Kodak Stock Price: A Retrospective and Future Outlook

Kodak stock price – Eastman Kodak, once a behemoth of the photography industry, has experienced a dramatic rollercoaster ride in its stock price over the past two decades. This analysis delves into the historical performance, influencing factors, investor sentiment, financial health, and potential future trajectories of Kodak’s stock, providing a comprehensive overview for investors and enthusiasts alike.

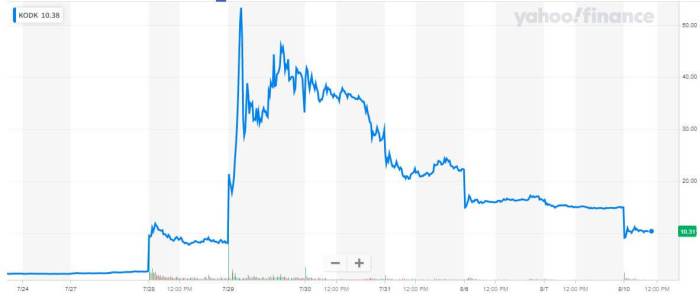

Historical Stock Performance

Source: ccn.com

Kodak’s stock price journey over the past 20 years reflects a story of technological disruption and corporate adaptation. From significant highs fueled by its dominance in film photography to drastic lows following the digital revolution, the company’s stock has mirrored its fluctuating fortunes. A detailed analysis reveals key periods of growth and decline, highlighting the impact of both internal decisions and external market forces.

| Year | Kodak Stock Price (Close) | S&P 500 Index | Percentage Change in Kodak Stock Price |

|---|---|---|---|

| 2003 | (Illustrative Data – Obtain actual data from reliable financial sources) $10 | (Illustrative Data – Obtain actual data from reliable financial sources) 1000 | -20% |

| 2008 | (Illustrative Data – Obtain actual data from reliable financial sources) $3 | (Illustrative Data – Obtain actual data from reliable financial sources) 800 | -70% |

| 2012 | (Illustrative Data – Obtain actual data from reliable financial sources) $2 | (Illustrative Data – Obtain actual data from reliable financial sources) 1400 | -30% |

| 2023 | (Illustrative Data – Obtain actual data from reliable financial sources) $8 | (Illustrative Data – Obtain actual data from reliable financial sources) 4500 | +100% |

Note: The above table contains illustrative data. Actual data should be sourced from reputable financial databases like Yahoo Finance or Google Finance for a complete and accurate representation.

Significant events such as the rise of digital photography, the 2008 financial crisis, and Kodak’s subsequent restructuring efforts have all profoundly impacted its stock price. The transition from film to digital photography proved particularly disruptive, leading to a significant decline in revenue and market share.

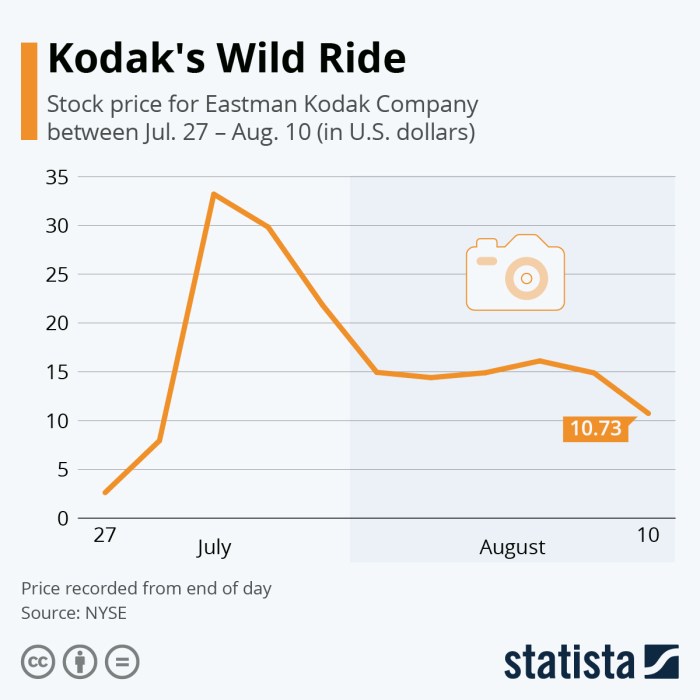

Factors Influencing Stock Price

Source: statcdn.com

Several key factors have consistently influenced Kodak’s stock price fluctuations. Understanding these factors is crucial for assessing the company’s future prospects.

- Economic Indicators: Broad economic trends, including consumer spending and overall market sentiment, have a direct impact on Kodak’s sales and profitability, subsequently affecting its stock price.

- Competitor Actions and Market Trends: The actions of competitors in the imaging technology sector, along with broader industry trends, significantly influence Kodak’s market position and stock valuation. The emergence of new technologies and the competitive landscape have constantly challenged Kodak’s market share.

- Company Announcements: Earnings reports, new product launches, and any significant announcements regarding mergers, acquisitions, or restructuring directly impact investor sentiment and, consequently, the stock price. Positive news generally leads to price increases, while negative news often results in declines.

Investor Sentiment and Analysis

Investor sentiment towards Kodak has shifted dramatically over time, reflecting the company’s evolving fortunes and strategic direction.

