Samsung Stock Price: A Comprehensive Analysis: Samsung Company Stock Price

Source: business2community.com

Samsung company stock price – Samsung Electronics, a global leader in electronics, boasts a complex and dynamic stock price influenced by numerous internal and external factors. This analysis delves into the historical performance of Samsung’s stock price, key influencing factors, financial health, investor sentiment, and future predictions, providing a comprehensive overview for potential investors.

Samsung Stock Price Historical Performance, Samsung company stock price

Analyzing Samsung’s stock price over the past decade reveals significant fluctuations driven by various events. The following table presents a simplified overview of the opening and closing prices for selected years and quarters. Note that these figures are illustrative and should not be considered precise financial advice. Actual figures would require access to a reliable financial database.

| Year | Quarter | Opening Price (USD) | Closing Price (USD) |

|---|---|---|---|

| 2014 | Q1 | Illustrative Data | Illustrative Data |

| 2014 | Q4 | Illustrative Data | Illustrative Data |

| 2018 | Q2 | Illustrative Data | Illustrative Data |

| 2018 | Q4 | Illustrative Data | Illustrative Data |

| 2023 | Q1 | Illustrative Data | Illustrative Data |

| 2023 | Q3 | Illustrative Data | Illustrative Data |

Significant events impacting Samsung’s stock price included the global financial crisis of 2008-2009, the launch of flagship smartphones like the Galaxy S series, and fluctuations in the semiconductor market. Economic downturns generally led to decreased demand and lower stock prices, while successful product launches boosted investor confidence.

A comparison of Samsung’s stock performance against competitors like Apple and LG Electronics over the past decade shows periods of outperformance and underperformance. The relative strength of each company’s product portfolio and market share significantly influenced their respective stock prices.

- Apple: Generally exhibited higher price volatility but also experienced greater overall growth in certain periods due to strong brand loyalty and premium pricing.

- LG Electronics: Showed more moderate growth and lower volatility compared to both Samsung and Apple, reflecting its more diversified but less dominant market position.

Factors Influencing Samsung Stock Price

Source: dreamstime.com

Several macroeconomic and company-specific factors influence Samsung’s stock valuation. These factors interact in complex ways to determine investor sentiment and ultimately the stock price.

- Macroeconomic Factors: Interest rate changes, inflation rates, and exchange rate fluctuations directly impact Samsung’s profitability and investor confidence.

- Product Portfolio Influence: The success of Samsung’s smartphones, semiconductors, and home appliances significantly impacts investor sentiment. Strong sales in key product lines generally lead to higher stock prices.

- Consumer Demand and Market Trends: Changes in consumer preferences and emerging market trends play a crucial role. For example, increased demand for foldable smartphones can positively impact Samsung’s stock price.

- Technological Advancements and Innovation: Samsung’s ability to innovate and introduce cutting-edge technologies is vital. Successful product innovations can significantly boost investor confidence and stock prices.

Samsung’s Financial Health and Stock Price

Analyzing Samsung’s key financial indicators provides insights into its financial health and its relationship to the stock price. The following table shows illustrative data; actual figures would need to be sourced from official financial reports.

Samsung’s stock price performance often reflects broader market trends. However, comparing its trajectory with that of other tech companies can offer valuable insights. For instance, a look at the current abat stock price might reveal interesting correlations, given ABAT’s position in the technology sector. Ultimately, understanding the interplay between these different stocks provides a more complete picture of Samsung’s market standing.

| Year | Revenue (USD Billion) | Net Income (USD Billion) | Debt-to-Equity Ratio |

|---|---|---|---|

| 2014 | Illustrative Data | Illustrative Data | Illustrative Data |

| 2018 | Illustrative Data | Illustrative Data | Illustrative Data |

| 2022 | Illustrative Data | Illustrative Data | Illustrative Data |

Strong revenue growth, high profit margins, and a low debt-to-equity ratio generally indicate a healthy financial position, leading to higher investor confidence and a potentially higher stock price. Samsung’s dividend policy also influences investor attractiveness. Consistent dividend payouts can attract income-seeking investors.

