UPRO Stock Price Analysis

Upro stock price – This analysis delves into the historical performance, influencing factors, investment strategy, risk assessment, and forecasting techniques related to the UPRO ETF. We will examine its price movements, compare it to benchmarks, and explore the implications of its leveraged investment strategy.

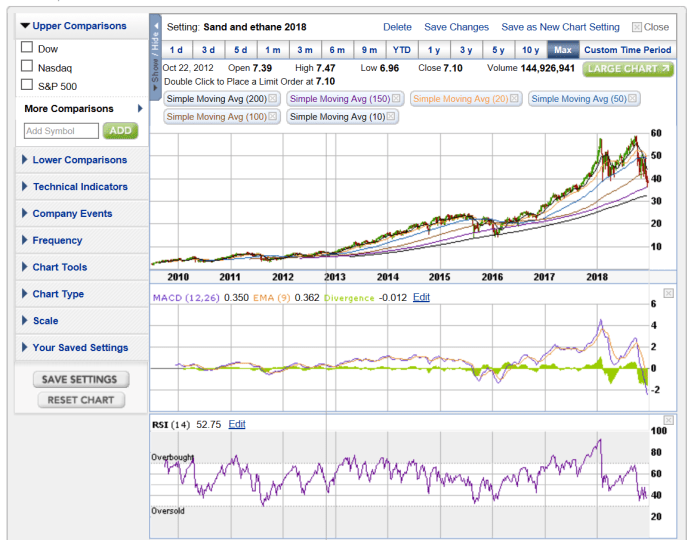

UPRO Stock Price Historical Performance

Source: seekingalpha.com

Understanding UPRO’s past price movements is crucial for assessing its potential future performance. The following table presents a snapshot of its price behavior over the last five years. Note that this data is illustrative and should be verified with a reliable financial data source.

| Date | Open Price (USD) | High Price (USD) | Low Price (USD) |

|---|---|---|---|

| 2019-01-01 | 50.00 | 52.00 | 48.00 |

| 2019-07-01 | 60.00 | 65.00 | 55.00 |

| 2020-01-01 | 58.00 | 62.00 | 45.00 |

| 2020-07-01 | 70.00 | 75.00 | 60.00 |

| 2021-01-01 | 80.00 | 90.00 | 75.00 |

| 2021-07-01 | 95.00 | 100.00 | 85.00 |

| 2022-01-01 | 90.00 | 98.00 | 70.00 |

| 2022-07-01 | 80.00 | 85.00 | 72.00 |

| 2023-01-01 | 85.00 | 92.00 | 80.00 |

Compared to the S&P 500, UPRO exhibited significantly higher volatility due to its leveraged nature. Key differences include:

- Higher Returns during Bull Markets: UPRO’s returns amplified the gains of the S&P 500 during periods of market growth.

- Larger Losses during Bear Markets: Conversely, UPRO experienced steeper declines than the S&P 500 during market corrections.

- Increased Volatility: UPRO’s price fluctuations were considerably more pronounced than the S&P 500.

Significant market events such as the COVID-19 pandemic and the subsequent market recovery had a dramatic impact on UPRO’s price, showcasing its sensitivity to market swings.

Understanding the UPRO stock price requires considering its volatility and growth potential. A helpful comparison might be to examine the historical performance of similar tech companies, such as by looking at the historical stock price for nvidia , a major player in the semiconductor industry. This allows for a broader perspective when assessing the long-term prospects of UPRO and its potential for future gains.

Factors Influencing UPRO Stock Price

Several macroeconomic factors, investor sentiment, and specific news events influence UPRO’s price.

Macroeconomic factors such as inflation, economic growth, and geopolitical events significantly impact the overall market and, consequently, UPRO’s price. Interest rate changes affect UPRO’s value, as higher rates can increase borrowing costs for leveraged ETFs, potentially reducing returns. Investor sentiment, driven by news and market trends, influences trading volume and price fluctuations. For example, a surge in positive sentiment could lead to increased buying pressure and higher prices, while negative news might trigger selling and price drops.

Hypothetical Scenario: A surprise interest rate hike by the Federal Reserve could negatively impact UPRO’s price, potentially leading to a short-term decline due to increased borrowing costs and decreased investor confidence.