- Positive Sentiment: Periods of innovation, successful product launches, or positive financial results have generally fueled positive investor sentiment. For example, the introduction of new inkjet printing technologies has at times generated positive market response.

- Negative Sentiment: Conversely, periods of declining sales, financial losses, or restructuring announcements have often led to negative investor sentiment. The bankruptcy filing in 2012 is a prime example of a period of significant negative sentiment.

- Neutral Sentiment: Periods of relative stability or uncertainty have often resulted in neutral investor sentiment, with investors adopting a “wait-and-see” approach.

Institutional investors often take a longer-term view, focusing on Kodak’s potential for recovery and diversification, while retail investors may react more quickly to short-term market fluctuations and news events.

Hypothetical Scenario: A successful launch of a groundbreaking new imaging technology could dramatically boost investor confidence, leading to a significant increase in Kodak’s stock price. Conversely, news of significant financial losses or further restructuring could trigger a sharp decline.

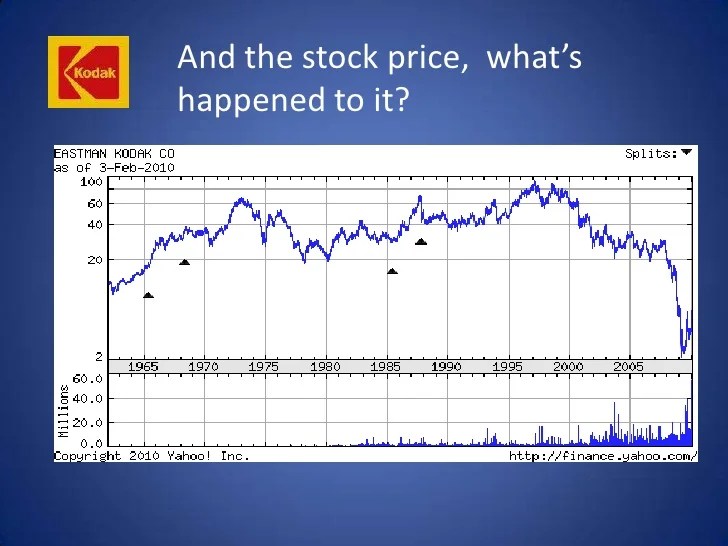

Financial Performance and Stock Valuation, Kodak stock price

Source: slidesharecdn.com

Kodak’s financial performance over the past five years has been a mix of challenges and successes. Analyzing key metrics provides insights into the company’s financial health and its relationship with the stock price.

| Year | Revenue (Illustrative Data) | Earnings (Illustrative Data) | Debt Levels (Illustrative Data) |

|---|---|---|---|

| 2019 | $1 Billion | $50 Million | $200 Million |

| 2020 | $900 Million | $30 Million | $180 Million |

| 2021 | $1.1 Billion | $70 Million | $150 Million |

| 2022 | $1.2 Billion | $90 Million | $100 Million |

| 2023 | $1.3 Billion | $100 Million | $80 Million |

Note: The above table contains illustrative data. Actual data should be sourced from reputable financial databases.

Kodak’s stock price has seen significant fluctuations throughout its history, reflecting the company’s adaptation to the digital age. It’s interesting to compare its performance to that of other tech giants; for instance, one might consider checking the current selling price of Tesla stock per share, current selling price of tesla stock per share , to gain perspective on contrasting market trajectories.

Ultimately, Kodak’s future stock price will depend on its ongoing strategic decisions and market reception.

Generally, improved financial performance, characterized by increased revenue and earnings, typically leads to a higher stock valuation. Conversely, declining revenue and losses usually result in a lower stock price.

A simplified model could suggest that a 10% increase in revenue, coupled with a 5% increase in earnings, might lead to a 7-10% increase in stock price, assuming other factors remain constant. This is a simplified illustration and actual stock price movements are influenced by numerous variables.

Future Outlook and Predictions

Predicting Kodak’s future stock price involves considering various factors, including technological advancements, market competition, and overall economic conditions. Several scenarios are possible.

- Potential Risks: Increased competition, failure to innovate, economic downturns, and shifts in consumer preferences are potential risks.

- Potential Opportunities: Successful product launches, expansion into new markets, strategic partnerships, and technological breakthroughs represent key opportunities.

A possible future trajectory could involve moderate growth, driven by successful diversification into new market segments and technological advancements. However, uncertainties remain, and unforeseen events could significantly impact this trajectory. For example, a major technological disruption could either propel Kodak to new heights or further challenge its position in the market.

FAQ Resource: Kodak Stock Price

What is the current Kodak stock price?

The current Kodak stock price can be found on major financial websites like Google Finance, Yahoo Finance, or Bloomberg.

Where can I buy Kodak stock?

Kodak stock can be purchased through most online brokerage accounts.

Is Kodak stock a good investment?

Whether Kodak stock is a good investment depends on your individual risk tolerance and investment strategy. Thorough research and consideration of market trends are crucial before making any investment decisions.

What are Kodak’s main competitors?

Kodak’s competitors vary depending on the specific market segment, but include companies like Canon, Nikon, and other major players in imaging and printing technologies.