Li Auto Stock Price: A Comprehensive Analysis

Li auto stock price – Li Auto, a prominent player in China’s burgeoning electric vehicle (EV) market, has experienced a dynamic journey since its inception. Understanding its stock price performance, influencing factors, and future prospects is crucial for investors seeking exposure to this rapidly evolving sector. This analysis delves into the historical performance of Li Auto’s stock price, examining key factors driving its fluctuations and offering insights into potential future trajectories.

Li Auto Stock Price Historical Performance

Source: investorplace.com

A line graph illustrating Li Auto’s stock price over the past five years would reveal significant volatility. The graph would show periods of rapid growth interspersed with corrections, reflecting the inherent risks and rewards associated with investing in a high-growth technology company within a dynamic market. Key dates would include significant product launches, regulatory changes in China, and major macroeconomic events impacting investor sentiment.

For instance, a surge in price might coincide with the successful launch of a new model, while a dip could be attributed to broader market downturns or negative news concerning the company.

During this five-year period, the highest point likely reflects periods of strong sales growth, positive investor sentiment, and successful product launches, potentially fueled by favorable government policies supporting the EV sector in China. Conversely, the lowest point would likely reflect periods of reduced sales, negative investor sentiment, perhaps driven by macroeconomic headwinds or negative press surrounding the company’s performance or product quality.

These low points often serve as important data points for evaluating resilience and future growth potential.

Comparing Li Auto’s performance to its major competitors requires considering factors such as market capitalization, geographic focus, and product positioning. A table comparing Li Auto to competitors like Nio (NIO), Xpeng (XPEV), and Tesla (TSLA) would highlight differences in their five-year high and low stock prices. This comparative analysis offers valuable context for understanding Li Auto’s relative performance within the broader EV landscape.

| Company | Stock Symbol | 5-Year High | 5-Year Low |

|---|---|---|---|

| Li Auto | LI | [Insert Data – Example: $40] | [Insert Data – Example: $15] |

| Nio | NIO | [Insert Data] | [Insert Data] |

| Xpeng | XPEV | [Insert Data] | [Insert Data] |

| Tesla | TSLA | [Insert Data] | [Insert Data] |

Factors Influencing Li Auto Stock Price

Source: financhill.com

Several macroeconomic, product-related, and regulatory factors significantly influence Li Auto’s stock price. Understanding these factors is crucial for informed investment decisions.

Three key macroeconomic factors are global economic growth, interest rates, and commodity prices. Strong global economic growth can boost demand for luxury vehicles like Li Auto’s, positively impacting its stock price. Conversely, slowing global growth could lead to reduced demand and lower stock prices. Similarly, rising interest rates increase borrowing costs for consumers and companies, potentially reducing demand and negatively impacting stock prices.

Fluctuations in commodity prices, particularly battery materials, can significantly affect Li Auto’s production costs and profitability, thereby impacting its stock valuation.

Li Auto’s product releases have a direct and often immediate impact on its stock price. The launch of new models or significant updates to existing models can generate excitement and boost investor confidence, leading to price increases. For example, the launch of a new SUV model with enhanced features might result in a positive stock price reaction. Conversely, delays in product launches or negative reviews could negatively affect investor sentiment and the stock price.

Regulatory changes within the Chinese automotive market significantly impact Li Auto’s valuation. These changes can include new emission standards, safety regulations, and government subsidies.

- New emission standards could increase production costs.

- Stricter safety regulations might necessitate costly design modifications.

- Changes in government subsidies could directly impact affordability and demand.

Li Auto’s Financial Performance and Stock Price Correlation

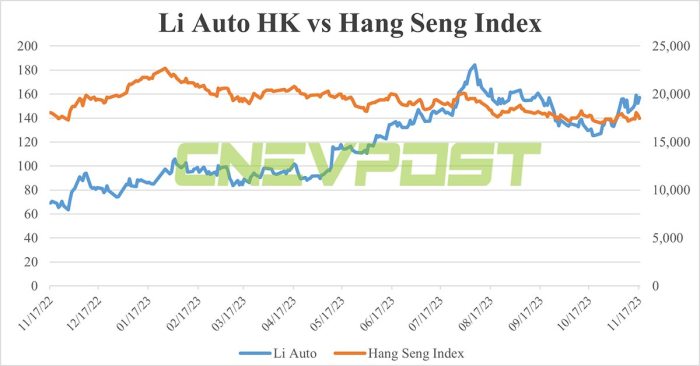

Source: cnevpost.com

A strong correlation exists between Li Auto’s quarterly earnings reports and its stock price fluctuations. A scatter plot illustrating this relationship would show a general trend of positive correlation, where stronger-than-expected earnings often lead to price increases, and weaker-than-expected earnings result in price declines. However, it’s important to note that other factors can also influence the stock price independently of quarterly results.

