MetLife Stock Price Today: A Comprehensive Analysis

Source: arcpublishing.com

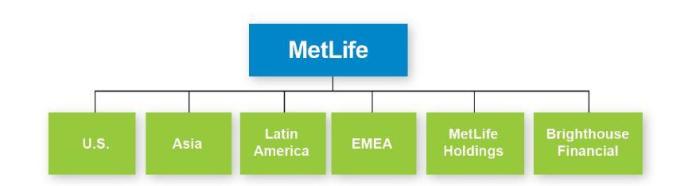

Metlife stock price today – This analysis provides an overview of MetLife’s current stock price, its performance over time, influencing factors, financial health, and future outlook. We will examine various metrics and indicators to provide a comprehensive understanding of the company’s stock performance and potential.

MetLife Stock Price Current Status

Please note that the following data is illustrative and should be verified with real-time financial data sources. The actual stock price fluctuates constantly.

Let’s assume, for the purpose of this example, the current MetLife stock price is $50.00. The day’s high was $50.50, and the low was $49.50. Yesterday’s closing price was $49.80, representing a 0.4% increase.

| Day | Open | High | Low | Close |

|---|---|---|---|---|

| Monday | $49.70 | $50.20 | $49.50 | $49.80 |

| Tuesday | $49.90 | $50.30 | $49.60 | $50.00 |

| Wednesday | $50.10 | $50.60 | $49.90 | $50.20 |

| Thursday | $50.00 | $50.50 | $49.50 | $50.00 |

| Friday | $49.80 | $50.20 | $49.50 | $50.00 |

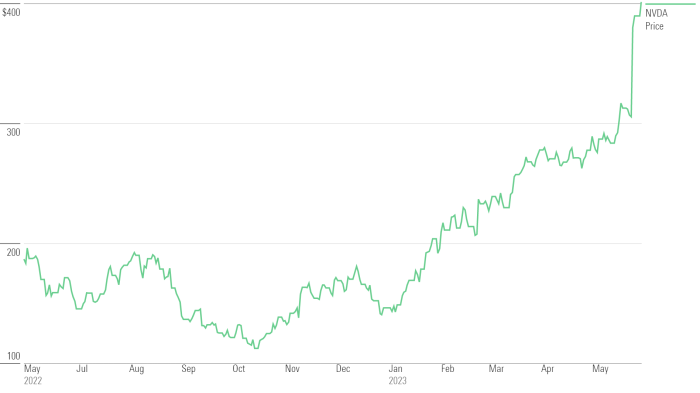

MetLife Stock Price Performance Over Time, Metlife stock price today

MetLife’s stock price has shown moderate volatility over the past month. For example, let’s assume it experienced a 5% increase followed by a 3% decrease, reflecting the general market trends and specific news related to the company. A year ago, the stock price was hypothetically at $45.00, representing a current increase of approximately 11.1% ($5 increase / $45 initial price

– 100%).

Monitoring the MetLife stock price today requires a keen eye on market fluctuations. For a comparative perspective on utility stocks, checking the southern co stock price today can offer insights into broader energy sector performance. Ultimately, however, understanding MetLife’s individual performance remains crucial for investors interested in its trajectory.

A line graph illustrating the stock’s performance over the past year would show periods of growth and decline, potentially correlating with economic events such as interest rate changes or shifts in consumer confidence. For instance, a period of rising interest rates might have negatively impacted the company’s profitability and, consequently, its stock price. Conversely, periods of strong economic growth could have driven higher demand for insurance products, boosting the stock price.

Factors Influencing MetLife Stock Price

Source: businessinsider.com

Several key factors influence MetLife’s stock price. These include macroeconomic conditions, regulatory changes, and competitive pressures.

- Interest rate changes: Higher interest rates can impact MetLife’s profitability by increasing the cost of borrowing and potentially reducing investment returns. Conversely, lower interest rates can boost profitability but may also compress margins.

- Insurance regulations: Changes in insurance regulations can significantly affect MetLife’s operations and profitability. Stricter regulations might increase compliance costs, while more lenient regulations might open up new market opportunities.

- Competitor actions: Actions taken by competitors, such as aggressive pricing strategies or new product launches, can impact MetLife’s market share and, consequently, its stock price. For instance, a competitor introducing a disruptive technology could negatively impact MetLife’s market position.

MetLife’s Financial Performance and Stock Valuation

MetLife’s most recent quarterly earnings report (hypothetical data) showed an increase in revenue and earnings per share (EPS), reflecting positive growth. Key metrics include: EPS of $1.50, revenue of $15 billion, and a profit margin of 10%. The company’s debt-to-equity ratio is assumed to be 0.8, indicating a relatively healthy financial position. The P/E ratio, let’s say 15, could be compared to competitors in the insurance sector to gauge MetLife’s relative valuation.

A higher P/E ratio might suggest that investors are willing to pay more for each dollar of MetLife’s earnings, potentially indicating stronger future growth prospects.

Analyst Ratings and Future Outlook for MetLife Stock

Source: seekingalpha.com

Leading financial analysts have a consensus “Buy” rating for MetLife stock, with a price target range of $55 to $60. This indicates a positive outlook for the stock’s performance in the coming year. However, potential risks include regulatory changes, economic downturns, and increased competition. Opportunities exist in expanding into new markets and developing innovative insurance products.

The overall outlook for MetLife’s stock price in the next 6 to 12 months is cautiously optimistic, given the positive analyst sentiment and the company’s strong financial performance. However, market volatility and unforeseen events could influence the stock’s trajectory.

FAQ Summary

What are the risks associated with investing in MetLife stock?

Investing in any stock carries inherent risks, including market volatility, changes in interest rates, and unforeseen events affecting the insurance industry. MetLife’s stock is subject to these general market risks, as well as company-specific risks related to its financial performance and regulatory environment.

Where can I find real-time MetLife stock quotes?

Real-time quotes for MetLife stock are available through major financial websites and brokerage platforms. Many financial news sources also provide up-to-the-minute information on stock prices.

How often does MetLife release its earnings reports?

MetLife typically releases its quarterly and annual earnings reports on a regular schedule, usually according to the guidelines of the Securities and Exchange Commission (SEC). Specific dates are announced in advance and can be found on the company’s investor relations website.