FHN Stock Price Analysis

Fhn stock price – This analysis provides a comprehensive overview of FHN’s stock price performance, influential factors, financial health, future outlook, and associated investment risks. We will explore historical trends, compare FHN against its competitors, and delve into various valuation methods to offer a well-rounded perspective for potential investors.

FHN Stock Price History and Trends

Over the past five years, FHN’s stock price has exhibited volatility, influenced by both macroeconomic conditions and company-specific events. The stock experienced a significant high in [Month, Year] reaching $[Price], followed by a correction to a low of $[Price] in [Month, Year]. This period of volatility was largely attributed to [brief explanation of the main cause]. Subsequently, the stock price demonstrated a recovery, reaching $[Price] by [Month, Year].

Compared to its major competitors, [Competitor A] and [Competitor B], FHN’s performance has been [better/worse/similar]. While [Competitor A] showed consistent growth due to [reason], FHN’s performance was more influenced by [reason]. [Competitor B]’s stock price mirrored market trends more closely, exhibiting less volatility than FHN.

| Date | FHN Stock Price | Volume | S&P 500 |

|---|---|---|---|

| [Date] | $[Price] | [Volume] | $[Index Value] |

| [Date] | $[Price] | [Volume] | $[Index Value] |

| [Date] | $[Price] | [Volume] | $[Index Value] |

| [Date] | $[Price] | [Volume] | $[Index Value] |

Factors Influencing FHN Stock Price

Several factors, both macroeconomic and company-specific, have significantly influenced FHN’s stock price. These factors interact in complex ways, making accurate prediction challenging.

Macroeconomic factors such as interest rate hikes and inflationary pressures have impacted FHN’s profitability and investor sentiment. Rising interest rates increased borrowing costs, affecting FHN’s investment strategies and potentially reducing future earnings. Inflationary pressures increased operating costs, impacting profit margins.

Company-specific factors include FHN’s financial performance, new product launches, and management changes. Strong revenue growth and increased profitability generally lead to positive stock price movements, while poor financial results can lead to declines. Successful product launches can boost investor confidence and drive stock prices higher, while management changes can create uncertainty and volatility.

Investor sentiment, shaped by news articles, analyst ratings, and market trends, plays a crucial role. Positive news and favorable analyst ratings can drive up demand and push the stock price higher, while negative news can trigger selling pressure and price declines. Market trends, such as overall market optimism or pessimism, also impact FHN’s stock price.

FHN Financial Performance and Stock Valuation

FHN’s financial performance over the past three years provides valuable insights into its stability and growth potential. Key metrics such as revenue, earnings, and debt levels offer a clearer picture of its financial health.

| Year | Revenue ($ millions) | Earnings Per Share ($) | Total Debt ($ millions) |

|---|---|---|---|

| [Year 1] | [Revenue] | [EPS] | [Debt] |

| [Year 2] | [Revenue] | [EPS] | [Debt] |

| [Year 3] | [Revenue] | [EPS] | [Debt] |

Valuation methods such as the Price-to-Earnings (P/E) ratio and Price-to-Sales (P/S) ratio can be used to assess FHN’s stock valuation relative to its peers and historical performance. A higher P/E ratio may suggest that investors expect higher future earnings growth, while a lower P/S ratio may indicate a more attractively priced stock.

