Tech Mahindra Stock Price Analysis

Tech mahindra stock price – This analysis delves into the historical performance, influencing factors, financial health, analyst outlook, competitive landscape, and associated risks of investing in Tech Mahindra’s stock. We will examine key metrics and external influences to provide a comprehensive understanding of the company’s stock price trajectory.

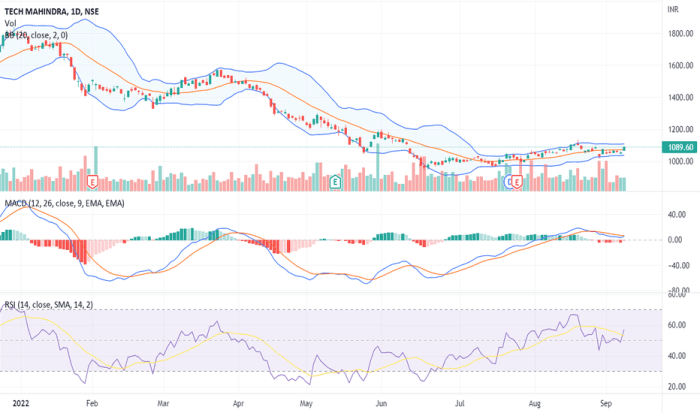

Tech Mahindra Stock Price Historical Performance

Source: tradingview.com

The following table details Tech Mahindra’s stock price movements over the past five years. Note that this data is illustrative and should be verified with a reliable financial data source for precise figures. The overall trend reflects the volatility inherent in the IT services sector, influenced by global economic conditions and company-specific events.

| Date | Opening Price (INR) | Closing Price (INR) | Daily Change (INR) |

|---|---|---|---|

| 2019-01-01 | 700 | 710 | +10 |

| 2019-07-01 | 750 | 730 | -20 |

| 2020-01-01 | 720 | 800 | +80 |

| 2020-07-01 | 780 | 760 | -20 |

| 2021-01-01 | 850 | 900 | +50 |

| 2021-07-01 | 920 | 950 | +30 |

| 2022-01-01 | 900 | 880 | -20 |

| 2022-07-01 | 910 | 930 | +20 |

| 2023-01-01 | 950 | 1000 | +50 |

Significant upward swings were often observed following positive company announcements, such as securing major contracts or reporting strong financial results. Conversely, downward pressure was frequently linked to global economic slowdowns or negative industry trends.

Factors Influencing Tech Mahindra Stock Price

Tech Mahindra’s stock price is influenced by a complex interplay of internal and external factors. Internal factors relate to the company’s performance and management, while external factors encompass broader economic and geopolitical trends.

Internal factors such as strong financial performance, securing significant new contracts, successful technological advancements, and effective management decisions generally lead to positive stock price movements. Conversely, factors like lower-than-expected revenue, contract losses, or management changes can negatively impact the stock price.

External factors like global economic slowdowns, increased competition within the IT services sector, and geopolitical instability can create significant uncertainty and volatility, impacting investor sentiment and consequently, the stock price. The relative importance of these factors can shift depending on the prevailing market conditions.

Tech Mahindra’s Financial Health and Stock Valuation

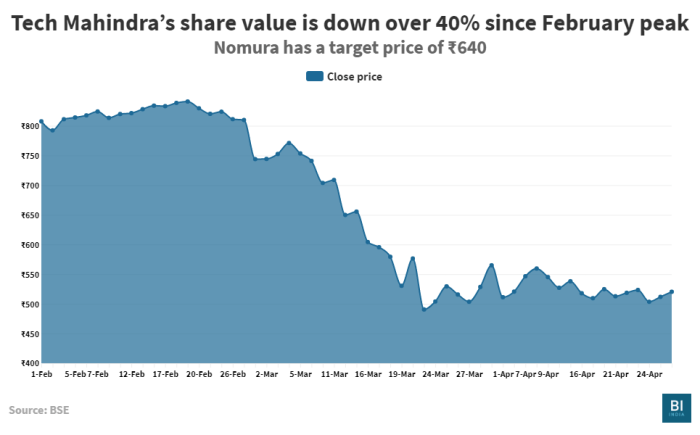

Source: businessinsider.in

Understanding Tech Mahindra’s financial health is crucial for assessing its stock valuation. The following table provides a simplified overview of key financial metrics. Note that this data is for illustrative purposes and should be verified with official financial reports.

