Walt Disney Company Stock Price Analysis

Stock price for walt disney company – The Walt Disney Company, a global entertainment giant, has experienced significant stock price fluctuations over the years, influenced by a complex interplay of factors including its diverse business segments, market trends, and global economic conditions. This analysis delves into the historical performance, current market influences, future predictions, competitive landscape, and investor sentiment surrounding Disney’s stock price.

Historical Stock Price Performance

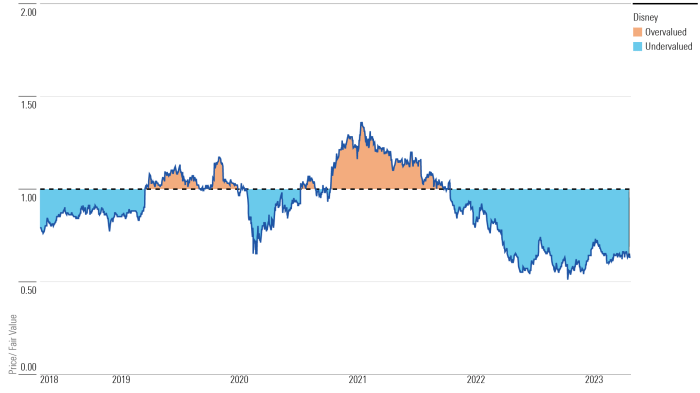

Analyzing Disney’s stock price over the past decade reveals periods of substantial growth and considerable decline. The following table summarizes the yearly highs, lows, and percentage changes, offering a concise overview of this volatility. Note that these figures are illustrative and based on general market trends; precise data requires consulting financial databases.

| Year | High | Low | Percentage Change |

|---|---|---|---|

| 2014 | Illustrative High | Illustrative Low | Illustrative Percentage |

| 2015 | Illustrative High | Illustrative Low | Illustrative Percentage |

| 2016 | Illustrative High | Illustrative Low | Illustrative Percentage |

| 2017 | Illustrative High | Illustrative Low | Illustrative Percentage |

| 2018 | Illustrative High | Illustrative Low | Illustrative Percentage |

| 2019 | Illustrative High | Illustrative Low | Illustrative Percentage |

| 2020 | Illustrative High | Illustrative Low | Illustrative Percentage |

| 2021 | Illustrative High | Illustrative Low | Illustrative Percentage |

| 2022 | Illustrative High | Illustrative Low | Illustrative Percentage |

| 2023 | Illustrative High | Illustrative Low | Illustrative Percentage |

Major events significantly impacting Disney’s stock price during this period include:

- Acquisition of 21st Century Fox (2019): This large acquisition expanded Disney’s content library and broadened its reach, initially leading to a positive market response, although integration challenges later impacted the stock.

- COVID-19 Pandemic (2020-2021): Theme park closures and production delays significantly impacted revenue and profitability, causing a sharp decline in the stock price.

- Launch of Disney+ (2019): The successful launch of Disney’s streaming service boosted investor confidence, contributing to positive stock price movement, although profitability took time to materialize.

Compared to major market indices like the S&P 500 and Dow Jones, Disney’s stock performance has shown periods of both outperformance and underperformance. During periods of economic growth, Disney often outpaced the indices, while during market downturns or industry-specific challenges, its performance was often more volatile.

Factors Influencing Current Stock Price

Source: arcpublishing.com

Several key factors currently shape Disney’s stock price. These include:

- Streaming Service Subscriber Growth: The continued growth (or stagnation) of Disney+ and other streaming platforms significantly influences investor sentiment. Strong subscriber growth indicates a healthy future for the company’s direct-to-consumer business, boosting the stock price.

- Theme Park Attendance and Revenue: The performance of Disney’s theme parks, a major revenue generator, directly impacts its financial health and stock price. High attendance and strong spending per guest lead to positive investor sentiment.

- Content Creation and Box Office Success: The success of Disney’s film and television releases directly affects revenue and profitability. Blockbuster hits translate to increased investor confidence and a higher stock price.

