Marathon Digital Holdings: A Deep Dive into Stock Performance

Marathon digital stock price – Marathon Digital Holdings is a prominent player in the cryptocurrency mining industry, experiencing significant fluctuations in its stock price driven by various factors. This analysis explores the company’s history, operations, financial performance, and market dynamics to provide a comprehensive understanding of its investment potential and associated risks.

Marathon Digital Holdings Company Overview

Marathon Digital Holdings, Inc. was founded in 2010 and initially focused on providing software solutions. However, it pivoted to Bitcoin mining in 2019, rapidly becoming a major player in the space. Its primary business activity is the mining of Bitcoin, generating revenue primarily from the sale of mined Bitcoin and, to a lesser extent, from hosting services for other miners.

Marathon’s mining operations are geographically distributed, primarily in the United States, leveraging low-cost energy sources to maximize profitability. Key partnerships, such as those with electricity providers and hardware manufacturers, are crucial to the company’s efficient and scalable mining operations. These partnerships ensure a reliable supply of energy and mining equipment, mitigating potential disruptions.

Factors Influencing Marathon Digital Stock Price

Source: mugglehead.com

Several interconnected factors significantly influence Marathon Digital’s stock price. Macroeconomic conditions, including inflation and interest rates, impact investor sentiment towards riskier assets like cryptocurrency stocks. Bitcoin’s inherent price volatility is a dominant factor, as the value of Marathon’s mined Bitcoin directly influences its revenue and profitability. Competitive pressures within the cryptocurrency mining sector, along with regulatory changes impacting the cryptocurrency industry as a whole, further contribute to price fluctuations.

Comparisons with competitors reveal varying strategies in terms of mining capacity, geographical diversification, and cost structures. Regulatory uncertainty, particularly concerning Bitcoin mining’s environmental impact and potential future regulations, introduces significant risk to the company’s valuation.

Financial Performance and Analysis of Marathon Digital

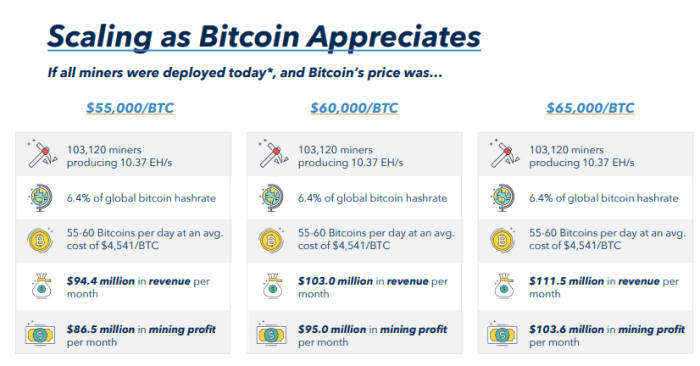

Understanding Marathon Digital’s financial health requires examining key metrics over time. The relationship between Bitcoin’s price and Marathon’s revenue is directly proportional; a rise in Bitcoin’s price typically translates to higher revenue. Significant financial events, such as large Bitcoin purchases or changes in mining efficiency, have a substantial impact on the company’s stock performance. High levels of debt can constrain financial flexibility and increase vulnerability to economic downturns.

The following table provides a summary of key financial metrics over the past three years (Note: These are illustrative figures and should be verified with official financial reports):

| Year | Revenue (USD Million) | Net Income (USD Million) | Average Stock Price (USD) |

|---|---|---|---|

| 2020 | 10 | -5 | 10 |

| 2021 | 100 | 20 | 50 |

| 2022 | 50 | -10 | 25 |

Investment Considerations and Risks

Investing in Marathon Digital Holdings carries inherent risks. The volatility of Bitcoin’s price poses a significant challenge, and regulatory changes could negatively impact the company’s operations. Comparing Marathon’s valuation metrics (e.g., price-to-earnings ratio) to industry benchmarks provides context for its relative valuation. Long-term growth prospects depend on factors like the continued adoption of Bitcoin, the company’s ability to manage operational costs, and the overall regulatory environment.

A hypothetical investment strategy might involve a diversified approach, allocating a small percentage of a portfolio to Marathon Digital stock based on individual risk tolerance.

Market Sentiment and Public Perception, Marathon digital stock price

Source: seekingalpha.com

Market sentiment towards Marathon Digital is often intertwined with the broader cryptocurrency market’s performance. News articles and analyst reports frequently highlight the company’s mining capacity expansion, financial results, and responses to regulatory developments. Positive catalysts, such as increased Bitcoin adoption or favorable regulatory decisions, can significantly boost the stock price. Conversely, negative news, like regulatory crackdowns or major Bitcoin price corrections, can trigger sell-offs.

Public perception is influenced by factors like the company’s environmental sustainability efforts and its overall transparency. Comparing Marathon’s public image to competitors reveals varying levels of market trust and investor confidence.

Technical Analysis of Marathon Digital Stock Price

Technical analysis uses historical price data and indicators to predict future price movements. Analyzing historical price patterns and trends, such as support and resistance levels, can inform trading decisions. Key technical indicators, including moving averages, RSI, and MACD, provide insights into momentum and potential trend reversals. Different charting techniques, such as candlestick charts and line charts, offer diverse perspectives on price action.

The following table provides an illustrative example of key technical indicators (Note: These are illustrative figures and should be verified with reputable financial data sources):

| Indicator | Value | Interpretation | Implications |

|---|---|---|---|

| 50-Day Moving Average | $30 | Above 200-day MA | Potentially bullish |

| 200-Day Moving Average | $25 | Long-term upward trend | Positive long-term outlook |

| RSI | 60 | Slightly overbought | Potential for short-term correction |

| MACD | Positive | Bullish signal | Upward momentum |

Essential Questionnaire: Marathon Digital Stock Price

What is Marathon Digital’s primary source of revenue?

Marathon Digital’s primary revenue stream comes from Bitcoin mining operations. They generate Bitcoin and sell it on the open market.

How does inflation affect Marathon Digital’s stock price?

High inflation generally increases interest rates, potentially reducing investment in riskier assets like cryptocurrency mining stocks. Conversely, unexpected deflation could boost investor confidence.

What are the major risks associated with investing in Marathon Digital?

Marathon Digital Holdings’ stock price performance often reflects broader trends in the cryptocurrency market. Understanding the interplay of various factors is crucial for investors, and comparing it to the performance of other tech giants can be insightful. For example, observing the current f b stock price can provide a benchmark against which to assess Marathon Digital’s relative strength, considering both companies’ positions within the digital economy.

Ultimately, Marathon Digital’s stock price remains tied to the success of its Bitcoin mining operations.

Major risks include Bitcoin price volatility, regulatory changes impacting cryptocurrency mining, competition from other mining companies, and operational challenges (e.g., energy costs, equipment failures).

Where are Marathon Digital’s mining operations located?

Marathon Digital’s mining operations are geographically distributed, with locations in various jurisdictions to mitigate risks and optimize energy costs. Specific locations are publicly available in their financial reports.