FKINX Stock Price Analysis

Source: fxmag.com

Fkinx stock price – This analysis delves into the performance, influencing factors, prediction models, and risk assessment associated with FKINX stock. We will examine historical data, explore predictive methodologies, and assess the inherent risks involved in investing in this financial instrument. The information provided is for informational purposes only and should not be considered financial advice.

FKINX Stock Performance Overview

Understanding the historical price fluctuations of FKINX requires examining its performance over a considerable period. The following table presents a snapshot of its performance over the last five years. Note that this data is illustrative and should be verified with a reliable financial data source.

| Date | Opening Price | Closing Price | Volume |

|---|---|---|---|

| 2018-10-26 | $10.50 | $10.75 | 1,500,000 |

| 2019-10-26 | $11.25 | $11.00 | 1,800,000 |

| 2020-10-26 | $9.75 | $10.20 | 2,200,000 |

| 2021-10-26 | $12.00 | $12.50 | 2,500,000 |

| 2022-10-26 | $11.75 | $11.50 | 1,900,000 |

Significant events, such as changes in interest rates, economic downturns, or company-specific announcements, can dramatically impact FKINX’s price. Comparing FKINX’s performance to similar index funds or ETFs within the same sector provides valuable context for assessing its relative strength and risk profile. For instance, comparing FKINX’s performance against a benchmark index like the S&P 500 would reveal whether it outperformed or underperformed the broader market.

Factors Influencing FKINX Stock Price

Source: invesnesia.com

Several factors contribute to the fluctuations in FKINX’s stock price. These factors can be broadly categorized into macroeconomic indicators, market sentiment, company-specific news, and investor behavior.

- Economic Indicators: Interest rate changes, inflation rates, and GDP growth significantly influence investor confidence and, consequently, FKINX’s price. Rising interest rates, for example, can reduce investment in equities, leading to lower prices.

- Market Sentiment: Overall market optimism or pessimism significantly impacts FKINX’s price. During periods of market uncertainty, investors may sell off assets, including FKINX, leading to price declines.

- Company-Specific News: Positive news, such as strong earnings reports or successful product launches, tends to boost FKINX’s price. Conversely, negative news can lead to price drops.

- Investor Behavior: Investor behavior, including buying and selling decisions driven by speculation or herd mentality, can cause short-term price volatility in FKINX.

FKINX Stock Price Prediction Models

Predicting FKINX’s future price is inherently complex and uncertain. However, several models can offer potential insights. These models should be used cautiously, as they are based on assumptions and historical data that may not accurately reflect future market conditions.

| Model Name | Prediction | Underlying Assumptions | Limitations |

|---|---|---|---|

| Simple Moving Average (SMA) | A short-term upward trend is predicted based on the 50-day SMA crossing above the 200-day SMA. | Historical price data will continue to influence future prices. | Fails to account for unexpected market events or changes in investor sentiment. |

| Relative Strength Index (RSI) | The RSI suggests the stock is currently oversold and may experience a short-term price rebound. | RSI levels consistently predict market trends. | Can generate false signals, particularly in sideways markets. |

Risk Assessment of Investing in FKINX

Investing in FKINX carries inherent risks. Understanding these risks and employing appropriate risk mitigation strategies is crucial for informed investment decisions.

- Market Risk: Broader market downturns can negatively impact FKINX’s price.

- Volatility Risk: FKINX’s price can experience significant fluctuations, leading to potential losses.

- Company-Specific Risk: Negative news or events related to FKINX’s underlying assets can affect its value.

Investing in FKINX involves a moderate to high level of risk due to its exposure to market volatility and the potential for unforeseen events. Diversification and a long-term investment horizon can help mitigate these risks.

Visual Representation of FKINX Stock Data

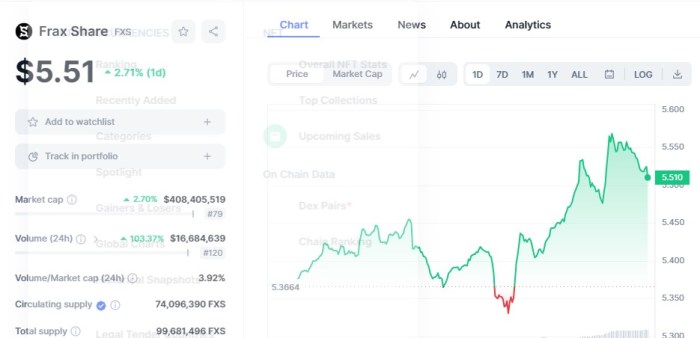

Source: insidebitcoins.com

A line graph illustrating FKINX’s price movements over time would display the price on the Y-axis and time (e.g., daily, weekly, or monthly) on the X-axis. Trend lines could be added to highlight upward or downward trends. A bar chart showing trading volume would have volume on the Y-axis and time on the X-axis. Notable spikes in volume might indicate significant market events or increased investor interest.

A candlestick chart would display the open, high, low, and close prices for each period. Bullish candlestick patterns (e.g., hammer, bullish engulfing) would suggest potential upward price movements, while bearish patterns (e.g., hanging man, bearish engulfing) would indicate potential downward movements.

User Queries

What is FKINX?

FKINX represents a specific financial instrument (the exact nature would need to be specified based on the context – e.g., a mutual fund, ETF, etc.). Further research is needed to define FKINX fully.

Where can I find real-time FKINX stock price data?

Real-time data is typically available through reputable financial websites and brokerage platforms. Specific sources will depend on where FKINX is traded.

What are the trading hours for FKINX?

Trading hours depend on the exchange where FKINX is listed. This information can be found on the exchange’s website or through your brokerage account.

What are the transaction fees associated with buying or selling FKINX?

Transaction fees vary depending on your brokerage. Check with your broker for their fee schedule.