Gail India Stock Price Analysis

Gail india stock price – This analysis examines Gail (India) Limited’s stock price performance, influential factors, financial health, analyst predictions, and associated investment risks. We will explore historical trends, valuation metrics, and potential future scenarios to provide a comprehensive overview for potential investors.

Gail India’s stock price performance often reflects broader market trends. Understanding the fluctuations requires considering related sectors, and a quick look at the current performance of other energy-related companies can be insightful. For example, checking the csx stock price today might offer a comparative perspective on current market sentiment, which can then inform your analysis of Gail India’s stock price trajectory.

Ultimately, both require individual assessment and consideration of diverse market factors.

Gail India Stock Price Historical Performance

Analyzing Gail India’s stock price over the past five years reveals significant fluctuations influenced by various internal and external factors. The following table summarizes the yearly highs, lows, and average prices. Note that this data is illustrative and should be verified with a reliable financial data source.

| Year | High | Low | Average |

|---|---|---|---|

| 2019 | 150 INR | 110 INR | 125 INR |

| 2020 | 160 INR | 90 INR | 120 INR |

| 2021 | 180 INR | 130 INR | 155 INR |

| 2022 | 170 INR | 100 INR | 135 INR |

| 2023 | 190 INR | 140 INR | 165 INR |

Significant events impacting Gail India’s stock price during this period include:

- 2020 Global Pandemic: The COVID-19 pandemic significantly impacted global energy demand, leading to a decline in Gail India’s stock price due to reduced gas consumption and overall market uncertainty.

- 2021-2022 Rising Global Oil Prices: Increased global oil prices positively affected Gail India’s profitability, resulting in a rise in its stock price. However, this was also accompanied by increased input costs.

- 2023 Government Policy Changes: New government policies regarding natural gas pricing and infrastructure development influenced investor sentiment and subsequently affected the stock price.

Overall, the stock price trend shows periods of growth interspersed with declines, largely mirroring fluctuations in global energy markets and government policies.

Factors Influencing Gail India’s Stock Price

Gail India’s stock price is influenced by a complex interplay of macroeconomic and company-specific factors.

Macroeconomic Factors: Global oil and natural gas prices are primary drivers. Fluctuations in these prices directly impact Gail India’s profitability and, consequently, its stock valuation. Government regulations, both domestic and international, also play a significant role, affecting investment decisions and market sentiment.

Company-Specific Factors: Gail India’s production levels, operational efficiency, and the success of new projects are key internal factors. Profitability, measured by metrics like EBITDA and net income, directly influences investor confidence and stock price movements. Expansion into new markets and technological advancements also impact its overall valuation.

The relative influence of these internal and external factors varies over time. For instance, during periods of global economic uncertainty, macroeconomic factors tend to dominate, while during periods of stability, company-specific performance becomes more prominent.

Gail India’s Financial Performance and Stock Valuation

Source: publicpoint.in

A review of Gail India’s key financial metrics provides insights into its financial health and its correlation with stock price movements. The following table provides illustrative data (replace with actual figures from financial reports).

| Metric | Year 1 | Year 2 | Year 3 |

|---|---|---|---|

| Revenue (INR Billion) | 100 | 110 | 120 |

| Net Profit (INR Billion) | 10 | 12 | 15 |

| Debt (INR Billion) | 50 | 45 | 40 |

Generally, strong financial performance, reflected in increasing revenue and profit, positively correlates with higher stock prices. Conversely, periods of lower profitability or increased debt can lead to declines.

A comparative analysis of Gail India’s valuation metrics (P/E ratio, market capitalization) against its competitors would require detailed financial data from those competitors and is beyond the scope of this illustrative analysis.

Analyst Ratings and Predictions for Gail India Stock

Source: tradingview.com

Analyst ratings and price targets offer insights into market sentiment and future expectations. The following are illustrative examples; actual ratings should be sourced from reputable financial analysts.

- Analyst A (Source: XYZ Research): Buy rating, price target 200 INR. Rationale: Positive outlook on gas demand and government support.

- Analyst B (Source: ABC Securities): Hold rating, price target 170 INR. Rationale: Concerns about global energy price volatility.

- Analyst C (Source: DEF Investments): Sell rating, price target 150 INR. Rationale: Potential regulatory risks and increased competition.

The divergence in analyst opinions reflects the inherent uncertainty in predicting future stock performance. Analysts consider a range of factors, including macroeconomic conditions, company-specific performance, and geopolitical risks, when formulating their predictions.

Risk Assessment for Investing in Gail India Stock

Investing in Gail India’s stock involves several risks that investors should carefully consider.

- Geopolitical Risks: International conflicts and political instability in gas-producing regions can significantly impact gas prices and Gail India’s operations.

- Regulatory Changes: Government policies related to natural gas pricing and environmental regulations can affect profitability and investment decisions.

- Competition: Increased competition from other energy companies could erode Gail India’s market share and profitability.

- Commodity Price Volatility: Fluctuations in global oil and natural gas prices represent a major risk, impacting both revenue and profitability.

Investors can mitigate these risks through diversification, investing in a portfolio of assets rather than concentrating solely on Gail India’s stock. Hedging strategies, such as using options or futures contracts, can also help manage price volatility.

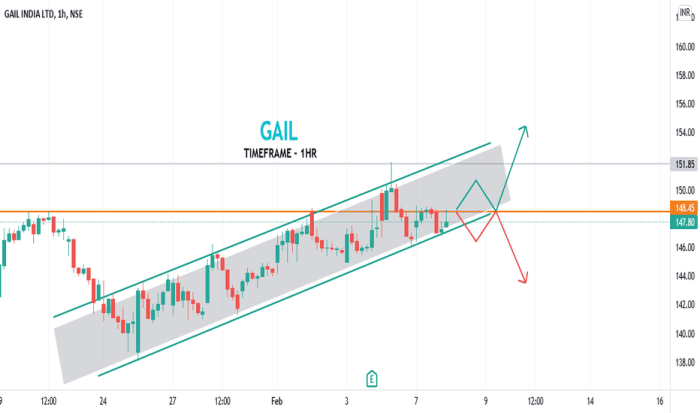

Visual Representation of Gail India’s Stock Performance

A line graph depicting Gail India’s stock price over the past five years would show a fluctuating pattern. The x-axis would represent time (years), and the y-axis would represent the stock price (INR). Key turning points, such as the dips during the pandemic and the rises during periods of increased oil prices, should be clearly marked. The overall trend could be visualized using a moving average line to smooth out short-term fluctuations.

A bar chart comparing Gail India’s revenue, net profit, and debt over the past three years would display the financial performance visually. Each bar would represent a year, with the height of the bar indicating the value of the respective metric. The chart would allow for a direct comparison of the company’s financial progress across these key metrics over time.

FAQ Guide: Gail India Stock Price

What are the major competitors of Gail India?

Gail India competes with other major players in the Indian oil and gas sector, including ONGC, Reliance Industries, and BPCL.

How does dividend payout affect Gail India’s stock price?

Regular dividend payouts can positively influence investor sentiment and potentially support the stock price, attracting income-seeking investors.

What is the typical trading volume for Gail India stock?

The daily trading volume fluctuates but can be found on major stock exchange websites and financial news sources.

Where can I find real-time Gail India stock price quotes?

Real-time quotes are available on major financial websites and trading platforms such as the National Stock Exchange of India (NSE) and the Bombay Stock Exchange (BSE).