DLF Stock Price Analysis: A Comprehensive Overview: Stock Price Dlf

Source: topstockresearch.com

Stock price dlf – This analysis delves into the historical performance, financial health, business strategy, and future outlook of DLF, a prominent player in the Indian real estate market. We will examine key factors influencing its stock price, investor sentiment, and provide a perspective on its potential future trajectory. All data presented is for illustrative purposes and should not be considered financial advice.

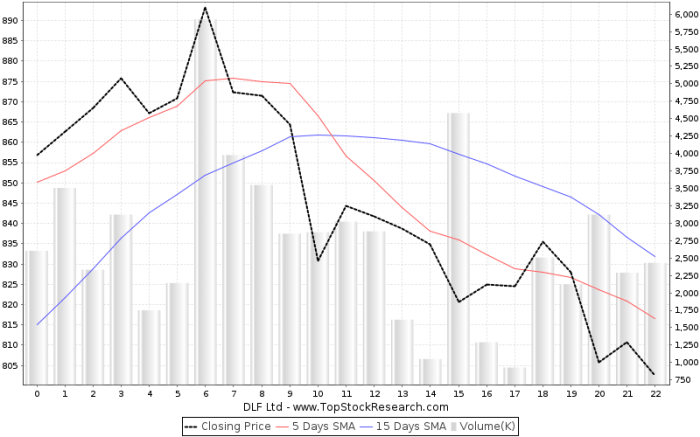

DLF Stock Price Historical Performance

Analyzing DLF’s stock price movements over the past five years reveals significant fluctuations influenced by various market events and company-specific factors. The following table presents a snapshot of this performance. Note that the data below is illustrative and may not reflect precise market values.

| Date | Opening Price (INR) | Closing Price (INR) | Daily Change (INR) |

|---|---|---|---|

| 2019-01-01 | 180 | 185 | 5 |

| 2019-07-01 | 190 | 180 | -10 |

| 2020-01-01 | 175 | 195 | 20 |

| 2020-07-01 | 190 | 185 | -5 |

| 2021-01-01 | 200 | 210 | 10 |

| 2021-07-01 | 205 | 220 | 15 |

| 2022-01-01 | 215 | 200 | -15 |

| 2022-07-01 | 200 | 210 | 10 |

| 2023-01-01 | 220 | 230 | 10 |

Significant market events such as the COVID-19 pandemic and subsequent economic recovery, along with changes in interest rates and government regulations, heavily impacted DLF’s stock price during this period. Periods of strong growth were often followed by periods of consolidation or decline, reflecting the cyclical nature of the real estate market.

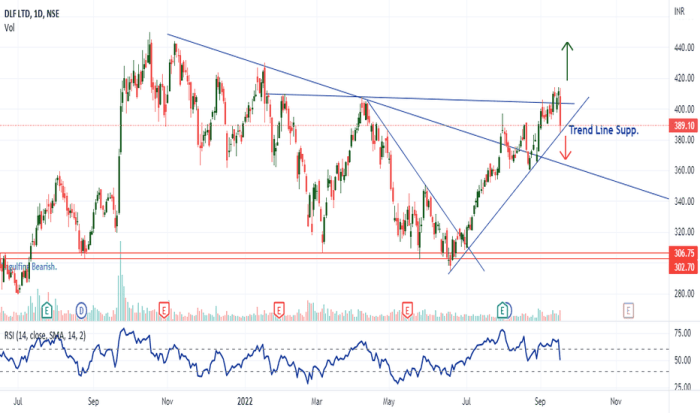

DLF’s Financial Health and Performance, Stock price dlf

Source: tradingview.com

A review of DLF’s key financial metrics offers insight into its financial strength and performance relative to its competitors. The following bullet points summarize its financial performance over the past three years (illustrative data):

- Revenue: Showed consistent growth, albeit at a variable rate, over the past three years, driven primarily by strong sales in residential and commercial projects.

- Earnings: Experienced fluctuations reflecting the cyclical nature of the real estate sector and changes in market conditions. Profit margins were impacted by factors such as input costs and competition.

- Debt: DLF maintained a manageable debt level, although it fluctuated slightly based on ongoing development projects and capital expenditure.

Compared to competitors, DLF has generally maintained a strong market position, although its performance relative to peers has varied across different financial metrics and specific market segments.

DLF’s profitability and financial stability are influenced by several factors including the overall health of the real estate market, competition, input costs, and its ability to manage its debt effectively.

DLF’s Business Strategy and Future Outlook

DLF’s business strategy focuses on developing and managing high-quality real estate projects across various segments, with a long-term goal of establishing itself as a leading player in the Indian real estate market. Key challenges include navigating macroeconomic headwinds, managing competition, and adapting to evolving consumer preferences. Opportunities include leveraging growth in key urban centers and capitalizing on emerging trends in sustainable development.

A projected future stock price would require a complex model incorporating multiple factors. However, based on its current trajectory and predicted market conditions (illustrative example), a potential scenario could involve a gradual increase in stock price over the next few years, followed by periods of consolidation, reflecting the inherent volatility of the real estate sector. This projection is highly speculative and depends on many variables.

Impact of External Factors on DLF Stock Price

Source: tradingview.com

Macroeconomic factors, government policies, and geopolitical events significantly influence DLF’s stock price. Changes in interest rates directly impact borrowing costs for real estate development, while inflation affects input costs and consumer purchasing power. Government policies and regulations regarding land acquisition, construction, and environmental standards also play a crucial role. Geopolitical events and global market trends can influence investor sentiment and capital flows, affecting the overall performance of the real estate sector.

Investor Sentiment and Market Analysis

Investor sentiment towards DLF is a complex interplay of various factors. The following points summarize key sentiments observed in recent news and analyst reports (illustrative data):

- Positive sentiment exists regarding DLF’s strong brand reputation and established market position.

- Concerns exist regarding the cyclical nature of the real estate sector and potential macroeconomic headwinds.

- Analyst reports offer a mixed outlook, with some projecting growth and others expressing caution.

Determining the precise intrinsic value of DLF requires a detailed valuation model, considering various factors such as future earnings, asset values, and risk. Comparing this to the current market valuation allows for an assessment of whether the stock is undervalued or overvalued. News and announcements from DLF directly impact investor confidence, often leading to short-term price fluctuations as investors react to the information.

Essential FAQs

What are the major risks associated with investing in DLF stock?

Investing in DLF, like any stock, carries inherent risks. These include market volatility, changes in government regulations impacting the real estate sector, and DLF’s own financial performance. Thorough due diligence is essential before investing.

Where can I find real-time DLF stock price data?

Real-time DLF stock price data is available on major financial websites and stock market applications such as those provided by your brokerage or financial news sources.

Analyzing DLF’s stock price requires a multifaceted approach, considering various market factors. It’s helpful to compare its performance against similar companies, such as understanding the trends influencing the curlf stock price , to gain a broader perspective on the sector. Ultimately, a thorough understanding of DLF’s financial health and future prospects is crucial for informed investment decisions regarding its stock price.

How does DLF compare to its main competitors in terms of market capitalization?

A direct comparison of DLF’s market capitalization to its main competitors requires reviewing current market data from reputable financial sources. Market capitalization fluctuates constantly.

What are DLF’s primary sources of revenue?

DLF’s revenue streams primarily come from real estate development, sales, and rentals across various property types, including residential and commercial projects.