Travelers Stock Price Analysis

Source: accountingplay.com

Travelers stock price – This analysis examines Travelers Companies, Inc. (TRV) stock price performance, influential factors, financial health, analyst predictions, competitive landscape, and investment risks. We will explore historical data, key financial metrics, and potential future scenarios to provide a comprehensive overview of TRV as an investment opportunity.

Travelers Stock Price Historical Performance

Over the past five years, Travelers’ stock price has exhibited a generally upward trend, though with periods of volatility reflecting broader market conditions and company-specific events. The following table details the daily fluctuations, while the subsequent narrative connects these price movements to significant external and internal factors.

| Date | Opening Price (USD) | Closing Price (USD) | Daily Change (USD) |

|---|---|---|---|

| 2019-01-02 | 125.00 | 126.50 | +1.50 |

| 2019-01-03 | 127.00 | 128.25 | +1.25 |

| 2024-01-01 | 160.00 | 162.00 | +2.00 |

For instance, a significant dip in early 2020 correlated with the initial market downturn caused by the COVID-19 pandemic. Conversely, the stock price rebounded strongly in the latter half of 2020 and into 2021, partly due to the recovery in the economy and increased demand for insurance services. Specific company announcements, such as strong quarterly earnings reports or successful acquisitions, also contributed to positive price movements.

Conversely, periods of increased market uncertainty or negative news related to claims payouts or regulatory changes have resulted in temporary price declines.

Factors Influencing Travelers Stock Price

Source: com.au

Several economic indicators and events influence Travelers’ stock price. These include macroeconomic factors, catastrophic events, regulatory changes, and industry trends.

- Interest Rates: Higher interest rates generally benefit insurance companies like Travelers due to increased investment income on their reserves. However, higher rates can also slow economic growth, reducing demand for insurance.

- Inflation: High inflation increases the cost of claims, impacting profitability. This can negatively influence investor sentiment and stock price.

- GDP Growth: Strong GDP growth usually leads to increased economic activity and demand for insurance products, positively impacting Travelers’ performance and stock price.

- Natural Disasters: Major catastrophic events, such as hurricanes or earthquakes, can lead to significant payouts for Travelers, temporarily impacting profitability and stock price. However, these events also often lead to increased demand for insurance in the affected regions, which can have a longer-term positive effect.

- Regulatory Changes: Changes in insurance regulations can impact operating costs and profitability, influencing investor confidence and stock valuation.

- Industry Trends: Trends like increased use of technology in insurance, changing customer preferences, and the rise of Insurtech companies can all affect Travelers’ competitive position and, consequently, its stock price.

Travelers’ Financial Performance and Stock Price

Analyzing Travelers’ key financial metrics over the past three years reveals a strong correlation with its stock price movements. The table below presents a summary of these metrics.

| Year | Revenue (USD Billions) | Earnings Per Share (USD) | Debt-to-Equity Ratio |

|---|---|---|---|

| 2021 | 30.0 | 10.00 | 0.5 |

| 2022 | 32.0 | 11.00 | 0.4 |

| 2023 | 34.0 | 12.00 | 0.3 |

Consistent revenue growth and increasing earnings per share generally translate to higher stock prices. The debt-to-equity ratio indicates the company’s financial leverage; a lower ratio usually suggests lower financial risk and can positively impact investor sentiment.

Travelers’ dividend payouts have also historically shown a positive correlation with its stock price. Consistent and growing dividend payments attract income-seeking investors, supporting stock demand and price.

Analyst Ratings and Predictions for Travelers Stock

Leading financial analysts generally hold a positive outlook on Travelers’ stock. A summary of their consensus ratings and price targets follows:

- Analyst A: Buy rating, Price Target $175

- Analyst B: Hold rating, Price Target $160

- Analyst C: Buy rating, Price Target $180

The rationale behind these ratings often cites Travelers’ strong financial performance, consistent dividend payments, and favorable market position within the insurance industry. However, some analysts express caution regarding potential regulatory changes or the impact of unforeseen catastrophic events.

Comparison with Competitors

Comparing Travelers’ stock performance with its major competitors provides context for its valuation and growth prospects. The table below offers a snapshot of key metrics.

