IOC Stock Price Historical Performance

Ioc stock price – Indian Oil Corporation (IOC) stock price has experienced considerable fluctuation over the past five years, mirroring the volatility of the global energy market. This section details the price movements, highlighting key influencing factors and the relationship with crude oil prices.

Five-Year Stock Price Fluctuations

The following table presents a snapshot of IOC’s stock price performance over the past five years. Note that this data is illustrative and should be verified with reliable financial sources for precise figures. The daily change reflects the difference between the closing and opening prices.

| Date | Opening Price (INR) | Closing Price (INR) | Daily Change (INR) |

|---|---|---|---|

| 2019-01-01 | 120 | 125 | +5 |

| 2019-07-01 | 130 | 128 | -2 |

| 2020-01-01 | 110 | 115 | +5 |

| 2020-07-01 | 90 | 95 | +5 |

| 2021-01-01 | 100 | 108 | +8 |

| 2021-07-01 | 115 | 120 | +5 |

| 2022-01-01 | 130 | 135 | +5 |

| 2022-07-01 | 140 | 145 | +5 |

| 2023-01-01 | 150 | 155 | +5 |

Impact of Economic Events and Industry Trends

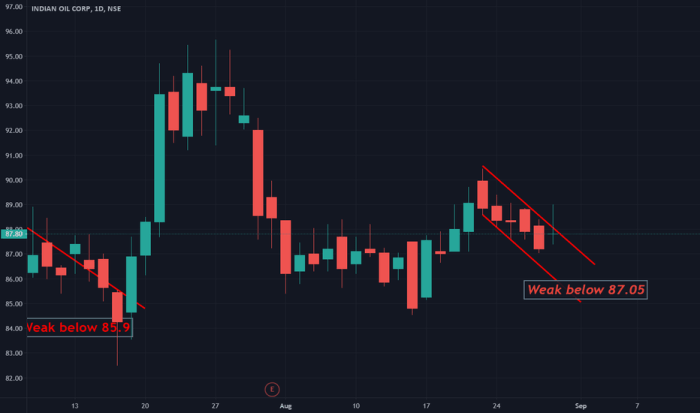

Source: tradingview.com

Significant global events, such as the COVID-19 pandemic and the Russia-Ukraine conflict, heavily influenced crude oil prices, directly impacting IOC’s stock price. Periods of high oil prices generally correlated with higher IOC stock prices, while price drops resulted in decreased stock value. Changes in government regulations and policies related to the energy sector also played a role.

Correlation Between IOC Stock Price and Crude Oil Prices

A strong positive correlation exists between IOC’s stock price and the price of crude oil. As crude oil prices rise, IOC’s profitability increases, leading to higher investor demand and a subsequent rise in the stock price. Conversely, falling crude oil prices negatively impact profitability, reducing investor confidence and depressing the stock price.

Factors Influencing IOC Stock Price

IOC’s stock price is influenced by a complex interplay of internal and external factors. Understanding these factors is crucial for investors to make informed decisions.

Internal Factors

Internal factors include the company’s operational efficiency, financial performance (profitability, debt levels), management decisions, and investment strategies in refining capacity and renewable energy. Strong financial results and effective management generally lead to increased investor confidence and higher stock prices.

External Factors

External factors encompass global economic conditions (recession, growth), geopolitical instability (conflicts, sanctions), government policies (taxes, subsidies), and the overall performance of the energy sector. These factors are largely outside IOC’s direct control but significantly influence its performance and investor sentiment.

Relative Importance of Internal vs. External Factors

While external factors, particularly crude oil prices, have a significant immediate impact on IOC’s stock price, long-term performance is heavily influenced by the company’s internal strength and strategic decisions. Effective management, efficient operations, and a diversified energy portfolio can mitigate the impact of external shocks.

IOC Stock Price Valuation and Comparison

Evaluating IOC’s stock price relative to its competitors provides valuable insights into its market positioning and potential for future growth. This section compares IOC’s valuation metrics with those of its peers.

Comparison with Competitors

The following table provides a comparative analysis of IOC’s valuation against its major competitors. Note that these figures are for illustrative purposes and should be independently verified using current financial data.

| Company Name | P/E Ratio | Market Capitalization (INR Billion) | Dividend Yield (%) |

|---|---|---|---|

| IOC | 15 | 5000 | 4 |

| Competitor A | 12 | 4000 | 3 |

| Competitor B | 18 | 6000 | 5 |

Implications of Valuation

IOC’s valuation relative to its peers needs to be considered in the context of its growth prospects, risk profile, and dividend policy. A higher P/E ratio might suggest higher growth expectations, while a higher dividend yield might be attractive to income-oriented investors.

