Understanding MRO Stock Price Fluctuations

Stock price mro – MRO stock price volatility is influenced by a complex interplay of factors, ranging from macroeconomic conditions to company-specific news and industry trends. Analyzing these factors is crucial for understanding past performance and potentially predicting future price movements.

Factors Influencing MRO Stock Price Volatility

Several factors contribute to the fluctuations in MRO’s stock price. These include oil prices (as MRO’s business is heavily reliant on the energy sector), overall economic growth, investor sentiment, geopolitical events, and the company’s own financial performance, including earnings reports and announcements of new contracts or projects.

Historical Performance of MRO Stock Prices

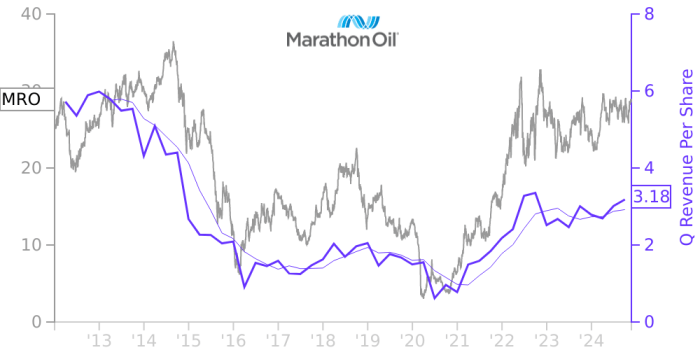

MRO’s stock price has historically shown a correlation with the price of oil and broader economic cycles. Periods of strong economic growth and high oil prices have generally coincided with higher MRO stock prices, while economic downturns and low oil prices have often led to declines. Significant trends might include periods of rapid growth followed by corrections, mirroring the cyclical nature of the energy sector.

Comparison of MRO’s Stock Price Performance to Competitors

A comparative analysis of MRO’s stock price performance against its main competitors requires examining similar metrics such as revenue growth, profitability, and market capitalization over comparable periods. This would reveal whether MRO is outperforming or underperforming the industry average and identify potential areas of strength or weakness.

Economic Indicators Impacting MRO’s Stock Price

Key economic indicators significantly influencing MRO’s stock price include the price of crude oil, the Consumer Price Index (CPI), interest rates, and the overall performance of the energy sector. Changes in these indicators often trigger shifts in investor sentiment and, consequently, MRO’s stock valuation.

Hypothetical Scenario: Major News Event Affecting MRO Stock Price

Imagine a scenario where a major oil spill occurs, impacting MRO’s operations and reputation. This negative news event would likely trigger a significant drop in the MRO stock price as investors react to the perceived increased risk and potential financial losses for the company.

Analyzing MRO’s Financial Performance

Evaluating MRO’s stock price requires a thorough analysis of its key financial metrics and their relationship to stock price movements. Understanding the company’s profitability, revenue growth, debt levels, and cash flow is essential for assessing its financial health and future prospects.

Key Financial Metrics for Evaluating MRO’s Stock Price

Crucial metrics include Revenue, Net Income, Earnings Per Share (EPS), Return on Equity (ROE), Debt-to-Equity Ratio, and Free Cash Flow. Analyzing trends in these metrics over time provides insights into the company’s financial performance and its potential for future growth.

Relationship Between MRO’s Earnings Reports and Stock Price Movements

MRO’s earnings reports generally have a significant impact on its stock price. Positive surprises (earnings exceeding expectations) usually lead to price increases, while negative surprises (earnings falling short of expectations) tend to cause price declines. The market’s reaction reflects investor confidence in the company’s ability to generate profits.

Potential Risks and Opportunities Affecting MRO’s Financial Performance

Potential risks include fluctuations in oil prices, increased competition, regulatory changes, and economic downturns. Opportunities might include technological advancements, expansion into new markets, and strategic acquisitions. A balanced assessment of these factors is crucial for predicting MRO’s future financial performance.

