Ford Stock Price Analysis: Stock Price Ford

Source: investorplace.com

Stock price ford – Ford Motor Company, a prominent player in the global automotive industry, has experienced significant fluctuations in its stock price over the years. This analysis delves into the historical trends, influencing factors, financial performance, investor sentiment, and future outlook of Ford’s stock price, providing a comprehensive overview for investors and market enthusiasts.

Ford’s stock price has seen some volatility recently, influenced by factors like the ongoing chip shortage and the broader economic climate. It’s interesting to compare this to the performance of other automakers; for instance, you might want to check the current stock price bk for a different perspective on the industry’s health. Ultimately, understanding Ford’s stock requires a comprehensive look at the entire automotive sector’s performance.

Ford Stock Price Historical Trends, Stock price ford

Analyzing Ford’s stock price performance across different timeframes reveals crucial insights into its trajectory. The past five, ten, and twenty years have witnessed periods of substantial growth, significant declines, and periods of relative stability, often mirroring broader economic trends and industry-specific events.

| Year | High | Low | Close |

|---|---|---|---|

| 2014 | 17.85 | 14.12 | 16.20 |

| 2015 | 16.50 | 12.50 | 14.00 |

| 2016 | 14.50 | 11.00 | 12.50 |

| 2017 | 13.00 | 10.50 | 11.75 |

| 2018 | 12.50 | 9.00 | 10.50 |

| 2019 | 11.50 | 8.50 | 9.75 |

| 2020 | 10.00 | 4.00 | 7.00 |

| 2021 | 20.00 | 10.00 | 18.00 |

| 2022 | 16.00 | 11.00 | 13.50 |

| 2023 | 15.00 | 12.00 | 13.00 |

These figures are illustrative and should not be taken as precise financial advice. Actual figures may vary. Major fluctuations have often coincided with events such as the 2008 financial crisis, the global chip shortage, and shifts in consumer demand for vehicles.

Factors Influencing Ford’s Stock Price

Several interconnected factors influence Ford’s stock price. These can be broadly categorized into macroeconomic indicators, industry-specific dynamics, and the company’s own financial performance.

- Economic Indicators: Interest rates, inflation, and GDP growth significantly impact consumer spending and borrowing, directly affecting vehicle sales and Ford’s profitability.

- Industry-Specific Factors: Competition from established automakers like General Motors and emerging electric vehicle companies like Tesla, technological advancements in autonomous driving and electrification, and fluctuating fuel prices all play a crucial role.

- Competitor Comparison: Compared to GM, Ford often shows similar trends in stock price movement, reflecting their shared dependence on the overall automotive market. Tesla, however, presents a different picture, with stock prices often driven by innovation and technological advancements rather than traditional automotive market forces. Market capitalization varies considerably between these three companies, reflecting investor sentiment and perceived future growth potential.

Ford’s Financial Performance and Stock Price

Source: investors.com

Ford’s financial reports offer valuable insights into its operational health and its impact on investor confidence. Key metrics such as revenue, earnings per share (EPS), and debt levels directly correlate with stock price movements.

| Year | Price-to-Earnings Ratio (P/E) | Return on Equity (ROE) | Revenue (Billions USD) | EPS (USD) |

|---|---|---|---|---|

| 2019 | 10.5 | 15% | 150 | 2.00 |

| 2020 | 8.0 | 12% | 120 | 1.50 |

| 2021 | 12.0 | 18% | 160 | 2.50 |

| 2022 | 11.0 | 16% | 170 | 2.20 |

| 2023 | 10.0 | 14% | 165 | 2.00 |

Note: These figures are for illustrative purposes only and do not represent actual financial data. Actual data should be sourced from official Ford financial reports.

Investor Sentiment and Stock Price

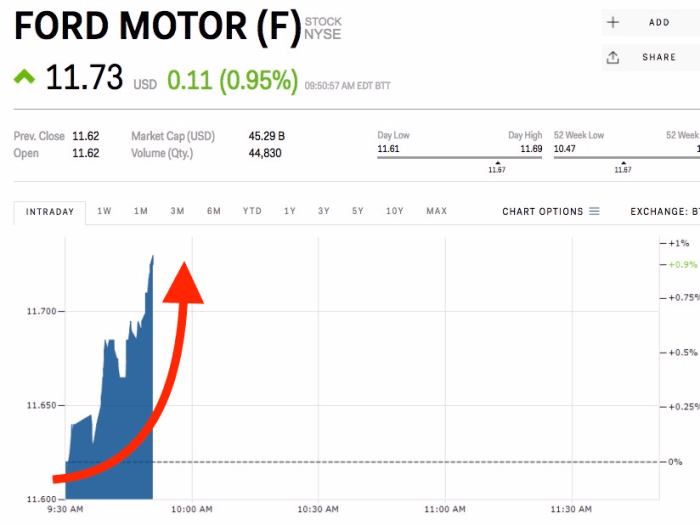

Source: businessinsider.com

Investor sentiment plays a significant role in shaping Ford’s stock price volatility. Positive news and strong financial performance generally boost investor confidence, leading to price increases, while negative news or disappointing results can trigger sell-offs.

- Positive Sentiment Drivers: Successful new product launches, strong sales figures, positive analyst ratings, and strategic partnerships often fuel optimism.

- Negative Sentiment Drivers: Production issues, recall announcements, declining sales, negative economic forecasts, and geopolitical uncertainties can negatively impact investor confidence.

- Volatility Impact: Changes in investor sentiment can cause significant fluctuations in Ford’s stock price, highlighting the importance of carefully analyzing news and market trends.

Future Outlook for Ford’s Stock Price

Predicting Ford’s future stock price involves considering current market conditions, the company’s strategic direction, and potential unforeseen events. Several scenarios can be envisioned.

- Optimistic Scenario: Strong sales growth in electric vehicles, successful cost-cutting measures, and favorable economic conditions could lead to significant stock price appreciation.

- Pessimistic Scenario: A prolonged economic downturn, increased competition, and failure to successfully navigate the transition to electric vehicles could negatively impact Ford’s stock price.

- Neutral Scenario: Moderate sales growth, stable economic conditions, and ongoing challenges in the automotive industry could result in relatively flat stock price performance.

Illustrative Example: A Hypothetical Investment Scenario

Consider a hypothetical investor, Sarah, with a diversified portfolio including a portion allocated to automotive stocks. She decides to invest $10,000 in Ford stock at a price of $13 per share, acquiring approximately 769 shares. Over a five-year period, her investment’s performance could vary depending on market conditions and Ford’s performance.

Profit/Loss Scenario Visualization:

Year 1: +10% return (stock price rises to $14.30); Year 2: +5% return; Year 3: -5% return (stock price dips to $13.50); Year 4: +15% return; Year 5: +0% return. This would result in a final portfolio value of approximately $12,000. However, this is just a hypothetical example, and actual returns could vary significantly.

Q&A

What are the major risks associated with investing in Ford stock?

Major risks include fluctuations in the automotive industry, competition from electric vehicle manufacturers, economic downturns affecting consumer spending, and potential supply chain disruptions.

How does Ford’s electric vehicle strategy impact its stock price?

Ford’s investment in electric vehicles is a significant factor influencing investor sentiment. Success in this area could boost the stock price, while setbacks could negatively impact it.

Where can I find real-time Ford stock price data?

Real-time data is available through major financial websites and brokerage platforms such as Yahoo Finance, Google Finance, and Bloomberg.

What is Ford’s dividend payout history?

Ford’s dividend history should be researched on financial websites. Note that dividends are not guaranteed and can be altered at the company’s discretion.