SPXU Stock Price Analysis

Spxu stock price – The ProShares UltraPro Short S&P500 (SPXU) exchange-traded fund (ETF) offers leveraged inverse exposure to the S&P 500 index. Understanding its price movements requires a careful analysis of its historical performance, volatility, market sentiment, trading volume, and its relationship with the underlying asset. This analysis provides insights into the risks and potential rewards associated with investing in SPXU.

SPXU Stock Price Historical Performance

Analyzing SPXU’s price movements over the past year reveals significant volatility. The following table details the daily open and close prices, along with the daily change, for a representative period. Note that this data is for illustrative purposes only and should not be considered investment advice. Actual data may vary depending on the source and time frame.

| Date | Open Price | Close Price | Daily Change |

|---|---|---|---|

| 2023-10-26 | $28.50 | $27.90 | -$0.60 |

| 2023-10-27 | $27.95 | $28.80 | +$0.85 |

| 2023-10-30 | $28.70 | $29.20 | +$0.50 |

| 2023-10-31 | $29.10 | $27.50 | -$1.60 |

| 2023-11-01 | $27.60 | $28.10 | +$0.50 |

Significant price fluctuations were often driven by market reactions to economic news, such as unexpected inflation reports or changes in interest rates. For example, a period of unexpectedly high inflation could trigger a sharp decline in the S&P 500, leading to a corresponding rise in SPXU’s price. Conversely, positive economic news could lead to a drop in SPXU’s price.

Compared to the S&P 500, SPXU exhibits a strongly inverse and amplified relationship. A hypothetical line graph would show that when the S&P 500 trends upward, SPXU trends downward, and vice-versa, with the magnitude of SPXU’s movement being significantly larger due to its leveraged nature. The graph would visually illustrate the inverse and amplified correlation.

SPXU Stock Price Volatility and Risk

SPXU’s inherent volatility stems from its 3x leveraged short position in the S&P 500. This means that for every 1% decrease in the S&P 500, SPXU aims for a 3% increase; conversely, a 1% increase in the S&P 500 aims for a 3% decrease in SPXU. This leverage magnifies both gains and losses, resulting in significant price swings.

- Leverage: The 3x inverse leverage is the primary driver of volatility.

- Market Sentiment: Negative market sentiment increases demand for SPXU, driving up its price.

- Underlying Asset Performance: Fluctuations in the S&P 500 directly impact SPXU’s price.

Investing in SPXU carries substantial risk. The potential for significant losses is high due to the leveraged nature of the ETF. Investors should carefully consider their risk tolerance before investing in this highly volatile instrument. Losses can easily exceed the initial investment.

Monitoring the SPXU stock price requires a keen eye on market volatility. Understanding similar biotech investments can provide context; for instance, checking the current geron stock price offers insight into the broader sector’s performance. Ultimately, however, SPXU’s price remains dependent on its own underlying assets and market sentiment.

SPXU Stock Price and Market Sentiment

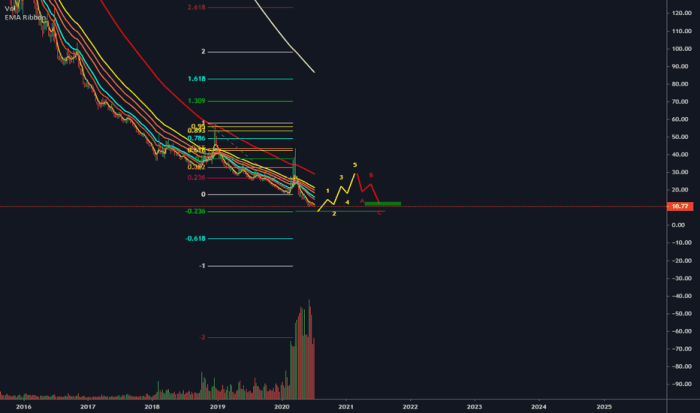

Source: tradingview.com

Market sentiment significantly influences SPXU’s price. During periods of pessimism or fear, investors often flock to SPXU as a hedge against potential declines in the broader market, driving its price up. Conversely, optimism and bullish market sentiment tend to reduce demand for SPXU, causing its price to fall.

