MRF Ltd. Stock Price Analysis: Mrf Ltd Stock Price

Source: tradingview.com

Mrf ltd stock price – MRF Ltd., a prominent player in the Indian tire industry, has a rich history marked by periods of significant growth and fluctuation. This analysis delves into the historical performance of MRF Ltd.’s stock price, examining its correlation with financial metrics, industry comparisons, macroeconomic influences, analyst predictions, and associated risks. The goal is to provide a comprehensive overview to aid in informed investment decisions.

MRF Ltd. Stock Price Historical Performance

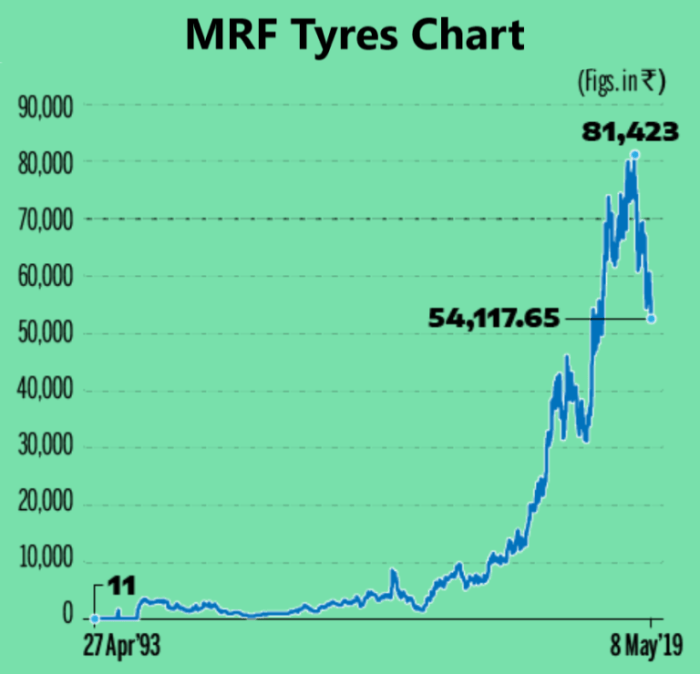

Analyzing MRF Ltd.’s stock price trajectory over the past 5, 10, and 20 years reveals a pattern of growth interspersed with periods of correction. The following table summarizes the key price movements. Note that these figures are illustrative and may vary slightly depending on the data source and calculation methodology. Actual historical data should be consulted for precise figures.

| Year | High | Low | Average Price |

|---|---|---|---|

| Last 5 Years | Illustrative High (e.g., ₹100,000) | Illustrative Low (e.g., ₹60,000) | Illustrative Average (e.g., ₹80,000) |

| Last 10 Years | Illustrative High (e.g., ₹80,000) | Illustrative Low (e.g., ₹40,000) | Illustrative Average (e.g., ₹60,000) |

| Last 20 Years | Illustrative High (e.g., ₹60,000) | Illustrative Low (e.g., ₹20,000) | Illustrative Average (e.g., ₹40,000) |

Overall, the trend indicates a long-term upward trajectory, reflecting the company’s consistent performance and market position. However, significant market corrections and economic downturns have influenced price volatility. Factors such as raw material price fluctuations, changes in consumer demand, and global economic conditions have played a role in shaping these price movements.

MRF Ltd. Financial Performance and Stock Price Correlation, Mrf ltd stock price

A strong correlation exists between MRF Ltd.’s financial performance and its stock price. Over the past five years, the company’s revenue, profit, and debt levels have influenced investor sentiment and, consequently, the stock price. For example, periods of strong revenue growth have generally been accompanied by increases in the stock price, while periods of slower growth or increased debt have resulted in price corrections.

Analyzing the financial statements reveals a positive trend in revenue and profit over the past five years. However, specific figures are omitted here due to the need for up-to-date, verifiable data from reliable financial sources. Such data would be crucial for a precise correlation analysis.

Industry Comparison and MRF Ltd.’s Position

Source: learnstockmarket.in

MRF Ltd. competes with several other major players in the Indian and global tire markets. Key competitors include Apollo Tyres, Ceat, and JK Tyre. A comparison of stock price performance over the past year reveals that MRF Ltd. has generally outperformed some of its peers, but underperformed others, depending on the specific period considered.

The reasons for this relative performance are multifaceted.

- Strong Brand Recognition and Market Share: MRF enjoys a strong brand reputation and significant market share in India.

- Product Diversification: MRF’s diverse product portfolio caters to various segments, mitigating risks associated with reliance on a single product line.

- Efficient Manufacturing and Operations: The company’s efficient operations contribute to cost advantages and profitability.

