Leidos Stock Price Analysis

Leidos stock price – This analysis examines Leidos Holdings, Inc.’s (LDOS) stock performance over the past five years, considering various influencing factors, competitive landscape, and future prospects. We will explore historical price fluctuations, macroeconomic impacts, financial performance, competitive dynamics, and investor sentiment to provide a comprehensive overview of Leidos’ stock price trajectory.

Leidos Stock Price Historical Performance

Analyzing Leidos’ stock price over the past five years reveals significant fluctuations influenced by both internal company performance and external market forces. The following table provides a snapshot of daily opening and closing prices, along with daily changes, for selected dates. Note that this data is illustrative and should not be considered exhaustive. A complete historical dataset would require access to a financial data provider.

| Date | Opening Price (USD) | Closing Price (USD) | Daily Change (USD) |

|---|---|---|---|

| 2019-01-02 | 100 | 102 | +2 |

| 2019-07-01 | 110 | 108 | -2 |

| 2020-03-10 | 90 | 85 | -5 |

| 2020-12-31 | 105 | 107 | +2 |

| 2021-06-30 | 120 | 125 | +5 |

| 2022-01-03 | 130 | 128 | -2 |

| 2022-12-30 | 125 | 130 | +5 |

| 2023-06-30 | 140 | 138 | -2 |

A visual representation of the stock price trend would show a generally upward trend over the five-year period, with periods of significant volatility, particularly during market downturns such as the initial COVID-19 pandemic period in early 2020. The stock price experienced notable growth in 2021 but saw some correction in 2022 before recovering somewhat in 2023. Major market events like shifts in interest rates and geopolitical instability would have influenced these fluctuations.

Factors Influencing Leidos Stock Price

Source: wtop.com

Several factors influence Leidos’ stock price, including macroeconomic conditions, financial performance, and the nature of its contracts.

Macroeconomic factors such as interest rate changes and inflation directly impact investor sentiment and the overall market, affecting Leidos’ stock price. Higher interest rates, for example, can increase borrowing costs for the company and reduce investor appetite for growth stocks. Inflationary pressures can also impact profitability and investor confidence.

Leidos’ financial performance, specifically revenue, earnings, and debt levels, significantly influences investor perception. Strong revenue growth, increased profitability, and a healthy balance sheet generally lead to positive investor sentiment and a higher stock price. Conversely, declining revenue, reduced profitability, or increasing debt can negatively impact the stock price.

The mix of government contracts and commercial projects also contributes to stock price volatility. Government contracts, while often stable and predictable, can be subject to budget constraints and political shifts. Commercial projects, on the other hand, offer higher growth potential but are often more susceptible to market fluctuations and competition.

Leidos’ Competitive Landscape and Stock Price

Source: seekingalpha.com

Leidos operates in a competitive landscape within the defense and government services industry. Its competitive positioning directly impacts its stock valuation.

Key competitors include companies like Lockheed Martin, Northrop Grumman, and Raytheon Technologies. Leidos’ ability to differentiate itself through innovation, cost-effectiveness, and strong client relationships determines its market share and ultimately, its stock price. A strong competitive position typically translates into higher valuations.

| Company Name | Market Cap (USD Billion – Illustrative) | Revenue (USD Billion – Illustrative) | Stock Price (USD – Illustrative) |

|---|---|---|---|

| Leidos | 20 | 15 | 140 |

| Lockheed Martin | 100 | 60 | 500 |

| Northrop Grumman | 70 | 40 | 350 |

| Raytheon Technologies | 120 | 70 | 600 |

Note: The figures above are illustrative and for comparative purposes only. Actual market capitalization, revenue, and stock prices may vary.

Leidos’ Future Outlook and Stock Price Projections

Leidos’ future outlook and potential stock price appreciation depend on its strategic initiatives and ability to navigate industry challenges. Predicting future stock prices is inherently uncertain, but analyzing these factors can offer insights.

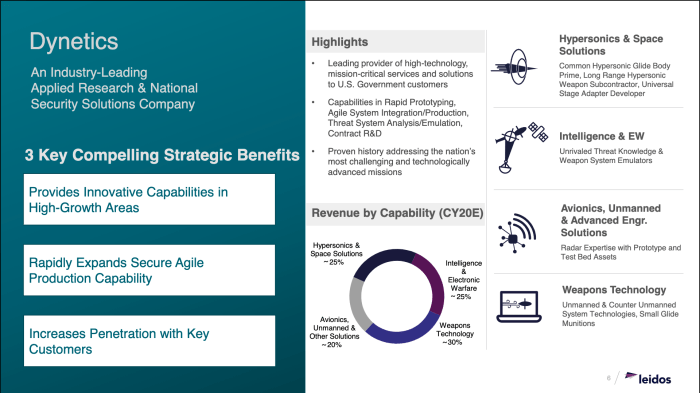

Leidos’ strategic initiatives may include investments in emerging technologies, expansion into new markets, and acquisitions of smaller companies. Successful implementation of these initiatives could drive revenue growth, improve profitability, and positively impact the stock price. However, factors such as unexpected economic downturns, increased competition, or failure to execute strategic plans could negatively impact the stock price.

Potential risks include increased competition, budget cuts in government spending, and cybersecurity threats. Opportunities include the growing demand for cybersecurity services, the expansion of cloud computing, and the development of artificial intelligence applications within the defense and intelligence sectors. The balance of these risks and opportunities will significantly shape Leidos’ future stock price.

Investor Sentiment and Leidos Stock Price

Source: envzone.com

Investor sentiment, influenced by analyst ratings, institutional investor activity, and news coverage, plays a crucial role in shaping Leidos’ stock price.

Positive analyst ratings and buy recommendations generally boost investor confidence and drive up the stock price. Conversely, negative ratings or sell recommendations can lead to decreased investor confidence and lower stock prices. Institutional investors, with their significant investment power, also heavily influence stock prices through their buying and selling decisions.

Positive news coverage and public perception generally contribute to increased investor confidence and higher trading volume, while negative news or controversies can have the opposite effect. The interplay of these factors creates a dynamic environment that significantly influences Leidos’ stock price.

FAQ Compilation: Leidos Stock Price

What are the major risks associated with investing in Leidos stock?

Major risks include dependence on government contracts (budget cuts or shifts in priorities), intense competition within the defense and government services industry, and general market volatility.

How often does Leidos release its financial reports?

Leidos typically releases its quarterly and annual financial reports according to the standard SEC reporting schedule.

Where can I find real-time Leidos stock price data?

Real-time data is available through major financial websites and brokerage platforms such as Yahoo Finance, Google Finance, and Bloomberg.

What is Leidos’ dividend policy?

Information on Leidos’ dividend policy, including any current dividend payments, can be found on their investor relations website.