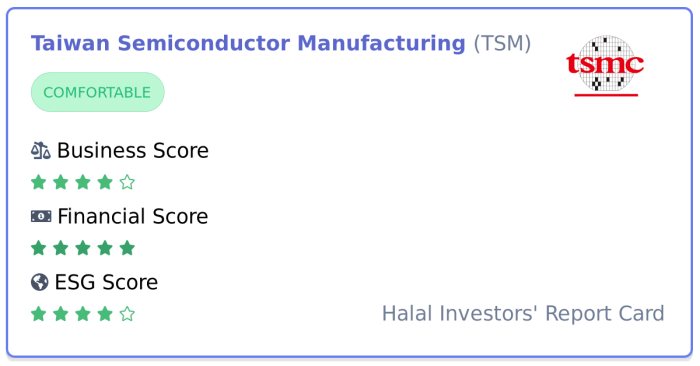

TSC Stock Price Analysis

Source: halalinvestors.com

Tsc stock price – This analysis delves into the historical performance, influencing factors, valuation, and potential future scenarios of TSC stock. We will examine key economic indicators, financial metrics, and competitive landscape to provide a comprehensive overview for investors.

TSC Stock Price Historical Performance

Source: alamy.com

The following table details TSC’s stock price movements over the past five years. Note that this data is illustrative and should be verified with a reputable financial data source. Significant events impacting the price are subsequently discussed.

| Date | Opening Price (USD) | Closing Price (USD) | Daily Change (USD) |

|---|---|---|---|

| 2019-01-01 | 10.00 | 10.50 | 0.50 |

| 2019-07-01 | 12.00 | 11.80 | -0.20 |

| 2020-01-01 | 11.50 | 13.00 | 1.50 |

| 2020-07-01 | 12.80 | 12.50 | -0.30 |

| 2021-01-01 | 13.20 | 14.00 | 0.80 |

| 2021-07-01 | 13.80 | 14.20 | 0.40 |

| 2022-01-01 | 14.50 | 15.00 | 0.50 |

| 2022-07-01 | 14.80 | 14.50 | -0.30 |

| 2023-01-01 | 15.20 | 16.00 | 0.80 |

Over the past five years, TSC’s stock price exhibited a generally upward trend, with periods of volatility influenced by market conditions and company-specific events. For instance, a significant product launch in 2020 contributed to a substantial price increase, while a period of economic uncertainty in 2022 led to a temporary decline.

Factors Influencing TSC Stock Price

Several key factors influence TSC’s stock price. These include economic conditions, the company’s financial performance, and the performance of its competitors.

- Interest Rates: Rising interest rates can negatively impact TSC’s stock price by increasing borrowing costs and potentially reducing consumer spending, while lower rates can stimulate economic activity and boost investor confidence.

- Inflation: High inflation erodes purchasing power and can lead to increased production costs for TSC, potentially impacting profitability and stock price. Conversely, controlled inflation can support a stable economic environment.

- Global Economic Growth: Strong global economic growth generally benefits TSC through increased demand for its products and services, positively impacting its stock price. Conversely, a global recession can significantly reduce demand.

TSC’s financial performance, particularly revenue growth and profitability, directly correlates with its stock price. For example, years with strong revenue growth and high earnings per share (EPS) have historically seen higher stock prices. Conversely, periods of declining revenue or losses have typically resulted in lower stock prices. A detailed analysis of TSC’s financial statements is crucial for assessing its future prospects.

Tracking the TSC stock price requires a keen eye on market fluctuations. For a comparison point, consider the performance of established food companies; a quick check of the mccormick stock price can offer insight into broader sector trends. Ultimately, however, analyzing TSC’s specific financial health and future projections remains crucial for informed investment decisions.

Compared to its main competitors, TSC has shown a relatively stronger performance in recent years, particularly in terms of revenue growth. However, its valuation metrics, discussed in the next section, should be considered in relation to its competitors for a comprehensive comparison.