FHN Stock Price Predictions and Future Outlook

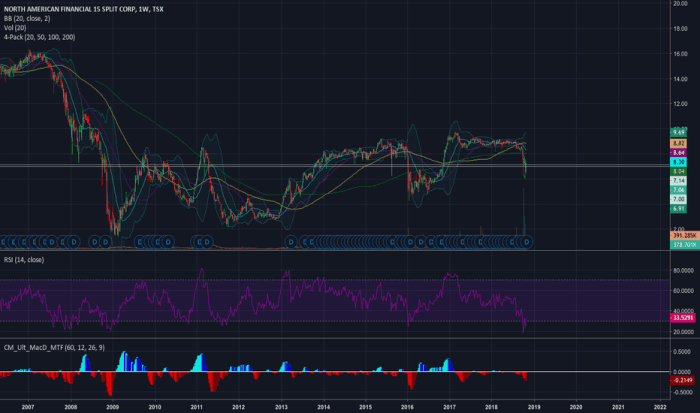

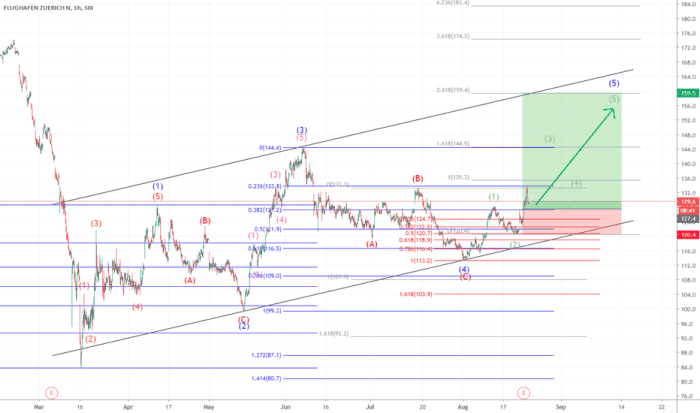

Source: tradingview.com

Understanding FHN’s stock price often involves considering its position within the broader agricultural sector. A key competitor, and thus a relevant benchmark, is Corteva, whose stock performance can offer valuable insights; you can check the current corteva stock price for comparison. Analyzing both Corteva and FHN’s stock prices allows for a more comprehensive understanding of market trends affecting the agricultural chemical industry and ultimately, FHN’s future prospects.

Predicting FHN’s stock price in the next year involves considering various scenarios based on different economic conditions and company performance. Several possible scenarios are presented below.

Scenario 1: A moderate economic growth scenario, coupled with FHN’s continued steady performance, could see the stock price range between $[Price] and $[Price]. This scenario assumes no major disruptions or unexpected events.

Scenario 2: A successful new product launch, exceeding market expectations, could significantly boost FHN’s revenue and earnings. This scenario envisions a potential increase in stock price to $[Price] within the next year, based on the success of a similar product launch by [Company X] which resulted in a [Percentage]% increase in their stock price.

Analyst predictions for FHN’s future stock price vary. Some analysts predict a price of $[Price] within the next year, while others are more cautious, projecting a price range of $[Price] to $[Price]. This divergence reflects differing opinions on FHN’s growth potential and the broader economic outlook.

Risk Assessment for FHN Stock Investment

Source: tradingview.com

Investing in FHN stock involves several risks, both market-related and company-specific. Understanding these risks is crucial for informed investment decisions.

- Market risk: Broader market downturns can negatively impact FHN’s stock price regardless of its individual performance.

- Company-specific risk: Poor financial performance, unsuccessful product launches, or management issues can all lead to stock price declines.

- Geopolitical risk: Global events such as trade wars or political instability can significantly impact FHN’s operations and stock price.

Risk mitigation strategies include diversifying investments, conducting thorough due diligence, and carefully monitoring FHN’s financial performance and news related to the company. Regular portfolio rebalancing can help manage risk and adjust to changing market conditions.

Geopolitical events, such as trade disputes or international conflicts, can impact FHN’s supply chains, access to markets, and overall profitability. For example, the [Specific Geopolitical Event] in [Year] led to a [Percentage]% drop in [Company Y]’s stock price, highlighting the potential impact of such events.

Questions Often Asked: Fhn Stock Price

What are the major competitors of FHN?

This analysis will identify and compare FHN’s performance against its key competitors within its sector. Specific competitor names will be provided in the detailed analysis.

How does FHN’s debt affect its stock price?

FHN’s debt levels and their impact on its financial health and stock valuation will be assessed within the section on financial performance and stock valuation. High debt can increase risk and potentially depress the stock price.

What are the potential long-term risks associated with investing in FHN?

The analysis will detail both market-related risks (e.g., economic downturns) and company-specific risks (e.g., operational challenges, competition) impacting FHN. Strategies for mitigating these risks will also be discussed.