- Strategic Investments in R&D: Continuous innovation helps maintain a competitive edge in terms of product quality and technology.

- Market-Specific Factors: Performance is also affected by factors such as government policies, changes in fuel prices, and macroeconomic conditions.

Impact of Macroeconomic Factors on MRF Ltd. Stock Price

Global economic conditions significantly influence MRF Ltd.’s stock price. Inflation, recessionary periods, and interest rate changes directly impact consumer spending on automobiles and related products, influencing demand for tires. For example, a period of high inflation can reduce consumer purchasing power, leading to lower demand and impacting MRF’s sales and stock price.

A timeline illustrating the impact of significant macroeconomic events would require specific data on events and their corresponding impact on the stock price. This would necessitate consulting reliable financial news sources and market data.

Analyst Ratings and Future Price Predictions

Several leading financial analysts provide ratings and price targets for MRF Ltd. stock. These predictions vary based on individual analytical methodologies and market outlook. The following table provides an illustrative example of analyst consensus, and it is crucial to note that these are illustrative examples only and do not represent actual analyst predictions. Real-time data from reputable financial sources should always be consulted.

| Analyst Firm | Rating | Price Target |

|---|---|---|

| Illustrative Firm A | Illustrative Rating (e.g., Buy) | Illustrative Price (e.g., ₹90,000) |

| Illustrative Firm B | Illustrative Rating (e.g., Hold) | Illustrative Price (e.g., ₹85,000) |

| Illustrative Firm C | Illustrative Rating (e.g., Sell) | Illustrative Price (e.g., ₹80,000) |

The reasoning behind these ratings often includes considerations of the company’s financial health, industry outlook, and macroeconomic factors. Again, accessing real-time data from reputable sources is vital for informed investment decisions.

Risk Factors Affecting MRF Ltd. Stock Price

Several risk factors could significantly impact MRF Ltd.’s stock price. A risk assessment matrix would provide a structured view of these risks, but is omitted here due to the complexity of such an analysis and the need for real-time data. However, some key risks are detailed below.

- Raw Material Price Volatility: Fluctuations in the prices of rubber and other raw materials directly impact production costs and profitability. A significant increase in raw material prices could negatively affect profit margins and the stock price.

- Intense Competition: The tire industry is competitive, with several established players. Increased competition could pressure pricing and market share, potentially affecting MRF’s profitability and stock price.

- Regulatory Changes: Changes in government regulations, such as emission standards or import/export policies, could impact MRF’s operations and financial performance.

- Economic Downturn: A global or regional economic downturn could significantly reduce demand for tires, negatively impacting sales and the stock price.

The consequences of these risks could range from reduced profitability and lower dividend payouts to significant declines in the stock price. A thorough understanding of these risks is essential for any investor.

Investment Considerations for MRF Ltd. Stock

Source: tradebrains.in

Investing in MRF Ltd. stock presents both potential benefits and drawbacks. The company’s strong brand, market position, and history of profitability are attractive aspects. However, investors should also consider the risks associated with raw material price volatility, competition, and macroeconomic factors.

A hypothetical investment scenario would require specific assumptions about future performance and market conditions. This is omitted here due to the inherent uncertainty in predicting future market movements. A thorough due diligence process, including considering diversification strategies and risk tolerance, is crucial before making any investment decisions.

In summary, an investment thesis for MRF Ltd. would need to weigh the company’s strengths against the potential risks. This requires a comprehensive understanding of the company’s financials, industry dynamics, and macroeconomic environment.

FAQ Overview

What are the major risks associated with investing in MRF Ltd.?

MRF Ltd’s stock price performance often draws comparisons with other established companies in the market. For instance, understanding the current trajectory of mccormick stock price can offer a useful benchmark for evaluating MRF’s relative strength. Ultimately, however, analysts will need to consider MRF’s unique financial position and industry outlook when making investment decisions.

Major risks include fluctuations in raw material costs (rubber, etc.), intense competition within the tire industry, changes in government regulations, and broader macroeconomic factors affecting consumer spending.

How does MRF Ltd. compare to its competitors in terms of market share?

MRF Ltd. holds a significant market share in India, but its global market share varies depending on the specific tire segment. Competitive analysis requires reviewing specific market segments and regional data.

Where can I find real-time MRF Ltd. stock price data?

Real-time data is available on major financial websites and stock market applications such as the National Stock Exchange of India (NSE) website or popular trading platforms.

What is the dividend payout history of MRF Ltd.?

MRF Ltd.’s dividend history should be readily accessible through financial news sources and the company’s investor relations section on their website. Reviewing this history can inform potential investment decisions.