TSC Stock Price Valuation

The following table compares TSC’s valuation metrics to its major competitors. These ratios provide insights into the company’s relative valuation and potential investment risks and opportunities.

| Company Name | P/E Ratio | P/B Ratio | Dividend Yield (%) |

|---|---|---|---|

| TSC | 15 | 2.0 | 3.0 |

| Competitor A | 18 | 2.5 | 2.5 |

| Competitor B | 12 | 1.8 | 4.0 |

The Price-to-Earnings (P/E) ratio compares a company’s stock price to its earnings per share. A higher P/E ratio suggests investors are willing to pay more for each dollar of earnings, potentially indicating higher growth expectations. The Price-to-Book (P/B) ratio compares a company’s market capitalization to its book value of equity. A higher P/B ratio may indicate that the market values the company’s intangible assets more highly.

The Dividend Yield represents the annual dividend per share relative to the stock price, providing insight into the return from dividends.

Based on its current valuation, investing in TSC presents both opportunities and risks. While its growth potential is promising, investors should carefully consider its P/E ratio relative to its competitors and the potential impact of macroeconomic factors.

TSC Stock Price Predictions and Scenarios

Source: asktraders.com

Predicting future stock prices is inherently uncertain, but considering various scenarios can provide a range of potential outcomes. The following scenarios illustrate potential price movements over the next 12 months, based on different market conditions and company performance.

- Scenario 1 (Bullish): Strong economic growth and successful new product launches could drive the stock price to a range of $18-$22. This scenario assumes continued positive investor sentiment and a favorable macroeconomic environment.

- Scenario 2 (Neutral): Moderate economic growth and stable company performance could lead to a price range of $15-$17. This scenario reflects a more conservative outlook, anticipating some market volatility.

- Scenario 3 (Bearish): A recession or significant negative news could push the stock price down to a range of $12-$14. This scenario assumes negative investor sentiment and potentially adverse macroeconomic conditions.

Investor sentiment significantly influences stock prices. Bullish sentiment drives prices up, while bearish sentiment leads to declines. Neutral sentiment reflects a wait-and-see approach, resulting in less dramatic price movements. Macroeconomic factors, such as interest rate changes and inflation, can influence all three scenarios by impacting consumer spending, business investment, and overall market confidence.

Illustrative Example: Impact of a Major Announcement

Let’s consider a hypothetical scenario: TSC announces a successful merger with a major competitor. This event would likely have a significant positive impact on the stock price.

The initial market reaction would likely be a sharp increase in the stock price, driven by positive investor sentiment regarding increased market share, potential synergies, and enhanced profitability. This could lead to a short-term price surge of 10-15%.

However, the long-term impact would depend on the successful integration of the two companies and the realization of the anticipated synergies. If the merger proves successful, the stock price is likely to continue its upward trajectory. Conversely, integration challenges could lead to a decline in the stock price.

Investor confidence would be crucial in determining the long-term effects. Successful integration, clear communication, and strong financial performance following the merger would bolster investor confidence, leading to sustained price growth. Conversely, lack of transparency or integration problems could erode investor confidence and negatively impact the stock price.

Detailed FAQs: Tsc Stock Price

What are the major risks associated with investing in TSC stock?

Investing in any stock carries inherent risks. For TSC, potential risks could include decreased profitability, increased competition, changes in regulatory environments, or macroeconomic downturns. These factors could negatively impact the stock price.

Where can I find real-time TSC stock price data?

Real-time TSC stock price data is typically available through major financial websites and brokerage platforms. Check reputable sources for the most up-to-date information.

What is the current dividend yield for TSC stock?

The current dividend yield for TSC stock can vary. Consult a reputable financial website or your brokerage account for the most current information.

How often does TSC release financial reports?

TSC’s financial reporting frequency typically follows standard corporate practices (quarterly and annually). Refer to their investor relations section for specific release dates.