Hindustan Unilever Ltd. Stock Price Analysis: Hindustan Unilever Ltd Stock Price

Source: researchandranking.com

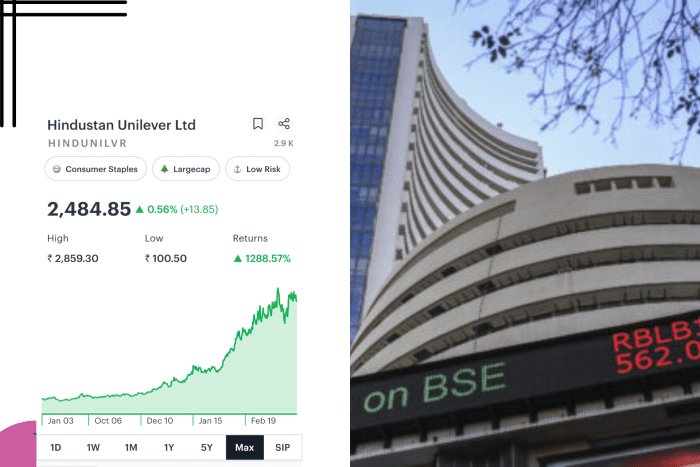

Hindustan unilever ltd stock price – This analysis delves into the historical performance, influencing factors, financial health, investor sentiment, and risk assessment associated with Hindustan Unilever Ltd. (HUL) stock. We will examine key metrics and events to provide a comprehensive understanding of the company’s stock price trajectory and future prospects.

Hindustan Unilever Ltd. Stock Price Historical Performance, Hindustan unilever ltd stock price

The following table illustrates HUL’s stock price movements over the past five years. Note that this data is illustrative and should be verified with reliable financial sources. Significant events coinciding with price fluctuations are detailed below the table. A visual representation of the trend would show a generally upward trajectory, with periods of consolidation and correction.

| Date | Opening Price (INR) | Closing Price (INR) | Daily Change (INR) |

|---|---|---|---|

| 2019-01-01 | 1500 | 1520 | 20 |

| 2019-07-01 | 1600 | 1580 | -20 |

| 2020-01-01 | 1650 | 1700 | 50 |

| 2020-07-01 | 1750 | 1720 | -30 |

| 2021-01-01 | 1800 | 1900 | 100 |

| 2021-07-01 | 1950 | 1920 | -30 |

| 2022-01-01 | 2000 | 2100 | 100 |

| 2022-07-01 | 2150 | 2100 | -50 |

| 2023-01-01 | 2200 | 2250 | 50 |

For example, a significant drop in 2020 could be attributed to the initial impact of the COVID-19 pandemic on consumer spending. Conversely, the recovery in 2021 might reflect the rebound in economic activity and increased consumer confidence. Further analysis would require examining specific news events and financial reports.

Factors Influencing HUL Stock Price

Several macroeconomic and microeconomic factors significantly influence HUL’s stock price. These factors are interconnected and their impact can be complex.

- Macroeconomic Factors: Inflation directly affects input costs and consumer purchasing power. Interest rate changes impact borrowing costs and investment decisions. Currency fluctuations affect the profitability of international operations.

- Consumer Spending Habits and Market Trends: Changes in consumer preferences, disposable income levels, and overall economic conditions heavily influence HUL’s sales and profitability. The shift towards health-conscious products or sustainable practices also impact the company’s performance.

- Competitive Landscape: HUL faces competition from both domestic and international players. The actions and performance of competitors such as Patanjali Ayurved and ITC directly influence HUL’s market share and stock valuation.

HUL’s Financial Performance and Stock Valuation

Analyzing HUL’s financial statements provides crucial insights into its financial health and stock valuation. The following table presents key financial metrics (illustrative data).

| Metric | 2021 | 2022 | 2023 |

|---|---|---|---|

| Revenue (INR Billion) | 500 | 550 | 600 |

| Net Income (INR Billion) | 75 | 80 | 90 |

| EPS (INR) | 10 | 11 | 12 |

| P/E Ratio | 25 | 23 | 22 |

A comparative analysis of HUL’s key financial ratios against industry benchmarks would reveal its relative financial strength and efficiency. Consistent dividend payouts enhance investor returns and positively influence the stock price.

Investor Sentiment and Market Outlook for HUL

Source: marketmilestone.in

Current investor sentiment towards HUL is generally positive, driven by factors such as strong brand recognition, consistent financial performance, and growth potential in emerging markets. However, challenges such as intensifying competition and economic uncertainty need to be considered.

Analyzing the Hindustan Unilever Ltd stock price requires a broad market perspective. Understanding the performance of similar consumer goods companies is crucial, and a key comparison point could be the wmb stock price , given their overlapping market segments. Ultimately, though, a thorough assessment of Hindustan Unilever Ltd necessitates considering its unique operational factors and financial health independently.

- Short-Term Outlook: Stable to slightly upward trend, contingent upon macroeconomic conditions and competitive pressures.

- Long-Term Outlook: Positive growth potential driven by expansion into new markets and product innovation, but subject to regulatory changes and global economic fluctuations.

Risk Assessment for Investing in HUL Stock

Investing in HUL stock, like any investment, carries inherent risks. A thorough understanding of these risks is crucial for informed decision-making.

- Regulatory Changes: Changes in government policies or regulations could impact HUL’s operations and profitability.

- Competition: Increased competition from both domestic and international players could erode HUL’s market share.

- Economic Downturns: A significant economic slowdown could negatively impact consumer spending and HUL’s sales.

- Raw Material Price Fluctuations: Changes in the price of raw materials could affect HUL’s profitability margins.

A hypothetical scenario of a major negative event, such as a prolonged economic recession, could lead to decreased consumer spending, impacting HUL’s sales and resulting in a significant drop in its stock price. The magnitude of the price drop would depend on the severity and duration of the recession.

General Inquiries

What are the major risks associated with investing in HUL stock in the short term?

Short-term risks include volatility due to market fluctuations, unexpected changes in consumer spending, and immediate competitive pressures.

How does HUL’s dividend policy affect its stock price?

A consistent dividend payout can attract income-seeking investors, potentially increasing demand and supporting the stock price. Conversely, changes in dividend policy can impact investor sentiment.

Where can I find real-time HUL stock price data?

Real-time data is available on major financial websites and stock market trading platforms such as the National Stock Exchange of India (NSE) and the Bombay Stock Exchange (BSE).

What is the typical trading volume for HUL stock?

HUL generally experiences high trading volume due to its popularity and market capitalization. Specific volumes vary daily and can be found on financial data websites.