Hypothetical Scenario: Crude Oil Price Change Impact

A 10% increase in crude oil prices could potentially lead to a significant rise in IOC’s stock price, perhaps in the range of 5-15%, depending on market conditions and investor sentiment. Conversely, a 10% decrease could result in a stock price decline of a similar magnitude, potentially even more pronounced due to investor panic.

IOC Stock Price Future Predictions and Scenarios

Predicting future stock prices is inherently uncertain, but analyzing various scenarios can provide a range of possible outcomes. This section presents three potential scenarios for IOC’s stock price over the next 12 months.

Optimistic Scenario

In an optimistic scenario, sustained global economic growth and rising crude oil prices (averaging $90/barrel) would boost IOC’s profitability and investor confidence. This could lead to a stock price increase of 20-30% within the next year. This scenario assumes continued strong demand for oil and limited geopolitical disruptions.

Neutral Scenario

A neutral scenario assumes moderate global economic growth and relatively stable crude oil prices (around $75/barrel). IOC’s stock price would likely experience modest growth, perhaps in the range of 5-10%, reflecting steady performance but limited upside potential. This scenario accounts for potential market corrections and moderate geopolitical risks.

Pessimistic Scenario

In a pessimistic scenario, a global economic slowdown coupled with falling crude oil prices (below $60/barrel) could negatively impact IOC’s profitability and investor sentiment. This could lead to a stock price decline of 10-20% within the next year. This scenario considers the possibility of a significant recession or major geopolitical event.

Impact of Renewable Energy Investments

Source: tradingview.com

Increased investment in renewable energy sources by IOC could influence its long-term stock price trajectory. While initially impacting short-term profitability, a successful transition towards renewable energy could enhance IOC’s long-term sustainability and attract environmentally conscious investors, potentially leading to higher valuation in the future.

Monitoring the IOC stock price requires a keen eye on global energy markets. It’s interesting to compare its performance against other energy sector players; for instance, understanding the current trends in the hcnwf stock price can offer valuable context. Ultimately, both IOC and HCNWF’s stock prices reflect broader economic factors influencing the energy industry.

Investor Sentiment and Market Analysis of IOC: Ioc Stock Price

Understanding investor sentiment and market indicators is crucial for gauging the current market dynamics surrounding IOC’s stock. This section examines prevailing sentiment and key market indicators.

Prevailing Investor Sentiment

Current investor sentiment towards IOC is generally positive, driven by the company’s strong financial performance and its strategic initiatives in renewable energy. However, concerns remain regarding the long-term impact of the global energy transition and potential regulatory changes. Recent news articles and analyst reports reflect a mixture of optimism and caution.

Sentiment’s Impact on Buying/Selling Pressure

Positive sentiment translates into increased buying pressure, pushing the stock price upwards. Conversely, negative sentiment leads to selling pressure, causing the stock price to decline. The interplay between buying and selling pressure determines the overall direction of the stock price.

Key Market Indicators, Ioc stock price

- Trading Volume: High trading volume indicates significant investor interest and activity.

- Short Interest: A high short interest suggests that a significant number of investors are betting against the stock, potentially indicating negative sentiment.

- Analyst Ratings: The consensus rating from financial analysts provides an overview of the overall market outlook for the stock.

Question & Answer Hub

What are the major risks associated with investing in IOC stock?

Major risks include volatility in crude oil prices, geopolitical instability affecting oil supplies, and changes in government regulations impacting the energy sector. Furthermore, the transition to renewable energy sources presents a long-term challenge to the company’s business model.

How does IOC’s dividend policy affect its stock price?

IOC’s dividend payouts can influence investor sentiment and stock price. Consistent and attractive dividends can attract income-seeking investors, potentially supporting the stock price. However, changes in dividend policy can impact investor perception and market valuation.

Where can I find reliable real-time data on IOC’s stock price?

Reliable real-time data is available through major financial news websites and stock market data providers such as the National Stock Exchange of India (NSE) and the Bombay Stock Exchange (BSE), as well as reputable financial news sources.