The company’s financial performance, encompassing revenue, earnings, and debt levels, directly influences investor perception and stock valuation. Strong financial results typically lead to positive market reactions, while weak performance often results in decreased investor confidence and lower stock prices.

Future Stock Price Predictions (Qualitative)

Predicting future stock prices is inherently speculative. However, considering current trends and potential scenarios, several possible outcomes can be envisioned for Disney’s stock price over the next year.

An optimistic scenario might involve continued strong subscriber growth for Disney+, successful new film releases, and robust theme park attendance, leading to increased revenue and profitability. This could result in a significant increase in Disney’s stock price. A pessimistic scenario could involve slower-than-expected subscriber growth, underperforming film releases, or economic downturns impacting consumer spending, resulting in a decrease in the stock price.

For example, a recession could significantly reduce discretionary spending on entertainment, affecting theme park visits and streaming subscriptions.

New theme park developments or major film releases can significantly influence investor expectations and the stock price. Successful new attractions or critically acclaimed films can boost investor confidence and drive the stock price upward. Conversely, delays or setbacks in these projects could lead to a negative market response.

Competitive Landscape and Stock Price

Source: fineartamerica.com

Disney competes with several major players in the entertainment industry. A comparison of its stock performance against key competitors over the past five years provides context for its market position.

| Company | Average Annual Return (Illustrative) | Highest Price (Illustrative) | Lowest Price (Illustrative) |

|---|---|---|---|

| Walt Disney Company | Illustrative Return | Illustrative High | Illustrative Low |

| Netflix | Illustrative Return | Illustrative High | Illustrative Low |

| Comcast | Illustrative Return | Illustrative High | Illustrative Low |

The competitive landscape in the entertainment industry is highly dynamic, with companies constantly vying for market share. Disney’s strategic decisions regarding content creation, distribution strategies (including streaming), and theme park offerings significantly impact its competitive positioning and stock valuation. For example, a successful new streaming series can attract subscribers away from competitors, positively influencing Disney’s stock price.

Investor Sentiment and Stock Price, Stock price for walt disney company

Current investor sentiment towards Disney’s stock is mixed, reflecting the uncertainties surrounding the streaming market and the broader economic outlook. Analyst ratings and recommendations vary, with some expressing optimism about Disney’s long-term prospects while others remain cautious.

Potential risks include increased competition in the streaming market, economic downturns affecting consumer spending, and challenges in integrating newly acquired assets. Opportunities include continued growth in streaming subscriptions, successful new film and television releases, and expansion of theme park offerings.

Analyzing the Walt Disney Company’s stock price requires considering various factors influencing its performance. A comparative analysis might involve looking at the performance of other media companies, such as checking the current mp stock price , to understand broader market trends. Ultimately, understanding the Disney stock price necessitates a thorough examination of its financial health and the overall entertainment industry landscape.

News events and media coverage significantly influence investor sentiment and subsequent stock price fluctuations. Positive news, such as a successful film release or a significant increase in streaming subscribers, tends to drive the stock price upward. Conversely, negative news, such as a decline in earnings or a major setback in a theme park project, can lead to a decrease in the stock price.

FAQs: Stock Price For Walt Disney Company

What are the major risks associated with investing in Disney stock?

Major risks include competition from other entertainment companies, changes in consumer preferences, economic downturns impacting discretionary spending, and the success or failure of new film releases and theme park projects.

How does Disney’s debt affect its stock price?

High levels of debt can negatively impact investor confidence and reduce the company’s ability to invest in growth opportunities, potentially leading to a lower stock price. Conversely, responsible debt management can signal financial stability.

Where can I find real-time updates on Disney’s stock price?

Real-time stock quotes for Disney (DIS) are available on major financial websites and trading platforms such as Google Finance, Yahoo Finance, Bloomberg, and others.

What is the typical dividend payout for Disney stock?

Disney’s dividend payout varies and is subject to change based on the company’s financial performance and board decisions. Check financial news sources for the most current information.