Hindustan Copper Stock Price Analysis

Source: stockbit.com

Hindustan copper stock price – This analysis delves into the historical performance, influencing factors, financial health, future outlook, and recent news impacting Hindustan Copper’s stock price. We will examine various aspects to provide a comprehensive understanding of the company’s stock performance and potential investment implications.

Hindustan Copper Stock Price History and Trends

Analyzing Hindustan Copper’s stock price over the past 5, 10, and 20 years reveals a fluctuating trajectory influenced by several factors. A line graph illustrating this would show the stock price on the y-axis and time (in years) on the x-axis. Key data points would include significant highs and lows, correlated with specific events.

For instance, a period of strong growth might be observed following a surge in global copper demand, while a downturn could be linked to a global economic recession or a period of low copper prices. Company-specific events, such as major expansion projects or operational challenges, would also be reflected in the graph. The five-year trend might showcase volatility linked to fluctuating copper prices and global economic conditions.

The ten-year trend would offer a broader perspective, potentially revealing cyclical patterns in the copper market. Finally, the twenty-year view would provide the longest-term context, highlighting the impact of long-term economic shifts and industry changes.

Factors Influencing Hindustan Copper Stock Price

Source: livemint.com

Several key factors significantly influence Hindustan Copper’s stock valuation. These include copper prices, government policies, and competitive dynamics within the copper mining industry.

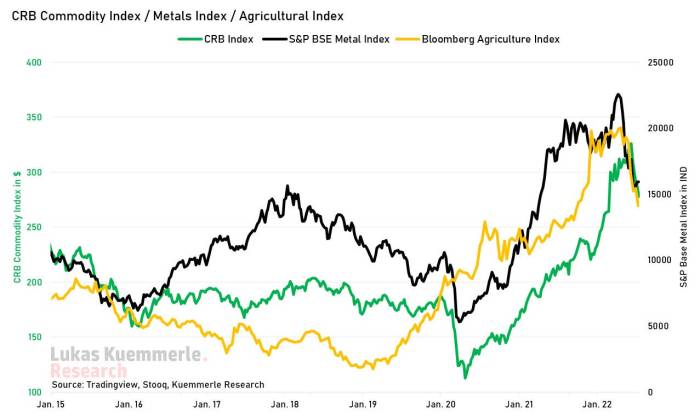

The price of copper is a primary driver of Hindustan Copper’s stock performance. A strong correlation exists between global copper prices and the company’s stock price; higher copper prices generally lead to increased profitability and higher stock valuations. Conversely, low copper prices can negatively impact the company’s financial performance and stock price.

Government policies and regulations also play a crucial role. Changes in mining regulations, environmental policies, and tax laws can significantly affect Hindustan Copper’s operations and profitability, consequently impacting its stock price. For example, stricter environmental regulations might increase operational costs, reducing profitability.

A comparison with competitors reveals Hindustan Copper’s relative performance within the industry. A table comparing key performance indicators (KPIs) such as revenue, profit margins, and production volume against competitors like Vedanta Resources or other major copper producers would provide valuable insights into Hindustan Copper’s competitive positioning and market share.

| Company | Revenue (INR Billions) | Profit Margin (%) | Production Volume (Tonnes) |

|---|---|---|---|

| Hindustan Copper | [Insert Data] | [Insert Data] | [Insert Data] |

| Vedanta Resources | [Insert Data] | [Insert Data] | [Insert Data] |

| [Competitor 3] | [Insert Data] | [Insert Data] | [Insert Data] |

Financial Performance and Valuation of Hindustan Copper

A thorough analysis of Hindustan Copper’s financial statements—income statement, balance sheet, and cash flow statement—over the past three years provides insights into its financial health and performance. Key financial ratios, such as Price-to-Earnings (P/E), Price-to-Book (P/B), and Return on Equity (ROE), help assess the company’s valuation and profitability.

