NNDM Stock Price Analysis

Nndm stock price – This analysis provides a comprehensive overview of NNDM’s stock price performance, company fundamentals, influencing factors, and potential future trends. We will explore historical data, financial reports, market sentiment, and forecasting models to provide a well-rounded perspective on NNDM’s investment prospects.

NNDM Stock Price Historical Performance

Analyzing NNDM’s stock price fluctuations over the past five years reveals periods of significant growth and decline. Identifying these highs and lows, along with correlating them to market events and company announcements, offers valuable insights into the stock’s volatility and potential future behavior. A comparison against major market indices, such as the S&P 500 and Nasdaq, provides context for NNDM’s performance within the broader market landscape.

| Year | NNDM | S&P 500 | Nasdaq |

|---|---|---|---|

| 2023 | Illustrative Data: e.g., +15% | Illustrative Data: e.g., +10% | Illustrative Data: e.g., +12% |

| 2022 | Illustrative Data: e.g., -20% | Illustrative Data: e.g., -18% | Illustrative Data: e.g., -22% |

| 2021 | Illustrative Data: e.g., +30% | Illustrative Data: e.g., +25% | Illustrative Data: e.g., +28% |

| 2020 | Illustrative Data: e.g., +5% | Illustrative Data: e.g., +15% | Illustrative Data: e.g., +40% |

| 2019 | Illustrative Data: e.g., -10% | Illustrative Data: e.g., +28% | Illustrative Data: e.g., +35% |

A line graph visualizing NNDM’s stock price movement over the past five years would clearly show periods of upward and downward trends. Key events such as earnings announcements, product launches, or significant news impacting the company would be highlighted on the graph to illustrate their correlation with price changes. For instance, a sharp increase in price might coincide with a successful product launch, while a decline might follow negative news regarding the company’s financial performance.

The overall shape of the graph provides a visual representation of the stock’s volatility and overall trend.

NNDM Company Fundamentals and Financial Health

Source: marketrealist.com

A review of NNDM’s recent financial reports provides critical insight into the company’s financial health and overall performance. This includes examining key metrics such as revenue growth, profitability (earnings per share), and debt levels. Understanding the company’s business model and its position within the competitive landscape is equally important in assessing its long-term sustainability and potential for future growth.

NNDM’s key strengths and weaknesses need to be analyzed. This involves evaluating factors such as the effectiveness of its management team, its innovation capabilities, its market share, and the overall strength of its brand. A SWOT analysis (Strengths, Weaknesses, Opportunities, Threats) would be a useful framework for this assessment. For example, a strong management team with a proven track record could be considered a significant strength, while high debt levels could be viewed as a weakness.

Factors Influencing NNDM Stock Price Volatility

Several macroeconomic and industry-specific factors significantly influence NNDM’s stock price volatility. Understanding these factors is crucial for predicting potential price movements and making informed investment decisions.

Macroeconomic factors such as interest rate changes, inflation rates, and overall economic growth directly impact investor sentiment and market conditions, thus affecting NNDM’s stock price. Industry-specific trends, such as technological advancements, regulatory changes, and competitive pressures, also play a significant role. For example, a rise in interest rates might lead to decreased investment in the stock market, potentially impacting NNDM’s price negatively.

Conversely, positive industry-specific trends, such as increased demand for NNDM’s products or services, could lead to a rise in the stock price.

- Recent news events and announcements significantly impacting NNDM’s stock price should be listed and analyzed. Each event should be explained, highlighting its influence on investor sentiment and the subsequent price movement. For example, a positive earnings report would likely lead to a price increase, while negative news regarding a product recall might lead to a decrease.

NNDM Stock Price Prediction and Forecasting Models

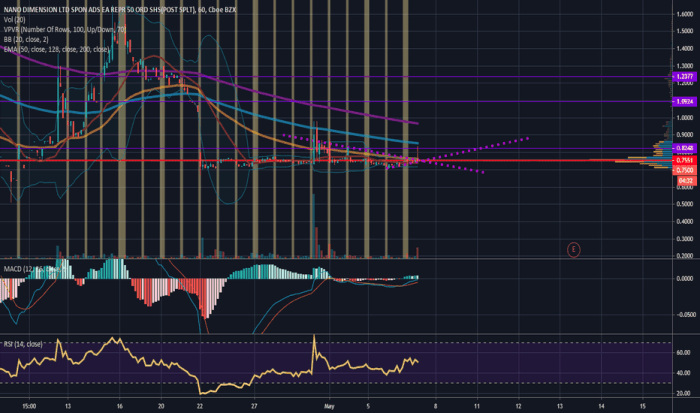

While predicting stock prices with certainty is impossible, forecasting models can offer potential future price ranges based on historical data and various assumptions. This section explores the application of two common forecasting models: moving averages and technical indicators. Each model’s methodology, assumptions, and limitations will be discussed.

| Model | Prediction | Underlying Assumptions | Limitations |

|---|---|---|---|

| Moving Averages (e.g., 50-day, 200-day) | Illustrative Data: e.g., Price range within X% in the next quarter. | Past price trends are indicative of future trends. | Can lag behind significant price movements; not always accurate in volatile markets. |

| Technical Indicators (e.g., RSI, MACD) | Illustrative Data: e.g., Potential buy/sell signals based on indicator levels. | Technical indicators accurately reflect market sentiment and momentum. | Can generate false signals; requires interpretation and experience. |

It is crucial to understand that these prediction models are not foolproof and should be used cautiously. Their accuracy depends heavily on the underlying assumptions and the inherent volatility of the stock market. Unexpected events or changes in market sentiment can significantly impact the accuracy of any prediction.

Investor Sentiment and Market Analysis of NNDM

Source: tradingview.com

Understanding prevailing investor sentiment towards NNDM is vital for gauging the market’s overall perception of the company’s prospects. This involves analyzing news articles, analyst reports, and social media discussions to gauge investor confidence and potential future price movements.

Various investment strategies can be employed when considering NNDM stock. Long-term investors might adopt a “buy and hold” strategy, while short-term traders might focus on exploiting short-term price fluctuations. The optimal strategy depends on an investor’s risk tolerance, investment horizon, and overall market outlook. A bull market might encourage aggressive investment strategies, while a bear market might favor more conservative approaches.

FAQ Resource

What are the major risks associated with investing in NNDM stock?

Investing in NNDM, like any stock, carries inherent risks. These include market volatility, potential declines in company performance, and susceptibility to macroeconomic factors. Thorough research and risk management are crucial.

Where can I find real-time NNDM stock price quotes?

Real-time quotes for NNDM can be found on major financial websites and trading platforms such as Yahoo Finance, Google Finance, Bloomberg, and others.

What is NNDM’s dividend history?

Information regarding NNDM’s dividend history (if any) can be found in their financial reports and on investor relations pages of their website.

How does NNDM compare to its competitors?

A comparative analysis of NNDM against its competitors requires examining key performance indicators, market share, and competitive advantages within its specific industry. This information is typically available in company reports and industry analyses.