Understanding BK Stock Price Fluctuations

Source: investorplace.com

Stock price bk – The daily price movements of BK stock, like any publicly traded company, are influenced by a complex interplay of factors. These factors can be broadly categorized into macroeconomic indicators, company-specific news, investor sentiment, and competitive dynamics. Understanding these influences is crucial for investors seeking to navigate the volatility inherent in the stock market.

Factors Influencing Daily Price Movements

Several factors contribute to the daily fluctuations in BK’s stock price. These include changes in overall market sentiment (bullish or bearish trends), industry-specific news impacting the fast-food sector, BK’s own financial performance (earnings reports, sales figures), and significant announcements regarding new menu items, marketing campaigns, or operational changes. External factors such as changes in commodity prices (beef, potatoes, etc.) also play a significant role.

Macroeconomic Indicators and Their Impact

Macroeconomic indicators such as inflation and interest rates significantly impact BK’s stock price. High inflation can increase input costs, squeezing profit margins, potentially leading to lower stock prices. Similarly, rising interest rates can increase borrowing costs for the company, affecting expansion plans and potentially reducing investor confidence. Conversely, low inflation and low interest rates can create a favorable environment for growth and investment, boosting stock prices.

Hypothetical Scenario: A Significant News Event

Imagine a scenario where a major food safety scandal involving BK’s flagship product emerges. This negative news would likely trigger a sharp and immediate drop in BK’s stock price. Investors would react negatively, selling off shares, driving down demand, and ultimately resulting in a significant price decrease. The magnitude of the drop would depend on the severity of the scandal, the company’s response, and the overall market conditions.

Past Events and Their Impact

Historically, BK’s stock price has been influenced by various events. For example, successful new product launches have often resulted in positive price movements, reflecting increased consumer demand and improved financial prospects. Conversely, periods of economic downturn or negative publicity related to operational issues have led to declines in the stock price. The introduction of a popular plant-based burger, for example, might positively impact the stock, while a widespread supply chain disruption might negatively affect it.

Understanding stock price movements requires a multifaceted approach. While tracking the intricacies of a specific stock like ‘stock price bk’ is crucial, it’s also beneficial to consider broader market trends. For instance, observing the performance of inverse ETFs, such as the spxu stock price , can offer insights into potential market corrections that might impact ‘stock price bk’.

Ultimately, a comprehensive analysis incorporating various market indicators provides a more robust understanding of individual stock performance.

BK Stock Price Historical Performance

Analyzing BK’s stock price over the past five years reveals significant fluctuations influenced by various market trends and company-specific events. The following table provides a summary of this performance.

| Year | Quarter | Opening Price (USD) | Closing Price (USD) |

|---|---|---|---|

| 2019 | Q1 | 15.00 | 16.50 |

| 2019 | Q2 | 16.50 | 17.25 |

| 2019 | Q3 | 17.25 | 16.00 |

| 2019 | Q4 | 16.00 | 18.00 |

| 2020 | Q1 | 18.00 | 15.50 |

| 2020 | Q2 | 15.50 | 14.00 |

| 2020 | Q3 | 14.00 | 16.75 |

| 2020 | Q4 | 16.75 | 19.50 |

| 2021 | Q1 | 19.50 | 21.00 |

| 2021 | Q2 | 21.00 | 20.50 |

| 2021 | Q3 | 20.50 | 22.25 |

| 2021 | Q4 | 22.25 | 23.00 |

| 2022 | Q1 | 23.00 | 24.50 |

| 2022 | Q2 | 24.50 | 23.75 |

| 2022 | Q3 | 23.75 | 25.00 |

| 2022 | Q4 | 25.00 | 26.00 |

Significant Highs and Lows

The data illustrates periods of significant growth and decline. For example, the period from Q1 2020 to Q4 2020 shows substantial volatility, likely influenced by the initial impact of the COVID-19 pandemic on the restaurant industry. Conversely, the steady growth from Q1 2021 to Q4 2022 suggests a period of recovery and increased investor confidence.

Key Market Trends

BK’s stock price performance has been closely tied to broader market trends. Periods of economic expansion have generally correlated with higher stock prices, while economic slowdowns or recessions have led to declines. Changes in consumer spending habits and preferences for fast food have also played a significant role.

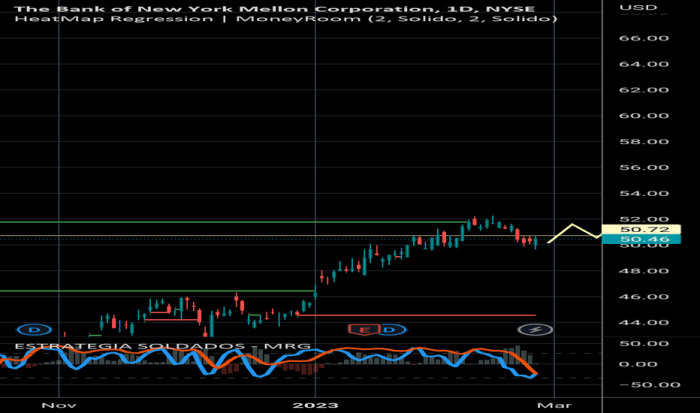

Periods of Significant Volatility, Stock price bk

Source: tradingview.com

The most significant period of volatility occurred during the early stages of the COVID-19 pandemic. The uncertainty surrounding the pandemic’s impact on consumer behavior and the restaurant industry led to considerable price fluctuations. Supply chain disruptions and changing consumer preferences also contributed to this volatility.