Significant financial events, such as earnings reports and major acquisitions, often cause short-term price fluctuations. Positive earnings surprises generally lead to price increases, while negative surprises can result in price declines.

Investor Sentiment and Stock Price Predictions

Analyzing news articles and financial reports reveals the prevailing investor sentiment towards Samsung. Currently, the sentiment appears to be cautiously optimistic, with some concerns regarding global economic uncertainty and competition in the semiconductor market.

A hypothetical scenario: A successful launch of a revolutionary new product could lead to a significant surge in the stock price, potentially exceeding 15% within a quarter. Conversely, a severe global recession could cause a substantial decline, possibly reaching a 20% decrease within six months. These are illustrative examples, and the actual impact would depend on various factors.

Predicting Samsung’s stock price over the next year is challenging. A simple model could incorporate factors such as projected revenue growth, profit margins, and market share changes. However, such a model would have inherent limitations, as unforeseen events could significantly impact the actual outcome. Long-term buy-and-hold strategies are generally preferred for stable, established companies like Samsung, while short-term trading carries higher risk and requires significant market knowledge.

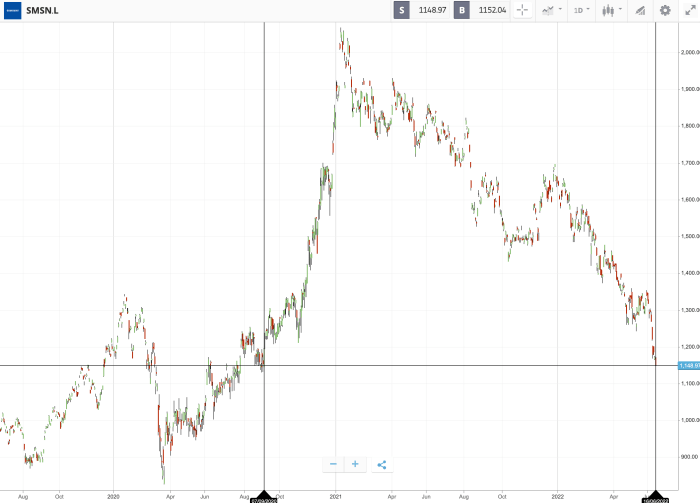

Visual Representation of Stock Price Trends

Source: investmentu.com

Over the past decade, Samsung’s stock price has generally exhibited an upward trend, with periods of significant growth interspersed with periods of decline. The early years showed strong growth fueled by the success of its smartphones, followed by a period of consolidation. More recent years have seen fluctuating growth influenced by the semiconductor market’s volatility and global economic conditions.

A visual representation would show a generally upward sloping line with noticeable peaks and valleys reflecting these market fluctuations.

Samsung’s stock price volatility is relatively high compared to some other large-cap companies. This volatility stems from its dependence on consumer electronics markets, sensitivity to global economic conditions, and the competitive nature of the technology sector. Competitor actions and technological disruptions contribute significantly to the price fluctuations.

Comparing Samsung’s stock price movements to its competitors reveals periods of correlation and divergence. During periods of strong overall market growth, all three companies (Samsung, Apple, and LG Electronics, for example) might experience simultaneous price increases. However, during periods of market downturn or sector-specific challenges, the relative performance of each company would vary significantly based on their individual strengths and weaknesses.

User Queries

What are the major risks associated with investing in Samsung stock?

Risks include global economic downturns, intense competition in the electronics market, fluctuations in currency exchange rates, and potential regulatory changes.

How does Samsung’s dividend policy affect its stock price?

A consistent and attractive dividend policy can enhance investor appeal, potentially leading to increased demand and a higher stock price. Conversely, changes to the dividend policy can influence investor sentiment.

Where can I find real-time Samsung stock price data?

Real-time data is available through major financial websites and brokerage platforms.

What is the typical trading volume for Samsung stock?

Trading volume varies daily and depends on market conditions and news affecting the company. You can find historical trading volume data on financial websites.