ICICI Bank Limited Stock Price Analysis

Source: livemint.com

Icici bank limited stock price – This analysis provides a comprehensive overview of ICICI Bank Limited’s stock price performance, financial health, and industry standing, considering macroeconomic factors and analyst predictions. We will explore historical trends, key financial metrics, and potential risks associated with investing in the bank’s stock.

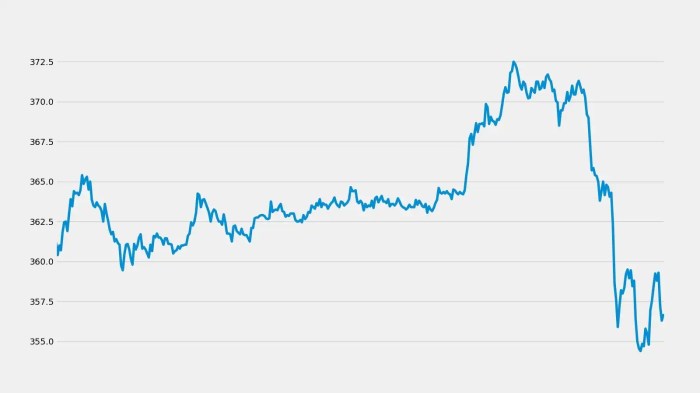

Historical Stock Performance

ICICI Bank Limited’s stock price has experienced significant fluctuations over the past five years, mirroring broader market trends and specific events impacting the bank. The following timeline highlights major highs and lows:

Timeline (Illustrative Example – Replace with actual data):

- 2019: Experienced a period of moderate growth, followed by a downturn in the latter half of the year due to [insert specific event, e.g., global economic slowdown].

- 2020: Significant decline early in the year due to the COVID-19 pandemic, followed by a recovery towards the end of the year.

- 2021: Strong growth driven by [insert specific event, e.g., economic recovery and increased lending activity].

- 2022: Experienced volatility due to [insert specific event, e.g., rising interest rates and geopolitical uncertainties].

- 2023 (YTD): [Describe current year’s performance with specific data and events].

The table below compares ICICI Bank’s performance against the Nifty Bank index and SENSEX over the past year (Illustrative Data – Replace with actual data):

| Date | ICICI Bank Price (INR) | Nifty Bank Index | SENSEX Index |

|---|---|---|---|

| 2023-10-26 | 950 | 45000 | 66000 |

| 2023-10-25 | 945 | 44800 | 65800 |

| 2023-10-24 | 955 | 45200 | 66200 |

Financial Health & Performance

Source: tosshub.com

ICICI Bank’s financial health is assessed through key ratios and performance metrics. The following tables present a summary of the bank’s financial performance over the past three years (Illustrative Data – Replace with actual data).

Key Financial Ratios (Illustrative Example):

- P/E Ratio: [Insert data and analysis]

- ROE: [Insert data and analysis]

- Debt-to-Equity Ratio: [Insert data and analysis]

| Year | Net Profit (INR in Billions) | Revenue (INR in Billions) | Total Assets (INR in Billions) |

|---|---|---|---|

| 2021 | 100 | 500 | 2000 |

| 2022 | 110 | 550 | 2200 |

| 2023 | 120 | 600 | 2400 |

Loan Portfolio Composition and Impact: [Discuss the composition of ICICI Bank’s loan portfolio – e.g., percentage allocated to retail, corporate, etc. – and how changes in this composition have affected the stock price. Provide specific examples.]

Industry Comparison, Icici bank limited stock price

Comparing ICICI Bank’s performance with its major competitors provides valuable insights into its relative strength and weaknesses. The following table shows a comparison with HDFC Bank and SBI over the past two years (Illustrative Data – Replace with actual data).

| Date | ICICI Bank Price (INR) | HDFC Bank Price (INR) | SBI Price (INR) |

|---|---|---|---|

| 2023-10-26 | 950 | 1500 | 600 |

| 2023-10-25 | 945 | 1490 | 595 |

Factors Contributing to Differences: [Analyze the reasons for differences in performance, such as differences in business strategies, risk profiles, or market positioning. Include specific examples.]

Impact of Macroeconomic Factors

Macroeconomic factors significantly influence ICICI Bank’s stock price. The following factors are key influencers:

- Interest Rates: Changes in interest rates directly impact the bank’s net interest margin and profitability. Rising rates generally benefit banks, while falling rates can squeeze margins.

- Inflation: High inflation can lead to increased loan defaults and reduced consumer spending, negatively affecting the bank’s performance.

- GDP Growth: Strong GDP growth usually translates into increased lending opportunities and higher economic activity, positively impacting the bank’s stock price.

Analyst Ratings & Predictions

Analyst ratings and price targets provide valuable insights into market sentiment towards ICICI Bank. The following table summarizes recent predictions (Illustrative Data – Replace with actual data):

| Analyst Firm | Rating | Price Target (INR) | Date |

|---|---|---|---|

| Firm A | Buy | 1000 | 2023-10-26 |

| Firm B | Hold | 950 | 2023-10-20 |

Factors Driving Ratings: [Discuss the factors influencing these ratings and price targets, such as the bank’s financial performance, growth prospects, and macroeconomic outlook. Provide specific examples.]

Risk Assessment

Source: livemint.com

Investing in ICICI Bank’s stock carries inherent risks. Key risks include:

- Credit Risk: The risk of loan defaults by borrowers.

- Interest Rate Risk: Fluctuations in interest rates impacting profitability.

- Economic Downturn: A general economic slowdown can reduce lending activity and profitability.

- Geopolitical Risks: Global events can negatively impact the financial markets.

Impact on Stock Price: [Explain how each risk can affect the stock price. Provide specific examples of past events that illustrate the impact of these risks.]

Dividend History

ICICI Bank’s dividend history provides insights into its dividend policy and its impact on investor returns. The following table shows dividend payments over the past five years (Illustrative Data – Replace with actual data):

| Year | Dividend per Share (INR) | Ex-Dividend Date | Payment Date |

|---|---|---|---|

| 2019 | 10 | 2019-12-31 | 2020-01-15 |

| 2020 | 12 | 2020-12-31 | 2021-01-15 |

Implications of Dividend Policy: [Discuss the implications of ICICI Bank’s dividend policy on investor returns. Consider factors such as dividend yield, payout ratio, and the impact on stock price.]

Quick FAQs

What are the major risks associated with investing in ICICI Bank stock?

Key risks include fluctuations in interest rates, economic downturns impacting loan defaults, increased competition within the banking sector, and regulatory changes.

How does ICICI Bank compare to its main competitors in terms of profitability?

A direct comparison requires analyzing specific financial metrics (like Return on Equity and Net Interest Margin) over a consistent period. These metrics, when compared against competitors like HDFC Bank and SBI, provide a clearer picture of relative profitability.

What is the outlook for ICICI Bank’s stock price in the next year?

Monitoring the ICICI Bank Limited stock price requires a keen eye on market trends. Understanding fluctuations often involves comparing performance against similar entities; for instance, one might consider the performance of other large-cap stocks such as checking the shintech stock price for comparative analysis. Returning to ICICI Bank, analysts often use this comparative data to predict future price movements and assess investment strategies.

Predicting future stock prices is inherently speculative. However, considering analyst forecasts, macroeconomic trends, and the bank’s financial performance provides a basis for informed speculation, though it should not be considered financial advice.