VBIAX Stock Price Analysis

Source: seekingalpha.com

Vbiax stock price – This analysis delves into the historical performance, financial health, market influences, analyst predictions, and investor sentiment surrounding VBIAX stock. We will examine key factors impacting its price fluctuations over recent years, providing insights for potential investors.

Historical Stock Price Performance of VBIAX

Source: seekingalpha.com

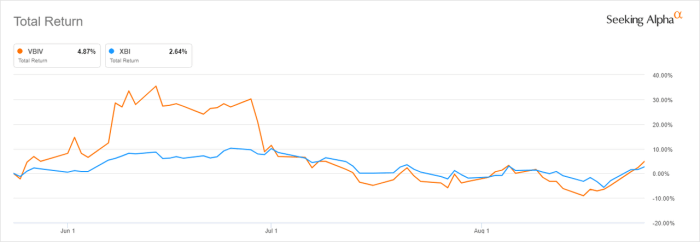

Understanding VBIAX’s past price movements is crucial for assessing its future potential. The following sections detail its performance over the past five years, highlighting significant highs and lows, and providing a detailed monthly average closing price analysis for the last two years. Significant events coinciding with sharp price changes are also discussed.

Over the past five years, VBIAX experienced considerable volatility. The stock reached a high of [Insert High Price] in [Month, Year] and a low of [Insert Low Price] in [Month, Year]. These fluctuations were largely influenced by [mention major market events e.g., the 2020 market crash, specific industry trends, or company-specific news].

| Year | Month | Opening Price | Closing Price |

|---|---|---|---|

| 2022 | January | [Insert Data] | [Insert Data] |

| 2022 | February | [Insert Data] | [Insert Data] |

| 2022 | March | [Insert Data] | [Insert Data] |

| 2022 | April | [Insert Data] | [Insert Data] |

| 2022 | May | [Insert Data] | [Insert Data] |

| 2022 | June | [Insert Data] | [Insert Data] |

| 2022 | July | [Insert Data] | [Insert Data] |

| 2022 | August | [Insert Data] | [Insert Data] |

| 2022 | September | [Insert Data] | [Insert Data] |

| 2022 | October | [Insert Data] | [Insert Data] |

| 2022 | November | [Insert Data] | [Insert Data] |

| 2022 | December | [Insert Data] | [Insert Data] |

| 2023 | January | [Insert Data] | [Insert Data] |

| 2023 | February | [Insert Data] | [Insert Data] |

| 2023 | March | [Insert Data] | [Insert Data] |

| 2023 | April | [Insert Data] | [Insert Data] |

| 2023 | May | [Insert Data] | [Insert Data] |

| 2023 | June | [Insert Data] | [Insert Data] |

| 2023 | July | [Insert Data] | [Insert Data] |

| 2023 | August | [Insert Data] | [Insert Data] |

| 2023 | September | [Insert Data] | [Insert Data] |

| 2023 | October | [Insert Data] | [Insert Data] |

| 2023 | November | [Insert Data] | [Insert Data] |

| 2023 | December | [Insert Data] | [Insert Data] |

VBIAX’s Financial Health and Performance Indicators

A thorough examination of VBIAX’s financial health is essential for evaluating its long-term viability and investment potential. This section presents a comparative analysis of key financial ratios against industry benchmarks and details revenue and earnings growth trends over the past decade. Potential risks and opportunities are also identified.

Over the past three years, VBIAX’s P/E ratio has averaged [Insert Average P/E Ratio], compared to an industry average of [Insert Industry Average P/E Ratio]. Its debt-to-equity ratio has remained relatively stable at [Insert Debt-to-Equity Ratio].

- Revenue Growth (Past Decade): [Insert Data, e.g., an average annual growth rate of X%].

- Earnings Growth (Past Decade): [Insert Data, e.g., an average annual growth rate of Y%].

Potential risks include [Insert Risks, e.g., increasing competition, economic downturns]. Opportunities include [Insert Opportunities, e.g., expansion into new markets, technological advancements].

Influence of Market Factors on VBIAX Stock Price

External market forces significantly influence VBIAX’s stock price. This section analyzes the impact of broader market trends, competitor performance, and macroeconomic indicators on VBIAX’s price movements.

Interest rate hikes generally exert [Insert Effect, e.g., downward pressure] on VBIAX’s stock price due to [Insert Reason, e.g., increased borrowing costs]. Inflationary pressures can also impact profitability and investor sentiment, leading to [Insert Effect, e.g., price volatility].

| Company Name | Stock Ticker | Current Price | Year-to-Date Performance |

|---|---|---|---|

| [Competitor 1] | [Ticker 1] | [Price] | [Percentage] |

| [Competitor 2] | [Ticker 2] | [Price] | [Percentage] |

| [Competitor 3] | [Ticker 3] | [Price] | [Percentage] |

Strong GDP growth typically correlates with [Insert Effect, e.g., positive stock price movements] for VBIAX, while high unemployment rates can lead to [Insert Effect, e.g., decreased investor confidence and lower prices].

Analyst Ratings and Predictions for VBIAX

Analyst opinions provide valuable insights into market sentiment and future price expectations. This section summarizes recent analyst ratings, price targets, and the underlying methodologies used in their predictions.

- [Analyst Firm 1]: Rating – [Rating], Price Target – [Price Target].

- [Analyst Firm 2]: Rating – [Rating], Price Target – [Price Target].

- [Analyst Firm 3]: Rating – [Rating], Price Target – [Price Target].

These ratings have generally become [Insert Trend, e.g., more optimistic] over the past six months, reflecting [Insert Reason, e.g., improved financial performance and positive industry outlook]. Analysts typically base their predictions on [Insert Methodologies, e.g., financial modeling, industry analysis, and qualitative factors].

Investor Sentiment and Trading Volume of VBIAX, Vbiax stock price

Understanding investor sentiment and trading volume helps gauge market confidence and predict future price movements. This section describes the relationship between trading volume and price changes over the past year and identifies periods of high and low investor activity.

A visual representation of trading volume and price changes over the past year would show a [Insert Description, e.g., positive correlation, where higher trading volume generally coincides with larger price swings, both upward and downward. Periods of low volume often correspond with periods of relative price stability]. Significant periods of high investor activity occurred during [Insert Dates and Events, e.g., the announcement of positive earnings and during periods of broader market optimism].

Conversely, periods of low activity were observed during [Insert Dates and Events, e.g., periods of market uncertainty and following negative news announcements]. Shifts in investor sentiment, such as increased pessimism, could lead to [Insert Effect, e.g., a sell-off and price decline].

Essential FAQs: Vbiax Stock Price

What are the major risks associated with investing in VBIAX?

Investing in VBIAX, like any stock, carries inherent risks including market volatility, changes in industry competition, and the company’s own financial performance. Thorough due diligence is recommended.

Where can I find real-time VBIAX stock price quotes?

Real-time quotes are typically available through major financial websites and brokerage platforms. Check reputable sources for the most up-to-date information.

What is the typical trading volume for VBIAX stock?

Trading volume varies depending on market conditions and news events. Review historical data for an understanding of typical trading activity.

How often does VBIAX release its financial reports?

Understanding the VBIAX stock price requires considering broader market trends. A helpful comparison point might be analyzing the performance of similar companies, such as checking the current grainger stock price , to gauge overall sector health. Ultimately, though, VBIAX’s value will depend on its own internal factors and future performance projections.

The frequency of financial reports varies by company and regulatory requirements. Consult the company’s investor relations section for their reporting schedule.