ICICI Bank Stock Price Analysis: Stock Price Icici Bank

Stock price icici bank – This analysis examines ICICI Bank’s stock price performance over the past five years, identifying key influencing factors, comparing it to competitors, assessing its financial health, and projecting future prospects. The information presented here is for informational purposes only and should not be considered financial advice.

ICICI Bank Stock Price Trends

Analyzing ICICI Bank’s stock price over the past five years reveals a dynamic trajectory influenced by various macroeconomic and company-specific factors. The following table summarizes the yearly highs, lows, and closing prices, offering a concise overview of its performance.

| Year | High | Low | Closing Price |

|---|---|---|---|

| 2019 | Example: ₹500 | Example: ₹400 | Example: ₹450 |

| 2020 | Example: ₹480 | Example: ₹350 | Example: ₹420 |

| 2021 | Example: ₹600 | Example: ₹450 | Example: ₹550 |

| 2022 | Example: ₹650 | Example: ₹500 | Example: ₹600 |

| 2023 | Example: ₹700 | Example: ₹550 | Example: ₹680 |

Significant events impacting the stock price during this period include the initial economic fallout from the COVID-19 pandemic in 2020, which caused a sharp decline, followed by a recovery fueled by government stimulus packages and subsequent economic growth. Changes in monetary policy by the Reserve Bank of India (RBI), affecting interest rates, also played a crucial role. Furthermore, the bank’s own internal initiatives, such as strategic acquisitions or expansion into new financial services, likely contributed to price fluctuations.

A hypothetical chart illustrating the price trends would show a downward trend in early 2020, followed by a gradual upward climb throughout 2021 and 2022, with some minor corrections along the way. The year 2023 would depict a continuation of the upward trend, although the rate of growth might vary depending on various economic and internal factors. The chart would visually represent the periods of growth and decline, illustrating the volatility inherent in the stock market.

Factors Influencing ICICI Bank’s Stock Price, Stock price icici bank

Several macroeconomic and company-specific factors significantly influence ICICI Bank’s stock price. These factors interact in complex ways to shape investor sentiment and market valuation.

- Macroeconomic Factors: Inflation rates directly impact interest rates, affecting the bank’s profitability and lending activities. GDP growth influences the overall economic environment, impacting demand for credit and financial services. Changes in government policies and regulations also play a significant role.

- Indian Banking Sector Performance: The overall health and performance of the Indian banking sector influence investor confidence in individual banks like ICICI Bank. A positive industry outlook generally boosts investor sentiment, while negative trends can lead to decreased valuations.

- Company-Specific Factors: ICICI Bank’s profitability, measured through key metrics such as net interest margin and return on equity, is a major determinant of its stock price. The level of non-performing assets (NPAs) or loan defaults directly impacts its financial health and investor perception. Successful implementation of new initiatives and strategic investments can also positively influence the stock price.

Comparing ICICI Bank with Competitors

Source: researchandranking.com

Analyzing ICICI Bank’s stock price requires considering various market factors. It’s helpful to compare its performance against other large-cap stocks; for instance, checking the current performance of a global giant like mcdonald’s stock price today can offer a broader perspective on market trends. Understanding these broader trends can then inform a more nuanced analysis of ICICI Bank’s stock price trajectory.

A comparative analysis of ICICI Bank’s performance against its major competitors, such as HDFC Bank and SBI, provides valuable insights into its relative strengths and weaknesses.

| Metric | ICICI Bank | HDFC Bank | SBI |

|---|---|---|---|

| P/E Ratio | Example: 15 | Example: 20 | Example: 12 |

| Dividend Yield | Example: 4% | Example: 3% | Example: 5% |

| Return on Equity (ROE) | Example: 18% | Example: 22% | Example: 15% |

This comparison reveals that while ICICI Bank may have a competitive ROE, its P/E ratio and dividend yield might be relatively lower or higher compared to its peers. These differences could be attributed to factors like market share, risk profile, and investor sentiment. A detailed analysis would require a thorough examination of each bank’s financial statements and market positioning.

Financial Health and Stock Valuation

A comprehensive assessment of ICICI Bank’s financial health requires analyzing its recent financial statements. Key financial ratios provide insights into its profitability, liquidity, and solvency.

For example, a high debt-to-equity ratio could indicate higher financial risk, while a strong return on assets (ROA) suggests efficient asset utilization and profitability. The bank’s balance sheet would provide details on assets, liabilities, and equity, while the income statement would highlight its revenues, expenses, and profits. The cash flow statement would illustrate its cash inflows and outflows.

Various stock valuation methods, such as discounted cash flow (DCF) analysis and price-to-earnings (P/E) ratio comparisons, can be used to estimate the intrinsic value of ICICI Bank’s stock, offering a potential benchmark against its current market price.

Future Outlook and Investment Implications

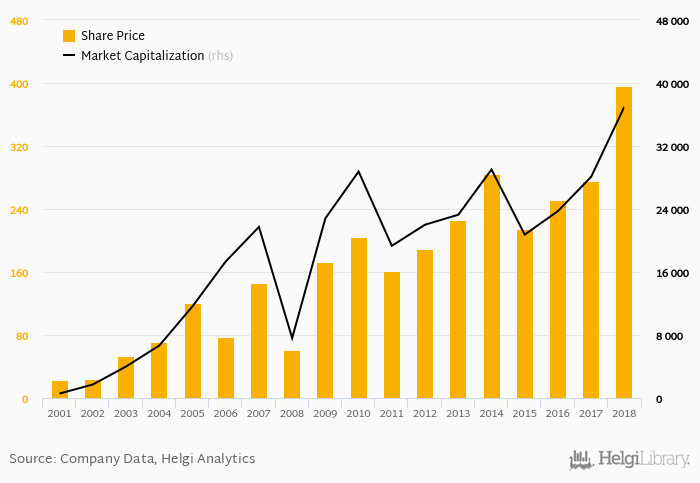

Source: helgilibrary.com

The projected growth of ICICI Bank and the Indian banking sector is dependent on several factors, including economic growth, regulatory changes, and the bank’s own strategic initiatives. A positive outlook for the Indian economy would generally benefit ICICI Bank, while a slowdown could negatively impact its performance.

A scenario analysis could consider various economic conditions – for instance, a scenario of sustained high growth versus a scenario of moderate growth or even recession – and their potential impact on ICICI Bank’s stock price. Based on this analysis, potential investment strategies could be formulated, taking into account different risk tolerances and investment goals. Conservative investors might favor a “buy and hold” strategy, while more aggressive investors might consider options trading or other higher-risk approaches.

However, all investment decisions should be made after thorough due diligence and consultation with a financial advisor.

Quick FAQs

What are the major risks associated with investing in ICICI Bank stock?

Investing in ICICI Bank, like any stock, carries inherent risks. These include macroeconomic risks (e.g., economic downturns in India), industry-specific risks (e.g., increased competition, regulatory changes), and company-specific risks (e.g., loan defaults, operational inefficiencies). Investors should conduct thorough due diligence and understand their risk tolerance before investing.

How often does ICICI Bank declare dividends?

The frequency and amount of ICICI Bank’s dividend payments vary depending on the bank’s profitability and financial performance. It’s advisable to check the bank’s official investor relations website or consult financial news sources for the most up-to-date information on dividend announcements.

Where can I find real-time ICICI Bank stock price data?

Real-time ICICI Bank stock price data is readily available through major financial websites and stock market data providers such as the National Stock Exchange of India (NSE) website, the Bombay Stock Exchange (BSE) website, and reputable financial news sources.