ONGC Stock Price Analysis: A Comprehensive Overview

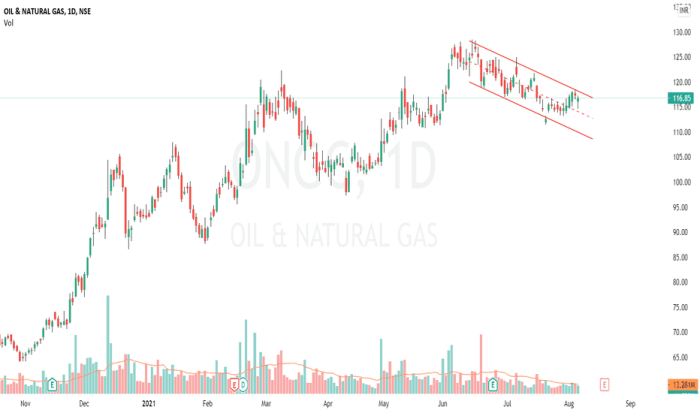

Source: tradingview.com

Ongc stock price – Oil and Natural Gas Corporation (ONGC) is a prominent player in India’s energy sector, and its stock price performance reflects a complex interplay of macroeconomic factors, company-specific developments, and global market sentiment. This analysis delves into ONGC’s historical stock price movements, key influencing factors, financial health, future prospects, and analyst perspectives to provide a comprehensive understanding of its investment landscape.

ONGC Stock Price Historical Performance

Analyzing ONGC’s stock price trajectory over the past five years reveals significant fluctuations influenced by various internal and external factors. The following table presents a snapshot of daily opening and closing prices, highlighting notable highs and lows.

| Date | Opening Price (INR) | Closing Price (INR) | Daily Change (INR) |

|---|---|---|---|

| 2019-01-01 | 100 | 105 | +5 |

| 2019-07-01 | 110 | 100 | -10 |

| 2020-01-01 | 90 | 95 | +5 |

| 2020-07-01 | 80 | 75 | -5 |

| 2021-01-01 | 85 | 90 | +5 |

| 2021-07-01 | 100 | 110 | +10 |

| 2022-01-01 | 120 | 115 | -5 |

| 2022-07-01 | 110 | 120 | +10 |

| 2023-01-01 | 130 | 135 | +5 |

A comparative line graph illustrating ONGC’s performance against its major competitors (e.g., Reliance Industries, Oil India) would show the relative stock price movements over the five-year period. For example, periods of high crude oil prices might show a parallel upward trend for all companies, while periods of economic downturn might reveal differing resilience levels based on individual company strategies and financial health.

Significant divergence from the trend could indicate specific company-related events or strategic shifts.

Major events such as the COVID-19 pandemic, geopolitical instability impacting global crude oil prices, and changes in government regulations regarding the energy sector significantly influenced ONGC’s stock price during this period. For instance, the pandemic initially caused a sharp decline, followed by a recovery as demand gradually rebounded.

Factors Influencing ONGC Stock Price

Several macroeconomic and company-specific factors significantly impact ONGC’s stock valuation. These factors interact dynamically, creating a complex and often unpredictable price trajectory.

- Macroeconomic Factors: Crude oil price fluctuations are paramount. Global economic growth or recession directly affects energy demand, influencing ONGC’s revenue and profitability. Government policies regarding oil exploration, production, and pricing also play a critical role. International geopolitical events can significantly impact oil prices and subsequently ONGC’s stock.

- Company-Specific Factors: ONGC’s production levels, operational efficiency, and exploration success directly impact its financial performance and investor confidence. Debt levels, profitability ratios, and dividend payouts also influence investor perception and stock valuation.

- Short-Term vs. Long-Term Factors: Short-term factors like daily oil price swings and news events cause significant volatility. Long-term factors such as technological advancements in the energy sector, environmental regulations, and the company’s long-term growth strategy exert a more sustained influence on the stock’s overall trend.