Over the past three years, Li Auto has demonstrated [Insert Data – e.g., strong revenue growth, improving profitability, and manageable debt levels]. This positive financial performance has generally boosted investor confidence and supported a positive stock price trajectory. However, specific details on revenue growth rates, profitability margins, and debt-to-equity ratios are needed for a comprehensive analysis. These metrics are crucial for assessing the company’s financial health and long-term sustainability.

Comparing Li Auto’s key financial ratios (Price-to-Earnings ratio, Price-to-Sales ratio) to its competitors provides valuable context for assessing its relative valuation. A table comparing these ratios would allow investors to benchmark Li Auto’s performance against its peers and identify potential overvaluation or undervaluation.

| Company | P/E Ratio | P/S Ratio | Debt-to-Equity Ratio |

|---|---|---|---|

| Li Auto | [Insert Data] | [Insert Data] | [Insert Data] |

| Nio | [Insert Data] | [Insert Data] | [Insert Data] |

| Xpeng | [Insert Data] | [Insert Data] | [Insert Data] |

| Tesla | [Insert Data] | [Insert Data] | [Insert Data] |

Investor Sentiment and Market Analysis of Li Auto Stock

Recent news and analyst ratings suggest [Insert Data – e.g., a generally bullish sentiment] towards Li Auto stock. However, this sentiment can shift rapidly based on new information. It’s important to regularly monitor news and analyst reports to gauge current market sentiment.

A summary of recent analyst reports and their price targets would provide a range of opinions and expectations for Li Auto’s future performance. A table summarizing the key findings of at least three different reports would offer a balanced perspective on the stock’s potential.

| Analyst Firm | Price Target | Rating | Key Findings |

|---|---|---|---|

| [Analyst Firm 1] | [Price Target] | [Rating – e.g., Buy, Hold, Sell] | [Summary of Key Findings] |

| [Analyst Firm 2] | [Price Target] | [Rating] | [Summary of Key Findings] |

| [Analyst Firm 3] | [Price Target] | [Rating] | [Summary of Key Findings] |

Significant news events, such as strategic partnerships, product recalls, or geopolitical instability, can significantly impact investor perception and the stock price. Positive news generally leads to price increases, while negative news can trigger price declines. The magnitude of the impact depends on the severity and nature of the event.

Future Outlook and Potential for Li Auto Stock Price

Li Auto’s long-term growth prospects depend on several factors, including market expansion, technological advancements, and competitive pressures. Success in expanding into new markets, developing innovative technologies, and effectively managing competition will be critical for sustained growth.

Potential risks and challenges that could negatively affect Li Auto’s stock price include increased competition, supply chain disruptions, regulatory hurdles, and macroeconomic headwinds. These risks require careful consideration when assessing the company’s investment potential.

- Increased competition from established and emerging EV manufacturers.

- Disruptions to the supply chain of key components, such as batteries and semiconductors.

- Changes in government regulations impacting the EV industry in China.

- A downturn in the global or Chinese economy.

A scenario analysis exploring two potential future outcomes (optimistic and pessimistic) would illustrate the range of possible outcomes for Li Auto’s stock price. An optimistic scenario might assume continued strong sales growth, successful product launches, and favorable regulatory conditions, leading to significant price appreciation. A pessimistic scenario might consider factors such as intense competition, economic slowdown, and regulatory challenges, potentially leading to a decline in the stock price.

Clarifying Questions

What are the major risks associated with investing in Li Auto stock?

Major risks include competition from established and emerging EV players, dependence on the Chinese market, regulatory changes in China, supply chain disruptions, and fluctuations in battery material costs.

How does Li Auto’s technology compare to its competitors?

Li Auto’s extended-range electric vehicle (EREV) technology differentiates it from purely battery electric vehicle (BEV) competitors. However, a direct comparison requires analyzing specific aspects like range, charging infrastructure, and overall performance against competitors’ offerings.

Where can I find reliable real-time Li Auto stock price data?

Major financial websites like Yahoo Finance, Google Finance, and Bloomberg provide real-time stock quotes and historical data for LI Auto (LI).

What is the current analyst consensus on Li Auto’s stock price?

Analyst ratings and price targets fluctuate. Consult reputable financial news sources for the most up-to-date consensus view.