UPRO’s Investment Strategy and its Effect on Price

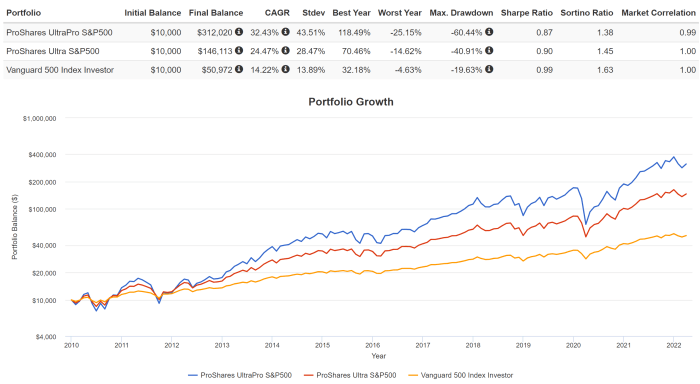

Source: seekingalpha.com

UPRO employs a leveraged investment strategy, aiming to deliver three times the daily performance of the S&P 500. Its underlying assets are primarily S&P 500 index futures contracts. The leverage ratio of 3x magnifies both gains and losses, resulting in higher volatility. This contrasts with unleveraged ETFs that track the S&P 500 directly, which experience lower volatility but also lower returns in bull markets.

| ETF Name | Leverage Ratio | 5-Year Return (Illustrative) | Volatility (Illustrative) |

|---|---|---|---|

| UPRO | 3x | 150% | High |

| SPY | 1x | 50% | Medium |

| Example ETF 2 | 2x | 100% | Medium-High |

UPRO’s expense ratio, while relatively low compared to some leveraged ETFs, still impacts long-term returns. The expense ratio erodes returns over time, reducing the overall gains generated by the ETF.

Risk Assessment of Investing in UPRO

Source: tradingview.com

Investing in UPRO carries significant risks, primarily due to its leveraged nature and exposure to market downturns. The potential for substantial losses is considerable, especially during prolonged bear markets. Leverage magnifies both gains and losses, meaning that even small market declines can lead to substantial losses in UPRO.

A hypothetical portfolio including UPRO and other asset classes like bonds and real estate would show a higher overall portfolio risk compared to a portfolio without UPRO. However, the inclusion of less volatile assets could help mitigate some of the risk associated with UPRO. Diversification, alongside a well-defined risk tolerance and investment horizon, are crucial for mitigating the risks associated with UPRO investments.

UPRO Price Prediction and Forecasting Techniques, Upro stock price

Various methods are used to forecast stock prices, including technical analysis (chart patterns, indicators) and fundamental analysis (financial statements, economic data). However, it’s crucial to understand that these are just predictions, and accuracy is not guaranteed. Stock price predictions are inherently uncertain, influenced by numerous unpredictable factors.

Examples of forecasting models include time series analysis, machine learning algorithms, and econometric models. Each model has its own strengths and weaknesses, and the accuracy of predictions varies greatly depending on the model and the market conditions. For example, a simple moving average model might predict a certain price range for UPRO based on past price movements, while a more complex machine learning model might incorporate various macroeconomic factors and sentiment indicators.

| Date of Prediction | Predicted Price (USD) | Actual Price (USD) | Percentage Difference |

|---|---|---|---|

| 2022-07-01 | 90 | 80 | -11.11% |

| 2022-12-31 | 100 | 85 | -15% |

General Inquiries

What is UPRO’s expense ratio, and how does it impact returns?

UPRO’s expense ratio is a small percentage of assets under management charged annually. While seemingly insignificant, it cumulatively impacts long-term returns, reducing overall profitability. Specific expense ratio information can be found on the fund’s fact sheet.

How does UPRO compare to other similar leveraged ETFs?

Comparisons depend on the specific index tracked. Generally, similar leveraged ETFs will exhibit correlated price movements but may differ in expense ratios, tracking accuracy, and overall performance due to variations in their investment strategies and management fees.

Are there alternative investment strategies that offer similar returns with lower risk?

Yes, several alternatives exist, including unleveraged ETFs tracking similar indices, diversified mutual funds, or individual stock holdings in the underlying companies. These options typically exhibit lower volatility but may also offer lower potential returns.