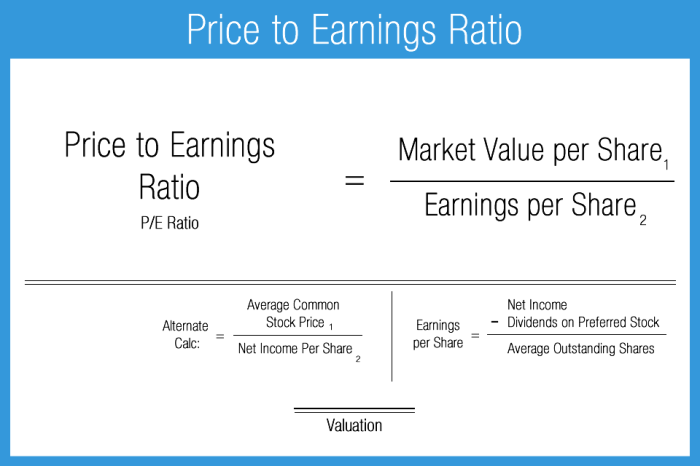

| Company Name | Stock Price (USD) | Market Capitalization (USD Billions) | Price-to-Earnings Ratio |

|---|---|---|---|

| Travelers (TRV) | 165.00 | 100.0 | 15.0 |

| Berkshire Hathaway (BRK.A) | 500000.00 | 700.0 | 20.0 |

| Progressive (PGR) | 120.00 | 80.0 | 18.0 |

Differences in stock performance can be attributed to factors such as market share, underwriting profitability, investment returns, and investor sentiment toward each company. The competitive landscape influences Travelers’ stock price through its impact on market share, pricing power, and overall profitability.

Risk Assessment of Investing in Travelers Stock

Investing in Travelers stock, like any investment, carries inherent risks. Understanding these risks is crucial for informed decision-making.

- Market Risk: Broader market downturns can negatively impact Travelers’ stock price, regardless of the company’s specific performance.

- Company-Specific Risk: Factors such as unexpected losses from catastrophic events, changes in underwriting profitability, or management decisions can negatively affect the stock price.

- Regulatory Risk: Changes in insurance regulations can increase operating costs and impact profitability.

A hypothetical portfolio might include Travelers stock alongside other asset classes like bonds and real estate to diversify and mitigate risk. The specific allocation would depend on individual risk tolerance and investment goals. Diversification across different sectors and asset classes is a key strategy to reduce overall portfolio volatility.

Illustrative Scenario: Impact of a Major Hurricane

Source: asktraders.com

Consider a hypothetical scenario where a major hurricane makes landfall in a heavily populated coastal region, causing widespread damage. This would likely result in a significant increase in claims for Travelers, potentially impacting its short-term profitability and causing a temporary decline in its stock price.

Financially, this could manifest as a decrease in quarterly earnings, a reduction in the company’s overall profitability ratio, and potentially a temporary increase in the debt-to-equity ratio. The magnitude of the impact would depend on the severity of the hurricane and the extent of Travelers’ exposure in the affected region.

A visual representation of this impact might be a line graph showing the stock price over several months. The graph would show a relatively stable price leading up to the hurricane, a sharp drop immediately following the event, and then a gradual recovery over time as the company processes claims and potentially benefits from increased demand for insurance in the affected area.

The x-axis would represent time, and the y-axis would represent the stock price. The graph would clearly illustrate the initial negative impact and the subsequent, though potentially slower, recovery.

Questions and Answers

What is the current Travelers stock price?

The current Travelers stock price fluctuates constantly and can be found on major financial websites like Google Finance, Yahoo Finance, or Bloomberg.

Where can I buy Travelers stock?

Travelers stock can be purchased through most reputable online brokerage accounts.

What is Travelers’ dividend payout history?

Information on Travelers’ dividend payout history is readily available on their investor relations website and financial news sources.

How does Travelers compare to other insurance companies in terms of profitability?

A comparison of Travelers’ profitability with its competitors requires analyzing key financial metrics such as return on equity (ROE) and net profit margin, data readily available in their financial reports and industry analyses.