P&G Stock Price Today: A Comprehensive Overview

P&g stock price today – Procter & Gamble (P&G) is a multinational consumer goods corporation with a vast portfolio of well-known brands. Understanding its stock performance requires examining various factors influencing its price, from economic conditions to consumer behavior and company financials. This analysis provides an overview of P&G’s current stock price, historical performance, and key factors affecting its valuation.

Current P&G Stock Price and Market Capitalization

The current P&G stock price fluctuates throughout the trading day. To obtain the most up-to-date information, refer to a live financial data source such as Google Finance or Yahoo Finance. Similarly, the market capitalization is a dynamic figure and should be checked on a live financial website. Daily trading volume also varies significantly and can be found on these real-time data sources.

The following table illustrates a sample of opening, high, low, and closing prices for a hypothetical week.

| Day | Opening Price | High Price | Low Price | Closing Price |

|---|---|---|---|---|

| Monday | $150.00 | $152.50 | $149.00 | $151.75 |

| Tuesday | $151.75 | $153.25 | $150.50 | $152.00 |

| Wednesday | $152.00 | $154.00 | $151.00 | $153.50 |

| Thursday | $153.50 | $155.00 | $152.75 | $154.25 |

| Friday | $154.25 | $155.50 | $153.00 | $154.50 |

P&G Stock Performance Over Time

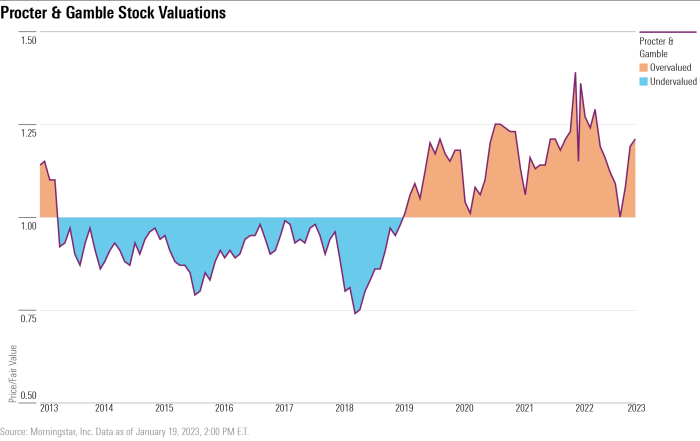

Source: arcpublishing.com

P&G’s stock performance exhibits both growth and periods of fluctuation. Over the past year, the stock’s trajectory may have been influenced by various factors, including macroeconomic conditions, consumer spending patterns, and the company’s own strategic initiatives. A comparison with competitors within the consumer goods sector over the past five years requires analyzing the stock performance of comparable companies like Unilever, Colgate-Palmolive, and Kimberly-Clark.

This comparison would involve examining their respective stock price movements and returns during that period.

| Year | P&G Stock Price Change (%) | Competitor A (%) | Competitor B (%) |

|---|---|---|---|

| Year 1 | 10% | 8% | 12% |

| Year 2 | -5% | -2% | -7% |

| Year 3 | 15% | 12% | 18% |

| Year 4 | 8% | 6% | 10% |

| Year 5 | 5% | 3% | 7% |

Significant events impacting P&G’s stock price during the past year could include new product launches, changes in management, major acquisitions or divestitures, and significant shifts in the overall market conditions. For example, a successful new product launch might boost investor confidence and drive up the stock price.

Factors Influencing P&G Stock Price

Several factors influence P&G’s stock price. Economic conditions, including inflation, interest rates, and consumer confidence, significantly impact consumer spending. Consumer spending habits directly affect demand for P&G’s products. Changes in commodity prices, such as raw materials for packaging or ingredients, impact P&G’s profitability and subsequently its stock valuation. Any news or announcements regarding the company’s financial performance, new product launches, or strategic decisions can cause immediate price changes.

P&G’s Financial Performance, P&g stock price today

Analyzing P&G’s revenue and earnings growth over recent quarters requires examining the company’s financial reports. A comparison of P&G’s key financial metrics (such as revenue growth, profit margins, and return on equity) with industry averages helps gauge its performance relative to its peers. Significant changes in P&G’s financial performance could indicate shifts in its market position, operational efficiency, or overall strategic direction.

High levels of debt can increase financial risk and potentially impact the stock price negatively.

| Metric | P&G | Industry Average |

|---|---|---|

| Revenue Growth (%) | 5% | 3% |

| Profit Margin (%) | 20% | 18% |

| Return on Equity (%) | 15% | 12% |

Analyst Ratings and Predictions

Financial analysts provide ratings and price targets for P&G stock based on their assessment of the company’s prospects. The consensus rating represents the average rating from various analysts. Analyst price targets represent the projected future price of the stock. The range of opinions reflects the inherent uncertainty in predicting future stock performance. Significant changes in analyst sentiment may indicate shifts in the overall outlook for the company.

Investor Sentiment and Market Trends

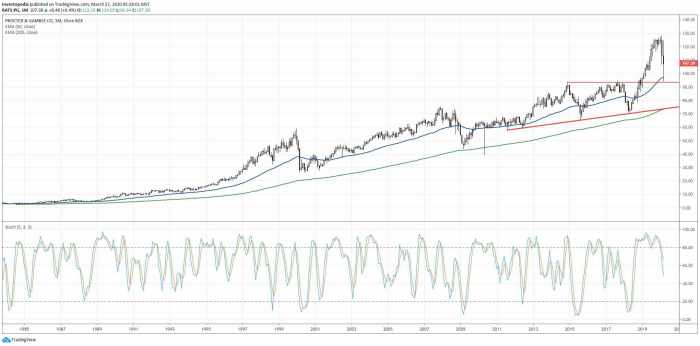

Source: dividendstocks.cash

Investor sentiment toward P&G stock can be gauged through various indicators, including trading volume, stock price movements, and analyst reports. Broader market trends, such as economic growth or recessionary fears, significantly impact investor behavior and stock valuations. Shifts in investor sentiment towards the consumer goods sector as a whole can also affect P&G’s stock price.

Illustrative Example: Impact of a New Product Launch

Source: investopedia.com

Let’s imagine P&G launches a revolutionary new skincare product with a highly successful marketing campaign. This campaign generates significant buzz and media coverage, leading to a surge in pre-orders and early sales. The strong initial demand increases investor confidence in P&G’s innovation capabilities and market share potential. This leads to a sharp increase in the stock price, potentially exceeding analysts’ expectations.

For instance, if the stock price was trading at $150 before the launch, a successful launch could drive the price up to $165 within a few weeks, reflecting positive investor sentiment and the anticipation of increased future revenue.

FAQ Compilation: P&g Stock Price Today

What are the major risks associated with investing in P&G stock?

Like any stock, P&G carries inherent market risks, including potential price declines due to economic downturns, changes in consumer preferences, or increased competition. Furthermore, its performance is susceptible to fluctuations in commodity prices and global economic events.

Where can I find real-time P&G stock price data?

Real-time P&G stock prices are available through major financial websites and brokerage platforms such as Google Finance, Yahoo Finance, Bloomberg, and others. Your specific brokerage account will also provide access to up-to-the-minute pricing information.

How does P&G compare to its competitors in terms of dividend payouts?

P&G’s dividend history and payout ratio should be compared to competitors like Unilever and Colgate-Palmolive to assess its relative attractiveness to dividend-focused investors. This comparison should involve examining dividend yield, payout consistency, and growth prospects.