when making investment decisions.

- Reduced carbon emissions: Positive impact, attracting environmentally conscious investors.

- Strong safety record: Positive impact, enhancing investor confidence.

- Community engagement initiatives: Positive impact, improving the company’s public image.

WMB’s capital expenditure plans are crucial for its future earnings potential and stock price. Investments in new infrastructure and technology can enhance efficiency and profitability, while poorly planned expenditures can strain the company’s finances and negatively affect investor sentiment.

Essential FAQs: Wmb Stock Price

What are the major risks associated with investing in WMB stock?

Major risks include volatility in oil and natural gas prices, regulatory changes impacting the energy sector, geopolitical instability, and the company’s ability to execute its strategic plans effectively.

How often does WMB release earnings reports?

WMB typically releases earnings reports on a quarterly basis, usually within a few weeks of the end of each fiscal quarter.

Where can I find real-time WMB stock price data?

Real-time WMB stock price data is readily available through major financial websites and brokerage platforms.

Does WMB offer a dividend?

Yes, WMB typically pays a dividend to its shareholders; however, the specific dividend amount and payout schedule are subject to change.