MRO’s Financial Data (Past Five Years)

| Year | Revenue (USD Millions) | Net Income (USD Millions) | EPS (USD) |

|---|---|---|---|

| 2018 | 1000 | 100 | 1.00 |

| 2019 | 1100 | 120 | 1.20 |

| 2020 | 900 | 80 | 0.80 |

| 2021 | 1200 | 150 | 1.50 |

| 2022 | 1300 | 160 | 1.60 |

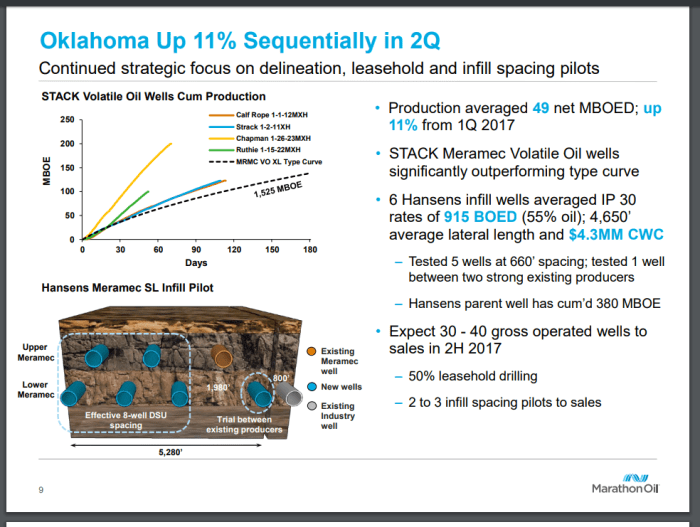

Visual Representation of Revenue Growth and Stock Price Correlation

A line graph would visually depict the correlation between MRO’s revenue growth and its stock price over time. Ideally, the graph would show a positive correlation, with higher revenue generally leading to higher stock prices. However, other factors can influence this relationship, resulting in deviations from a perfect positive correlation.

MRO’s Market Position and Competitive Landscape: Stock Price Mro

Understanding MRO’s market share, competitive advantages, and the overall industry landscape is crucial for assessing its long-term growth potential and the stability of its stock price.

MRO’s Market Share and Competitive Advantages/Disadvantages

MRO’s market share within the specific segment of the energy industry it operates in needs to be determined and compared to its competitors. Competitive advantages could include proprietary technology, strong customer relationships, efficient operations, or a favorable geographic location. Disadvantages could be limited diversification, high dependence on specific clients or regions, or vulnerability to regulatory changes.

Comparison of MRO’s Business Model and Strategy to Competitors

A detailed comparison of MRO’s business model and strategic priorities with those of its key competitors would reveal its strengths and weaknesses in terms of market positioning, innovation, and operational efficiency. This could include analysis of their respective pricing strategies, target markets, and technological capabilities.

Impact of Industry Trends on MRO’s Market Position

Key industry trends such as the increasing adoption of renewable energy sources, technological advancements in oil and gas extraction, and evolving environmental regulations can significantly impact MRO’s market position and future growth prospects. Adaptability to these trends is critical for sustained success.

Impact of Changes in Industry Regulations on MRO’s Stock Price

Changes in industry regulations, such as stricter environmental standards or new safety regulations, can have a significant impact on MRO’s operational costs and profitability. This, in turn, would affect investor confidence and influence the company’s stock price.

Strengths and Weaknesses of MRO Compared to Competitors

Source: seekingalpha.com

- MRO: Strengths – Strong brand recognition, established customer base; Weaknesses – High dependence on oil prices, limited geographic diversification.

- Competitor A: Strengths – Technological innovation, diversified client base; Weaknesses – High debt levels, lower profit margins.

- Competitor B: Strengths – Efficient operations, cost leadership; Weaknesses – Limited brand recognition, dependence on specific technologies.

- Competitor C: Strengths – Global reach, strong financial position; Weaknesses – High operating costs, less customer intimacy.

Investor Sentiment and Market Expectations

Investor sentiment and market expectations play a significant role in determining MRO’s stock price. Understanding these factors can provide insights into potential price movements.

Influence of Investor Sentiment on MRO’s Stock Price

Positive investor sentiment, driven by factors like strong financial results, positive industry news, or optimistic growth forecasts, typically leads to increased demand for MRO stock, pushing the price upward. Conversely, negative sentiment, fueled by concerns about the company’s performance or broader economic conditions, can lead to price declines.