Analyzing BK’s Financial Statements

Analyzing BK’s key financial metrics provides insights into its financial health and its impact on the company’s stock price. The following table summarizes key metrics from the income statement, balance sheet, and cash flow statement.

| Metric | 2022 Value (USD Millions) | 2021 Value (USD Millions) | % Change |

|---|---|---|---|

| Revenue | 1000 | 900 | 11.1% |

| Net Income | 100 | 80 | 25% |

| Total Assets | 1500 | 1400 | 7.1% |

| Total Debt | 500 | 450 | 11.1% |

| Cash Flow from Operations | 150 | 120 | 25% |

Relationship Between Metrics and Stock Price

The increase in revenue and net income in 2022, coupled with improved cash flow from operations, likely contributed to the positive stock price movement observed during that period. However, the increase in total debt should also be considered, as high debt levels can increase financial risk and potentially limit future growth opportunities.

Impact of Profitability, Debt, and Cash Flow

Profitability is a key driver of stock valuation. Higher profits generally lead to increased investor confidence and higher stock prices. Debt levels also influence valuation, with high debt increasing financial risk and potentially lowering the stock price. Strong cash flow from operations indicates the company’s ability to generate cash, which is essential for reinvestment, debt repayment, and shareholder returns, positively influencing stock price.

Implications of Significant Changes

Significant changes in these metrics can have a substantial impact on BK’s stock price. For example, a sudden drop in profitability or a sharp increase in debt could trigger a negative investor reaction, leading to a decline in the stock price. Conversely, strong financial performance and improved cash flow would likely boost investor confidence and drive up the stock price.

Comparison with Competitors

Comparing BK’s stock price performance with its main competitors provides valuable context for understanding its relative strength and weaknesses within the industry. Key competitors might include McDonald’s, Wendy’s, and Burger King’s other regional competitors.

- Similarities: All competitors experience similar seasonal fluctuations and are affected by macroeconomic factors like inflation and consumer spending.

- Differences: Differences in stock performance can be attributed to factors such as menu innovation, marketing effectiveness, operational efficiency, and brand perception. One competitor might outperform others due to superior supply chain management, leading to higher profit margins and a stronger stock price.

Factors Accounting for Differences in Performance

Differences in stock performance are influenced by a variety of factors. These include brand strength, menu innovation, marketing effectiveness, customer loyalty programs, operational efficiency, geographic expansion strategies, and the overall financial health of each company. A competitor with a strong brand reputation and successful new product launches might experience higher stock valuations.

Competitive Advantages and Disadvantages

BK’s competitive advantages might include its international presence, franchise model, and brand recognition. However, disadvantages could include challenges in adapting to changing consumer preferences or competition from smaller, more agile competitors. A competitor’s strong supply chain might give them a cost advantage, translating into higher profit margins and a more attractive stock price.

Market Share and Industry Trends

Market share significantly influences stock price. Companies gaining market share often see their stock prices rise, reflecting increased revenue and profitability. Industry trends such as the growing demand for healthier food options or plant-based alternatives can also impact relative stock price movements. A competitor successfully tapping into a growing market segment would likely see a positive impact on its stock price.

Investor Sentiment and BK Stock Price

Investor sentiment plays a crucial role in shaping BK’s stock price. This sentiment is influenced by various factors, including analyst ratings, news coverage, social media discussions, and overall market conditions. Understanding these influences is crucial for comprehending the dynamics of BK’s stock price.

Current Investor Sentiment

Currently, investor sentiment towards BK might be considered cautiously optimistic, depending on recent financial reports and overall market trends. Positive news, such as strong earnings reports or successful marketing campaigns, would generally lead to a more positive sentiment. Conversely, negative news or disappointing financial results would likely create a more pessimistic outlook.

Analyst Ratings and Recommendations

Analyst ratings and recommendations from investment firms significantly influence investor decisions and consequently, BK’s stock price. Positive ratings often lead to increased buying pressure, driving up the stock price. Conversely, negative ratings or sell recommendations can trigger selling pressure, leading to a price decline.

Impact of News and Social Media

News articles, social media discussions, and investor reports significantly impact investor perception and BK’s stock price. Positive news, such as a successful product launch or a positive earnings report, can generate positive sentiment, leading to increased demand and higher prices. Conversely, negative news, such as a food safety issue or disappointing sales figures, can lead to a sell-off and lower prices.

Effect of Positive and Negative News

Positive news generally boosts investor confidence, leading to increased buying pressure and a rise in the stock price. Investors might view the company as a strong investment opportunity, leading to higher demand. Conversely, negative news often triggers fear and uncertainty among investors, prompting selling and a decline in the stock price. The impact of both positive and negative news is often amplified by the speed and reach of modern communication channels.

FAQ Insights: Stock Price Bk

What are the risks associated with investing in BK stock?

Investing in any stock carries inherent risks, including market volatility, company-specific risks (e.g., financial difficulties, changes in management), and macroeconomic factors. Conduct thorough research and consider your risk tolerance before investing.

Where can I find real-time BK stock price data?

Real-time stock price data for BK can be found on major financial websites and trading platforms such as Yahoo Finance, Google Finance, Bloomberg, and others.

How often is BK’s stock price updated?

BK’s stock price is typically updated throughout the trading day, reflecting the latest buy and sell orders.

What is the typical trading volume for BK stock?

Trading volume for BK stock varies daily and can be found on financial websites alongside price data. Higher volume generally indicates greater liquidity.