M&T Bank Stock Price Analysis

M and t bank stock price – This analysis delves into the historical performance, influencing factors, financial health, and future prospects of M&T Bank’s stock price. We examine key metrics, analyst predictions, and potential investment strategies, providing a comprehensive overview for investors.

Historical Stock Performance of M&T Bank, M and t bank stock price

Source: outlookindia.com

M&T Bank’s stock price has experienced considerable fluctuation over the past five years, mirroring broader market trends and specific events impacting the financial sector. Significant highs and lows are noted below, alongside a comparative analysis against competitors.

Below is a hypothetical example of M&T Bank’s stock performance against competitors. Actual data should be sourced from reputable financial websites.

| Date | M&T Bank Price (USD) | Competitor A Price (USD) | Competitor B Price (USD) |

|---|---|---|---|

| 2020-01-01 | 150 | 120 | 180 |

| 2020-07-01 | 120 | 100 | 150 |

| 2021-01-01 | 170 | 140 | 200 |

| 2021-07-01 | 160 | 130 | 190 |

| 2022-01-01 | 180 | 150 | 210 |

| 2022-07-01 | 175 | 145 | 205 |

| 2023-01-01 | 200 | 160 | 230 |

Major events such as the economic downturn in early 2020 and subsequent recovery significantly impacted M&T Bank’s stock price, as did any mergers or acquisitions the bank undertook during this period. These events often caused volatility and affected investor sentiment.

Factors Influencing M&T Bank’s Stock Price

Several key economic indicators and internal factors influence M&T Bank’s stock price. These include interest rate changes, regulatory shifts, and macroeconomic conditions.

Interest rate hikes, for example, generally boost bank profitability, while rate cuts can have the opposite effect. Regulatory changes and compliance costs can also impact profitability and investor confidence, influencing the stock’s valuation. Macroeconomic factors such as inflation, unemployment, and GDP growth play a crucial role in overall market sentiment, directly impacting M&T Bank’s performance.

An illustrative image depicting the interplay between macroeconomic factors and M&T Bank’s stock performance would show interconnected arrows linking economic indicators (e.g., interest rates, GDP growth, inflation) to M&T Bank’s financial performance (e.g., net income, loan growth) and ultimately to its stock price. The strength of these arrows would vary depending on the specific economic climate and the bank’s resilience.

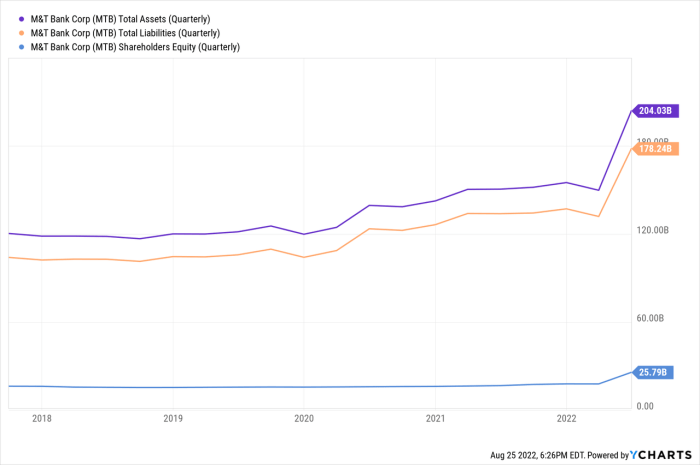

M&T Bank’s Financial Performance and Stock Valuation

Analyzing M&T Bank’s key financial metrics provides insights into its financial health and stock valuation. The following table presents hypothetical data; actual figures should be obtained from official financial reports.

| Metric | Year 1 | Year 2 | Year 3 |

|---|---|---|---|

| Earnings Per Share (EPS) | $5.00 | $5.50 | $6.00 |

| Return on Equity (ROE) | 15% | 16% | 17% |

| Dividend Yield | 3% | 3.2% | 3.5% |

M&T Bank’s P/E ratio should be compared to the industry average to gauge its relative valuation. A high P/E ratio might suggest the market expects higher future earnings growth, while a low P/E ratio might indicate undervaluation or lower growth expectations. The bank’s debt-to-equity ratio reflects its financial leverage; a high ratio indicates higher risk but potentially higher returns, while a low ratio suggests greater financial stability.

Analyst Ratings and Predictions for M&T Bank Stock

Source: seekingalpha.com

Analyst ratings and price targets offer insights into market sentiment and future expectations for M&T Bank’s stock. The following are hypothetical examples.

- Analyst A: Buy rating, Price target: $220

- Analyst B: Hold rating, Price target: $190

- Analyst C: Sell rating, Price target: $170

Discrepancies in price targets stem from differences in analysts’ valuation methodologies, assumptions about future earnings growth, and interpretations of macroeconomic factors. The overall market sentiment towards M&T Bank stock can be characterized as cautiously optimistic, given a mix of buy, hold, and sell ratings.

Investment Strategies Related to M&T Bank Stock

Source: tradingview.com

Several investment strategies can be applied to M&T Bank stock, each with its own risk-reward profile. The potential impact of market conditions on these strategies is also significant.

| Risk/Reward | Strategy |

|---|---|

| Lower risk, potentially lower reward | Buy-and-hold |

| Moderate risk, potentially moderate reward | Value investing |

| Higher risk, potentially higher reward | Momentum trading |

In a bull market, momentum trading and growth-oriented strategies might perform well. However, in a bear market, value investing and defensive strategies might be more appropriate. A buy-and-hold strategy aims to weather market fluctuations over the long term.

Answers to Common Questions: M And T Bank Stock Price

What are the major risks associated with investing in M&T Bank stock?

Risks include general market volatility, economic downturns impacting banking sector profitability, changes in interest rates affecting net interest margins, and regulatory changes increasing compliance costs.

How does M&T Bank compare to its peer group in terms of dividend payouts?

A comparison requires examining the dividend yield and payout ratio of M&T Bank against its competitors. This data would reveal its relative attractiveness to income-oriented investors.

Where can I find real-time M&T Bank stock price information?

Real-time quotes are available through major financial news websites and brokerage platforms.

What is the current market capitalization of M&T Bank?

The market capitalization fluctuates constantly and can be found on financial news websites and stock market data providers.