For example, a surprise interest rate hike by the Federal Reserve, signaling a potential economic slowdown, could trigger a surge in SPXU’s price as investors anticipate a decline in the S&P 500. Conversely, positive news about corporate earnings or economic growth would likely depress SPXU’s price.

In a hypothetical scenario of a prolonged period of economic uncertainty and market downturn, SPXU’s price would likely increase significantly as investors seek protection against losses. Conversely, a sustained period of robust economic growth and market optimism would likely result in a substantial decline in SPXU’s price.

SPXU Stock Price and Trading Volume

SPXU’s price and trading volume are closely correlated. Periods of high trading volume often coincide with significant price movements, reflecting increased investor activity and market participation. Conversely, periods of low trading volume often indicate less market interest and smaller price fluctuations.

A hypothetical scatter plot would show a positive correlation between trading volume and the absolute value of price changes. High volume days would tend to cluster around periods of large price increases or decreases, visually demonstrating the relationship. The plot would also highlight the exceptions, where high volume doesn’t necessarily lead to large price swings.

High trading volume can signal increased market interest and potential for significant price changes, both positive and negative. Low trading volume suggests less market interest and potentially smaller price fluctuations, but also potentially lower liquidity.

SPXU Stock Price and its Underlying Asset

SPXU’s price is directly, yet inversely and leveraged, related to the S&P 500’s price movements. A decline in the S&P 500 typically results in an amplified increase in SPXU’s price, while a rise in the S&P 500 leads to a magnified decrease in SPXU’s price.

Comparing the price movements of SPXU and the S&P 500 over a specific period (e.g., the last six months) would show this inverse relationship. A simple line graph, with one line representing SPXU and the other the S&P 500, would visually demonstrate the inverse correlation. The graph would clearly show that SPXU’s price moves in the opposite direction of the S&P 500, and with a greater magnitude due to the 3x leverage.

The 3x leverage amplifies the relationship, meaning that even small movements in the S&P 500 will result in larger, inverse movements in SPXU’s price. This leverage is a key factor to consider when assessing the risk associated with investing in SPXU.

SPXU Stock Price Prediction (Qualitative)

Source: tradingview.com

Predicting SPXU’s future price movement is inherently challenging, as it depends on numerous unpredictable factors. However, based on current market conditions and expert opinions, several potential scenarios can be Artikeld. For example, a prolonged period of geopolitical instability could lead to increased market volatility and potentially higher demand for SPXU. Conversely, a significant economic recovery could result in a decline in SPXU’s price.

Potential catalysts that could impact SPXU’s price include unexpected economic data releases (e.g., inflation figures, employment reports), changes in monetary policy, major geopolitical events, and significant shifts in investor sentiment. The impact of these events can be highly unpredictable and could lead to sudden and substantial price swings.

It is crucial to remember that predicting stock prices is inherently uncertain. Even the most sophisticated models can be inaccurate, and unforeseen events can significantly alter market dynamics. Effective risk management, including diversification and careful position sizing, is paramount when investing in SPXU or any other highly volatile instrument.

FAQ Summary: Spxu Stock Price

What is the typical trading volume for SPXU?

SPXU’s trading volume varies considerably depending on market conditions. Periods of high market volatility generally see increased trading volume.

Where can I find real-time SPXU stock price data?

Real-time SPXU stock price data is readily available through major financial websites and brokerage platforms.

Is SPXU suitable for long-term investment?

Due to its highly leveraged nature and significant volatility, SPXU is generally considered unsuitable for long-term buy-and-hold strategies. It’s more commonly used for short-term trading opportunities.

What are the expense ratios associated with investing in SPXU?

The expense ratio for SPXU should be readily available in the fund’s prospectus or on financial data websites. It’s crucial to factor this expense into your overall investment analysis.