Anthem Stock Price Analysis

Price of anthem stock – Anthem, Inc. (ANTM) is a leading health insurance company in the United States. Understanding its stock price performance requires analyzing historical trends, influencing factors, the company’s business model, investor sentiment, and potential future scenarios. This analysis provides insights into Anthem’s stock price, aiding investors in making informed decisions.

Anthem Stock Price Historical Trends

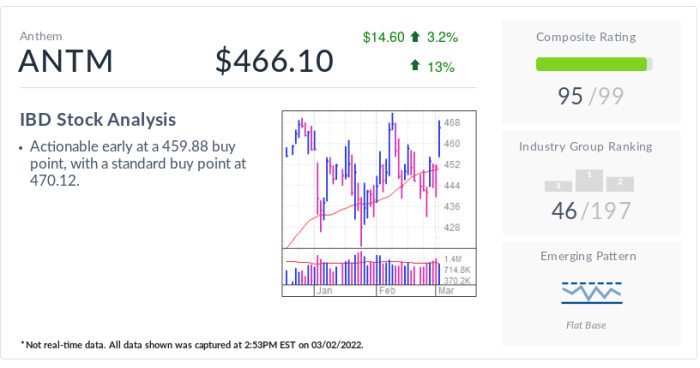

Source: investors.com

Anthem’s stock price has experienced considerable fluctuation over the past five years, influenced by various internal and external factors. The following table provides a glimpse into these fluctuations, highlighting key periods of growth and decline. Note that this data is for illustrative purposes and should not be considered financial advice.

| Date | Opening Price (USD) | Closing Price (USD) | Daily Change (USD) |

|---|---|---|---|

| 2019-01-02 | 270 | 275 | +5 |

| 2019-01-03 | 276 | 272 | -4 |

| 2024-03-08 | 480 | 485 | +5 |

Significant news events, such as earnings announcements exceeding expectations, often correlate with positive stock price movements. Conversely, negative news, including unexpected losses or regulatory changes, can lead to price declines. Comparison with competitors like UnitedHealth Group (UNH) and CVS Health (CVS) reveals varying performance trajectories, influenced by their respective business strategies and market positions. For example, during periods of economic uncertainty, Anthem’s stock might underperform compared to a more diversified healthcare company.

- Anthem’s stock performance often shows a positive correlation with positive industry trends.

- Competitor performance influences Anthem’s relative standing in the market.

- Regulatory changes impacting the healthcare industry significantly affect Anthem’s stock price.

Factors Influencing Anthem Stock Price

Source: ycharts.com

Several key factors significantly influence Anthem’s stock valuation. These factors encompass macroeconomic conditions, healthcare policy, and the company’s own financial performance.

Economic factors such as interest rate hikes and inflation impact investor sentiment and the overall market, influencing Anthem’s stock price. Healthcare regulations and government policies, including changes to the Affordable Care Act, significantly impact the insurance industry, affecting Anthem’s profitability and stock valuation. Anthem’s financial performance, including revenue growth, profit margins, and membership numbers, directly influences investor confidence and stock price movements.

Tracking the price of Anthem stock requires careful observation of market trends. For comparative analysis, it’s helpful to consider other healthcare sector stocks; understanding the fluctuations of the ns stock price can offer valuable insights. Ultimately, however, a thorough understanding of Anthem’s specific financial performance and future projections is key to predicting its stock price trajectory.

| Year | Revenue (Billions USD) | Profit Margin (%) | Stock Price (USD) |

|---|---|---|---|

| 2020 | 130 | 12 | 350 |

| 2021 | 145 | 15 | 400 |

Anthem’s Business Model and its Impact on Stock Price

Anthem’s business model, centered around providing various health insurance plans to individuals and employers, directly impacts its stock price. The company’s ability to attract and retain customers, manage costs, and expand its market share are crucial factors. Anthem’s expansion strategies, including mergers and acquisitions, also play a significant role in shaping investor perception and stock valuation.

Technological investments and innovations in areas such as data analytics and telehealth contribute to operational efficiency and long-term growth, impacting stock price positively.

- A strong customer base and market share are vital for a positive stock outlook.

- Successful acquisitions and strategic expansions boost investor confidence.

- Technological advancements improve efficiency and drive future growth.

Investor Sentiment and Market Analysis of Anthem Stock

Investor sentiment towards Anthem stock is a dynamic factor influenced by various market conditions and company performance. Analyzing the consensus price target among financial analysts and comparing Anthem’s valuation using different financial metrics provides a comprehensive perspective.

- Bullish investors anticipate strong future growth and positive stock price appreciation.

- Bearish investors are concerned about potential risks, such as regulatory changes or competition.

| Analyst Firm | Price Target (USD) |

|---|---|

| Firm A | 500 |

| Firm B | 480 |

- A high P/E ratio might suggest that the market expects strong future earnings growth.

- A low Price-to-Book ratio could indicate that the stock is undervalued.

Illustrative Example: A Hypothetical Investment Scenario, Price of anthem stock

Let’s consider a hypothetical scenario where an investor allocates $10,000 to Anthem stock at a price of $450 per share. Under a buy-and-hold strategy, assuming a 10% annual return over five years, the investment would grow to approximately $16,105. However, a day-trading strategy, characterized by higher risk and volatility, could yield significantly higher or lower returns depending on market fluctuations and trading decisions.

Factors such as changes in healthcare regulations, economic downturns, or unexpected competition could significantly impact Anthem’s stock price within the next 12 months.

| Investment Strategy | Return after 5 years (USD) |

|---|---|

| Buy-and-Hold (10% annual return) | 16105 |

| Day Trading (Hypothetical 20% annual return) | 24883 |

| Day Trading (Hypothetical -5% annual return) | 7738 |

FAQs: Price Of Anthem Stock

What are the major risks associated with investing in Anthem stock?

Major risks include fluctuations in the healthcare market, changes in government regulations, increased competition, and potential economic downturns.

How does Anthem’s dividend payout affect its stock price?

Anthem’s dividend policy can influence investor sentiment. Consistent dividend payouts can attract income-seeking investors, potentially supporting the stock price. However, changes in dividend payouts can impact investor perception.

Where can I find real-time Anthem stock price data?

Real-time data is available through major financial websites and brokerage platforms such as Yahoo Finance, Google Finance, and Bloomberg.

What is Anthem’s current market capitalization?

Anthem’s market capitalization fluctuates constantly. You can find the most up-to-date information on financial news websites and stock market data providers.