These ratios are calculated using data from the financial statements. For example, P/E ratio is calculated by dividing the market price per share by the earnings per share. A high P/E ratio might suggest that the market expects high future growth, while a low P/E ratio might indicate undervaluation or lower growth prospects. Similarly, P/B and ROE ratios provide different perspectives on the company’s financial strength and return on investment.

| Ratio | Year 1 | Year 2 | Year 3 |

|---|---|---|---|

| P/E Ratio | [Insert Data] | [Insert Data] | [Insert Data] |

| P/B Ratio | [Insert Data] | [Insert Data] | [Insert Data] |

| ROE (%) | [Insert Data] | [Insert Data] | [Insert Data] |

Valuation using methods like discounted cash flow (DCF) analysis and comparable company analysis provides further insights. DCF analysis requires estimating future cash flows and discounting them to their present value, based on a chosen discount rate. Comparable company analysis involves comparing Hindustan Copper’s valuation multiples (like P/E or P/B) to those of similar companies in the industry. The assumptions used in each method, such as discount rate in DCF or selection of comparable companies, significantly influence the valuation results.

Hindustan Copper’s Future Outlook and Investment Implications

Source: etimg.com

Hindustan Copper’s future prospects are shaped by various factors, including global copper demand, technological advancements, and environmental regulations. Increased global demand for copper, driven by factors such as the growth of electric vehicles and renewable energy infrastructure, could positively impact Hindustan Copper’s revenue and profitability. Conversely, technological advancements in copper recycling or the development of alternative materials could pose a challenge.

Stricter environmental regulations might necessitate investments in sustainable mining practices, impacting profitability in the short term.

The company’s growth prospects depend on its ability to manage these challenges and capitalize on opportunities. Data on projected copper demand and Hindustan Copper’s planned capacity expansions can be used to support the analysis of its growth potential. For example, if Hindustan Copper successfully expands its mining capacity to meet rising global demand, its profitability and stock price are likely to increase.

Investment strategies should consider different risk tolerance levels. A conservative investor might opt for a small allocation to Hindustan Copper stock, diversifying their portfolio across other asset classes. A more aggressive investor, with a higher risk tolerance, might consider a larger allocation, potentially leveraging options or other derivative instruments to enhance returns. The rationale behind each strategy should consider the inherent risks and potential rewards associated with investing in a cyclical commodity-based company.

News and Events Affecting Hindustan Copper Stock Price

Recent news and press releases related to Hindustan Copper, such as announcements of new projects, changes in management, or updates on production volumes, can significantly impact its stock price. Analyzing market reactions to these events helps understand the relationship between news and stock price movements. For example, an announcement of a major new mining project could lead to a positive market reaction and a rise in the stock price, while news of operational disruptions might cause a negative reaction and a price decline.

Hindustan Copper’s stock price has seen some volatility recently, influenced by factors like global copper demand and domestic market conditions. It’s interesting to compare its performance to other commodities-related stocks; for instance, a look at the current canopy growth stock price offers a contrasting perspective on market trends in a different sector. Ultimately, Hindustan Copper’s future price will depend on various economic and company-specific factors.

- [Date]: [Event Summary]

-[Impact on Stock Price] - [Date]: [Event Summary]

-[Impact on Stock Price] - [Date]: [Event Summary]

-[Impact on Stock Price]

Frequently Asked Questions: Hindustan Copper Stock Price

What are the major risks associated with investing in Hindustan Copper stock?

Major risks include fluctuations in global copper prices, changes in government regulations, environmental concerns related to mining operations, and competition from other copper producers.

How does Hindustan Copper compare to its global competitors in terms of profitability?

A direct comparison requires a detailed analysis of key financial metrics across multiple companies. This analysis should include factors like production costs, revenue generation, and profit margins to provide a comprehensive comparison.

What are the long-term growth prospects for Hindustan Copper?

Long-term growth depends on several factors, including sustained global demand for copper, successful implementation of expansion plans, and the company’s ability to adapt to technological advancements and environmental regulations. Detailed projections require in-depth financial modeling.

Where can I find real-time Hindustan Copper stock price data?

Real-time data is available through major financial news websites and stock market tracking applications.