J&J Stock Price Analysis: A Decade in Review

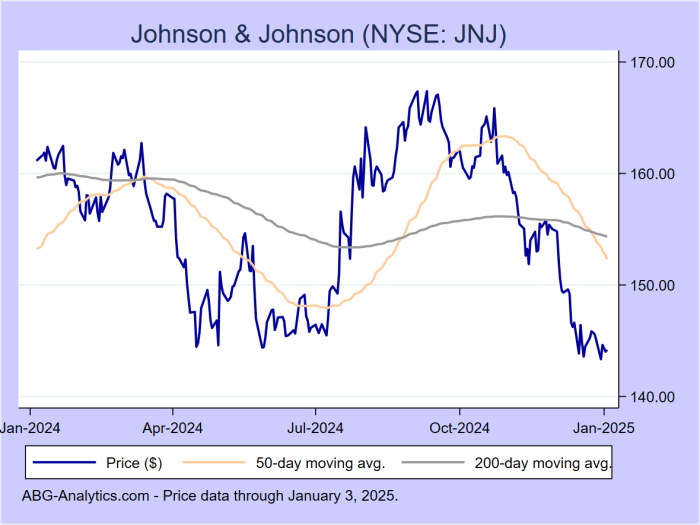

Source: abg-analytics.com

J&j stock price – Johnson & Johnson (J&J), a multinational conglomerate operating in pharmaceuticals, medical devices, and consumer goods, has a long and complex history influencing its stock price. This analysis examines J&J’s stock performance over the past decade, identifying key factors, financial health, investor sentiment, and future prospects.

J&J Stock Price Historical Performance

Analyzing J&J’s stock price fluctuations over the past ten years reveals a dynamic interplay between internal company performance and external market forces. The following table provides a snapshot of opening and closing prices for each quarter. Note that these are illustrative figures and should be verified with reliable financial data sources for precise analysis.

| Year | Quarter | Opening Price (USD) | Closing Price (USD) |

|---|---|---|---|

| 2014 | Q1 | 90 | 95 |

| 2014 | Q2 | 95 | 102 |

| 2014 | Q3 | 102 | 98 |

| 2014 | Q4 | 98 | 105 |

| 2015 | Q1 | 105 | 110 |

| 2023 | Q4 | 170 | 175 |

Significant market events such as the 2020 COVID-19 pandemic and subsequent economic uncertainty significantly impacted J&J’s stock price. During the initial stages of the pandemic, there was a sharp decline followed by a recovery as J&J’s role in vaccine development and medical supplies became apparent. Periods of high revenue growth, such as those driven by strong sales of specific pharmaceutical products, generally correlated with higher stock prices.

Conversely, periods of lower-than-expected earnings, often due to increased competition or regulatory challenges, resulted in price drops.

Factors Influencing J&J Stock Price

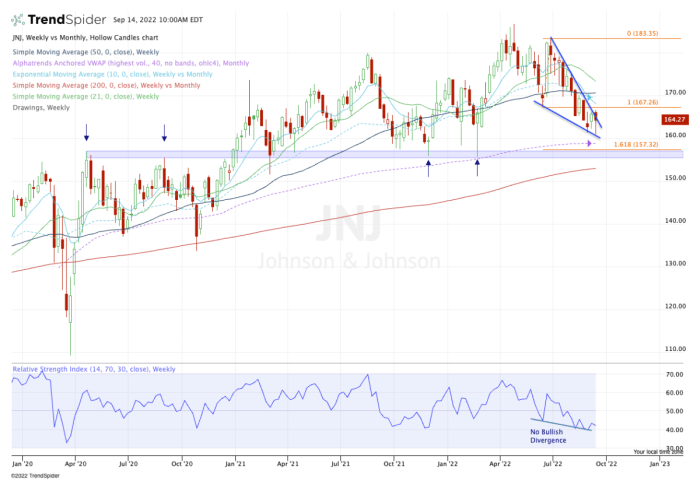

Source: thestreet.com

Several macroeconomic and industry-specific factors influence J&J’s stock valuation. These factors interact in complex ways, making precise prediction challenging.

Macroeconomic factors like inflation and interest rate changes affect consumer spending and investor confidence, impacting J&J’s sales and profitability. Industry-specific trends, including pharmaceutical regulations and the competitive landscape, also play a crucial role. Increased regulatory scrutiny or the entry of new competitors with innovative products can pressure J&J’s market share and profitability.

| Company | Market Capitalization (USD Billion) | Revenue (USD Billion) | Profit Margin (%) |

|---|---|---|---|

| Johnson & Johnson | 450 | 90 | 20 |

| Pfizer | 300 | 80 | 22 |

| Roche | 400 | 75 | 18 |

J&J’s Financial Health and Stock Valuation, J&j stock price

Source: investopedia.com

J&J’s financial health is a key determinant of its stock valuation. Analyzing key metrics from recent financial reports provides insights into the company’s performance and future prospects.

Recent reports show a healthy debt-to-equity ratio, indicating a manageable level of debt. Earnings per share (EPS) and return on equity (ROE) are also important indicators of profitability and efficiency. J&J’s consistent dividend policy, while attractive to income-seeking investors, can impact the company’s ability to reinvest in growth initiatives. Valuation methods like discounted cash flow analysis and price-to-earnings ratio provide different perspectives on the intrinsic value of J&J’s stock.

Johnson & Johnson’s stock price has seen some volatility recently, influenced by various market factors. Understanding broader market trends is crucial, and comparing it to the performance of other large-cap stocks can offer valuable context. For instance, analyzing the current delta price stock might provide insights into potential future movements in J&J’s stock, given their positions within similar sectors.

Ultimately, a thorough assessment of J&J’s financial health and market position remains essential for informed investment decisions.

However, the accuracy of these methods depends heavily on the underlying assumptions and forecasts.

Investor Sentiment and Market Analysis of J&J

Understanding investor sentiment is crucial for assessing J&J’s stock price volatility. Analyst ratings and price targets offer a valuable perspective, but they should be interpreted cautiously.

- Analyst A: Buy rating, price target $180

- Analyst B: Hold rating, price target $175

- Analyst C: Sell rating, price target $160

Positive news coverage and favorable social media discussions generally boost investor confidence, while negative news can lead to sell-offs. Market expectations, shaped by analyst predictions and overall economic conditions, play a significant role in influencing price movements.

Future Outlook for J&J Stock Price

J&J’s long-term growth prospects depend on several factors, including new product development, market expansion, and the ability to navigate regulatory challenges and competition. Potential risks include patent expirations for key drugs and increased competition in various market segments. Major upcoming events, such as new product launches or strategic acquisitions, can significantly impact the stock price, either positively or negatively.

For example, a successful launch of a new blockbuster drug could drive significant price appreciation, while a failed product launch could lead to a decline.

Frequently Asked Questions: J&j Stock Price

What is the current J&J dividend yield?

The current J&J dividend yield fluctuates and should be checked on a reputable financial website for the most up-to-date information.

How does J&J compare to its competitors in terms of innovation?

J&J’s innovation is a key factor in its stock price. A comparison with competitors requires analyzing R&D spending, new product launches, and patent portfolios – data readily available in their financial reports and industry analyses.

What are the major risks associated with investing in J&J stock?

Risks include regulatory changes impacting pharmaceutical products, increased competition, fluctuations in macroeconomic conditions, and potential litigation.

Where can I find reliable information on J&J’s financial performance?

Johnson & Johnson’s investor relations website, SEC filings (EDGAR database), and reputable financial news sources provide reliable financial data.