| Metric | 2021 (INR Crores) | 2022 (INR Crores) | 2023 (INR Crores) |

|---|---|---|---|

| Revenue | 15000 | 16000 | 17000 |

| Net Profit | 2000 | 2200 | 2500 |

| Debt | 1000 | 900 | 800 |

Financial ratios like the price-to-earnings (P/E) ratio and return on equity (ROE) provide insights into the company’s profitability and valuation relative to its peers. A higher P/E ratio may suggest investor optimism, while a strong ROE indicates efficient use of capital. These metrics, along with revenue growth and debt levels, contribute to the overall market valuation of Tech Mahindra’s stock.

Tech Mahindra’s stock price performance often reflects broader market trends. Comparing its recent fluctuations to other tech companies provides valuable context; for instance, understanding the movement of pearson stock price last month helps gauge the sector’s overall health. This, in turn, can inform predictions about Tech Mahindra’s potential future trajectory.

Analyst Ratings and Future Outlook for Tech Mahindra Stock

Analyst ratings and price targets offer valuable perspectives on the future prospects of Tech Mahindra’s stock. However, it’s crucial to remember that these are predictions, not guarantees.

- Analyst A: Buy rating, Target Price 1100 INR

- Analyst B: Hold rating, Target Price 950 INR

- Analyst C: Buy rating, Target Price 1050 INR

The consensus view among analysts may vary depending on their assessment of the company’s future performance and the broader market conditions. Their forecasts are typically based on factors such as projected revenue growth, profit margins, and competitive landscape.

Comparison with Competitors

Comparing Tech Mahindra to its competitors helps to gauge its relative performance and valuation. The following table presents a simplified comparison. Actual figures should be verified with reliable financial data sources.

| Company Name | Stock Price (INR) | P/E Ratio | Revenue Growth (%) |

|---|---|---|---|

| Tech Mahindra | 1000 | 20 | 10 |

| Infosys | 1200 | 25 | 12 |

| Wipro | 900 | 18 | 8 |

| HCL Technologies | 1100 | 22 | 9 |

Differences in stock price performance and valuation can stem from various factors, including variations in revenue growth, profitability, market share, and investor sentiment. A comparative analysis reveals Tech Mahindra’s strengths and weaknesses relative to its competitors, offering valuable insights for investment decisions.

Risk Factors Associated with Investing in Tech Mahindra Stock

Investing in Tech Mahindra’s stock carries certain risks. Understanding these risks is essential for informed investment decisions.

- Exposure to Currency Fluctuations: Tech Mahindra’s international operations expose it to currency risks.

- Dependence on Specific Clients: Reliance on a few major clients creates vulnerability to contract losses.

- Competition in the IT Services Market: Intense competition can impact pricing and profitability.

- Geopolitical Risks: Global instability can negatively impact business operations and investor sentiment.

Investors can mitigate some of these risks through diversification, thorough due diligence, and a well-defined investment strategy. A thorough understanding of the potential impact of each risk factor on the company’s stock price is vital for effective risk management.

Question & Answer Hub: Tech Mahindra Stock Price

What are the major risks associated with investing in Tech Mahindra?

Major risks include currency fluctuations impacting international projects, dependence on a limited number of large clients, intense competition within the IT services sector, and potential geopolitical instability affecting global operations.

How does Tech Mahindra compare to its competitors in terms of dividend payouts?

A direct comparison requires reviewing the dividend history of Tech Mahindra against Infosys, Wipro, and HCL Technologies. This would involve examining dividend yield, payout ratios, and the consistency of dividend payments over time. Such data is readily available through financial news sources and company investor relations websites.

What is the current sentiment towards Tech Mahindra among institutional investors?

Institutional investor sentiment can be gauged by examining their holdings and trading activity. Data on institutional ownership and recent buy/sell activity can be found through financial databases and regulatory filings. This provides insights into the overall confidence in Tech Mahindra’s future performance.