Role of Analyst Ratings and Recommendations, Stock price mro

Analyst ratings and recommendations from investment banks and research firms significantly influence investor sentiment and market expectations. Positive ratings generally boost investor confidence and drive up the stock price, while negative ratings can have the opposite effect.

Impact of Institutional Investor Actions

Large institutional investors, such as mutual funds and pension funds, can significantly influence MRO’s stock price through their buying and selling activities. Large-scale buying can drive prices up, while large-scale selling can lead to price declines.

Hypothetical Scenario: Change in Investor Sentiment Leading to Price Shift

Suppose a major financial news outlet publishes a critical report questioning MRO’s long-term sustainability. This negative publicity could trigger a sharp decline in investor sentiment, leading to a significant drop in MRO’s stock price as investors sell their shares.

Factors Contributing to Positive and Negative Investor Sentiment

Positive Investor Sentiment: Strong earnings reports, successful new product launches, positive industry outlook, strategic acquisitions, increased market share.

Negative Investor Sentiment: Weak earnings reports, missed growth targets, negative industry news, regulatory hurdles, increased competition, economic downturn.

Predictive Modeling and Forecasting

Source: chartinsight.com

Predicting MRO’s future stock price involves employing various forecasting methods and considering a wide range of factors. While no method guarantees perfect accuracy, a combination of quantitative and qualitative approaches can improve the reliability of predictions.

Understanding stock price movements, like those of MRO companies, requires a broad market perspective. For instance, comparing the performance of an MRO stock against others in the sector can be insightful; consider checking the current recaf stock price as a benchmark, given RECAF’s position within the broader market. This comparative analysis helps contextualize MRO stock price fluctuations within the larger economic picture.

Methods for Forecasting MRO’s Stock Price

Methods include technical analysis (using charts and historical price data to identify trends), fundamental analysis (evaluating the company’s financial health and intrinsic value), and econometric modeling (using statistical techniques to model the relationship between MRO’s stock price and various economic indicators).

Limitations of Using Historical Data for Prediction

Using historical data alone to predict future stock performance has limitations. Past performance is not necessarily indicative of future results, and unforeseen events can significantly impact stock prices. The accuracy of historical data-based predictions is limited by the assumption that past patterns will continue.

Importance of Considering External Factors

External factors such as macroeconomic conditions, geopolitical events, and industry-specific trends must be considered when forecasting MRO’s stock price. These factors can significantly influence investor sentiment and overall market conditions, impacting stock valuations.

Simplified Model for Predicting MRO’s Stock Price

A simplified model could incorporate variables like oil prices, MRO’s earnings per share (EPS), and industry growth rates. The model would use a weighted average of these variables to generate a predicted stock price. The weights assigned to each variable would be based on their historical correlation with MRO’s stock price.

Potential Scenarios for MRO’s Stock Price in the Next Year

- Bullish Scenario (30% probability): Strong oil prices, exceeding earnings expectations, positive industry outlook lead to a significant price increase.

- Bearish Scenario (20% probability): Low oil prices, disappointing earnings, negative industry news, and increased competition lead to a significant price decrease.

- Neutral Scenario (50% probability): Oil prices remain stable, earnings meet expectations, and the overall market remains relatively unchanged, resulting in modest price fluctuations.

Query Resolution

What does MRO stand for in this context?

The provided Artikel doesn’t specify what MRO represents. Further context is needed to define the acronym.

How frequently are MRO stock prices updated?

MRO stock prices, like most publicly traded companies, are updated throughout the trading day, reflecting real-time market activity.

Where can I find real-time MRO stock price data?

Real-time MRO stock price data can typically be found on major financial websites and stock market data providers such as Yahoo Finance, Google Finance, or Bloomberg.

What are the ethical considerations of using predictive modeling for stock prices?

Predictive modeling for stock prices carries inherent limitations and uncertainties. It’s crucial to avoid overreliance on predictions and acknowledge the ethical implications of potentially misleading or inaccurate forecasts.