TGT Stock Price Analysis: Tgt Stock Price Today

Tgt stock price today – This report provides a comprehensive overview of Target Corporation (TGT) stock performance, encompassing current market data, historical price movements, influential factors, analyst predictions, financial health, and prevailing investor sentiment. The analysis aims to offer a holistic perspective on TGT’s stock prospects.

Current TGT Stock Price and Volume

Source: thestreet.com

As of [Insert Date and Time], the TGT stock price is [Insert Current Price]. The current trading volume stands at [Insert Current Volume]. The day’s high was [Insert Day’s High], and the low was [Insert Day’s Low].

| Open | High | Low | Close |

|---|---|---|---|

| [Insert Open Price Day 1] | [Insert High Price Day 1] | [Insert Low Price Day 1] | [Insert Close Price Day 1] |

| [Insert Open Price Day 2] | [Insert High Price Day 2] | [Insert Low Price Day 2] | [Insert Close Price Day 2] |

| [Insert Open Price Day 3] | [Insert High Price Day 3] | [Insert Low Price Day 3] | [Insert Close Price Day 3] |

| [Insert Open Price Day 4] | [Insert High Price Day 4] | [Insert Low Price Day 4] | [Insert Close Price Day 4] |

| [Insert Open Price Day 5] | [Insert High Price Day 5] | [Insert Low Price Day 5] | [Insert Close Price Day 5] |

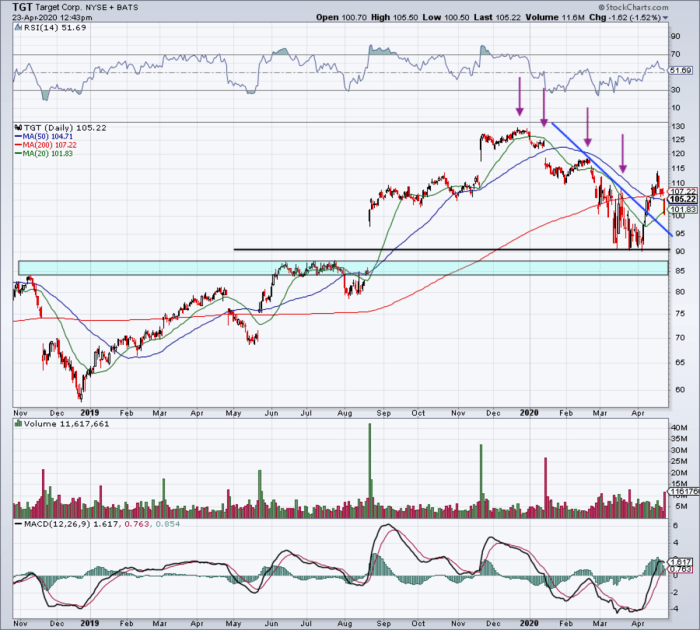

TGT Stock Price Movement Over Time

TGT’s stock price performance has exhibited [Describe overall trend – e.g., volatility, steady growth, decline] over the past month. The past year has shown [Describe overall trend – e.g., significant gains, moderate fluctuations, a downward trend]. Compared to competitors such as [List Competitors – e.g., Walmart, Amazon], TGT’s performance over the last quarter has been [Describe relative performance – e.g., stronger, weaker, comparable].

A line graph illustrating TGT’s stock price fluctuation over the past six months would show [Describe the graph’s visual appearance – e.g., an upward trend with periods of correction, a downward trend with brief rallies, a relatively flat trajectory]. The x-axis would represent the time period (months), and the y-axis would represent the stock price. Key trends would include [Describe key visual trends and their corresponding timeframes – e.g., a sharp increase in March followed by a plateau in April, a consistent decline from June to August].

Factors Influencing TGT Stock Price

Several economic, news-related, and company-specific factors can significantly impact TGT’s stock price.

Three key economic factors are inflation rates, consumer spending patterns, and interest rate changes. Recent news events, such as [Cite specific news events – e.g., supply chain disruptions, changes in consumer confidence], have had [Describe the impact – e.g., a negative, positive, or neutral effect] on TGT’s stock price. Recent company announcements, including [Cite specific announcements – e.g., new strategic initiatives, financial results], have resulted in [Describe the impact – e.g., a surge, a dip, or minimal change] in the stock price.

- Changes in consumer preferences and retail trends

- Successful or unsuccessful marketing campaigns

- Major competitive actions from rivals

- Geopolitical events with global economic implications

Analyst Ratings and Price Targets, Tgt stock price today

Source: investors.com

Analyst ratings for TGT stock are currently [Summarize overall sentiment – e.g., mixed, predominantly positive, largely negative]. The average price target among analysts is [Insert Average Price Target]. This compares to the current stock price of [Insert Current Price], indicating [Describe the comparison – e.g., an upside potential, a downside risk, or alignment with the current price].

| Financial Institution | Rating | Price Target |

|---|---|---|

| [Institution 1] | [Rating 1] | [Price Target 1] |

| [Institution 2] | [Rating 2] | [Price Target 2] |

| [Institution 3] | [Rating 3] | [Price Target 3] |

TGT Stock’s Financial Performance

TGT’s financial performance provides further insights into its stock valuation.

| Quarter | EPS | Revenue | P/E Ratio |

|---|---|---|---|

| [Quarter 1] | [EPS Q1] | [Revenue Q1] | [P/E Ratio Q1] |

| [Quarter 2] | [EPS Q2] | [Revenue Q2] | [P/E Ratio Q2] |

| [Quarter 3] | [EPS Q3] | [Revenue Q3] | [P/E Ratio Q3] |

| [Quarter 4] | [EPS Q4] | [Revenue Q4] | [P/E Ratio Q4] |

Revenue growth over the last two years has been [Describe the trend – e.g., steady, fluctuating, significant increase or decrease]. Other key financial ratios, such as the debt-to-equity ratio, will provide a more comprehensive view of TGT’s financial health.

Investor Sentiment Towards TGT Stock

Current investor sentiment towards TGT stock can be characterized as [Describe overall sentiment – e.g., cautiously optimistic, bearish, bullish]. This sentiment is primarily driven by [Explain contributing factors – e.g., recent financial performance, market trends, macroeconomic conditions]. Social media sentiment, while often volatile, has [Describe the impact – e.g., generally reflected broader market trends, amplified negative news, had a minimal impact] on TGT’s stock price.

Over the past few months, there has been [Describe changes in sentiment – e.g., a shift from pessimism to optimism, a sustained period of negativity, little change in overall sentiment].

Tracking the TGT stock price today requires diligence. Investors often compare performance against similar companies, and a quick check of the fhn stock price can provide valuable context for understanding market trends. Ultimately, however, the focus remains on TGT’s performance and its implications for your portfolio.

FAQ Corner

What are the risks associated with investing in TGT stock?

Investing in any stock carries inherent risks, including potential price volatility, market downturns, and company-specific challenges. Thorough research and diversification are crucial to mitigate risk.

Where can I find real-time TGT stock quotes?

Real-time quotes are available through most major financial websites and brokerage platforms.

How often is TGT stock price updated?

TGT stock price is updated continuously during trading hours.

What is Target Corporation’s primary business?

Target Corporation operates a chain of general merchandise stores across the United States.