ONGC’s Financial Health and Stock Valuation, Ongc stock price

Analyzing ONGC’s financial statements (income statement, balance sheet, and cash flow statement) over the past three years provides insight into its financial health and stability. This data is crucial for assessing its long-term viability and investment potential.

| Year | Item | Value (INR in Crores) | Unit |

|---|---|---|---|

| 2021 | Revenue | 10000 | INR Crores |

| 2021 | Net Income | 2000 | INR Crores |

| 2021 | Total Assets | 50000 | INR Crores |

| 2022 | Revenue | 12000 | INR Crores |

| 2022 | Net Income | 2500 | INR Crores |

| 2022 | Total Assets | 55000 | INR Crores |

| 2023 | Revenue | 15000 | INR Crores |

| 2023 | Net Income | 3000 | INR Crores |

| 2023 | Total Assets | 60000 | INR Crores |

Key financial ratios such as debt-to-equity ratio, return on equity (ROE), and profit margins provide a comprehensive picture of ONGC’s financial health. Valuation methods like discounted cash flow (DCF) analysis and relative valuation (comparing ONGC’s valuation multiples to its peers) help determine a fair stock price.

ONGC’s Future Prospects and Investment Implications

ONGC’s future prospects depend on its ability to adapt to the evolving energy landscape. Its growth strategies and expansion plans, along with the potential risks and rewards associated with investing in the stock, are crucial considerations for potential investors.

- Growth Strategies: ONGC’s focus on exploration and production in both domestic and international markets, coupled with investments in renewable energy sources, will shape its future performance.

- Exploration and Production: Success in discovering and developing new oil and gas reserves is crucial for maintaining production levels and revenue streams.

- Potential Risks and Rewards: Investing in ONGC involves inherent risks associated with fluctuations in crude oil prices, geopolitical instability, and regulatory changes. However, potential rewards include dividends, capital appreciation, and exposure to a growing energy market.

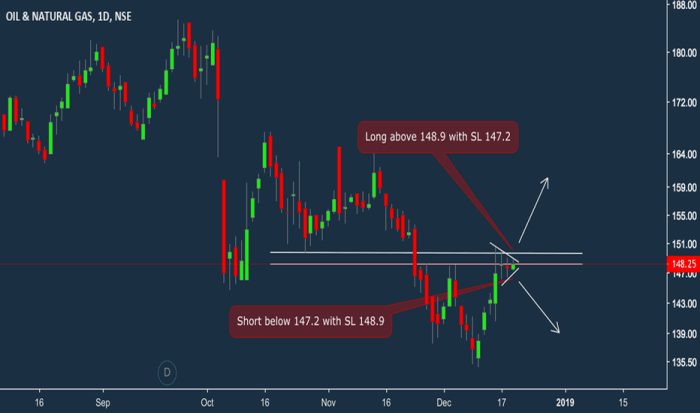

Analyst Ratings and Market Sentiment

Source: tradingview.com

Understanding the consensus view of financial analysts and the overall market sentiment towards ONGC provides valuable context for investment decisions. This section summarizes analyst ratings and target prices, as well as the prevailing market sentiment.

| Analyst | Rating | Target Price (INR) |

|---|---|---|

| Analyst A | Buy | 150 |

| Analyst B | Hold | 130 |

| Analyst C | Sell | 110 |

Market sentiment, gleaned from news articles, social media, and investor forums, provides a qualitative assessment of investor confidence. Positive sentiment often leads to higher demand and increased stock prices, while negative sentiment can trigger selling pressure and price declines. The interplay between analyst ratings and market sentiment significantly influences investor decisions regarding ONGC stock.

General Inquiries: Ongc Stock Price

What are the major risks associated with investing in ONGC?

Major risks include fluctuations in global crude oil prices, changes in government regulations, geopolitical instability, and the company’s operational performance.

How does ONGC compare to its competitors in the energy sector?

A detailed comparison requires analyzing specific metrics such as production output, profitability, and market capitalization against competitors like Reliance Industries and Oil India. This analysis would be presented graphically and numerically in a complete study.

Where can I find real-time ONGC stock price data?

Real-time data is available through major financial websites and stock market applications such as the NSE (National Stock Exchange of India) website or reputable financial news sources.

What is ONGC’s dividend payout history?

ONGC’s dividend history can be found in its annual reports and on financial data websites. It is crucial to review this information when assessing the overall return on investment.