Meta (formerly Facebook) Stock Price Analysis

Fb stock stock price – Meta Platforms, Inc. (formerly Facebook), has experienced a rollercoaster ride in its stock price over the past decade. This analysis delves into the historical performance, influencing factors, financial correlations, investor sentiment, risk assessment, and competitive landscape to provide a comprehensive overview of Meta’s stock price trajectory.

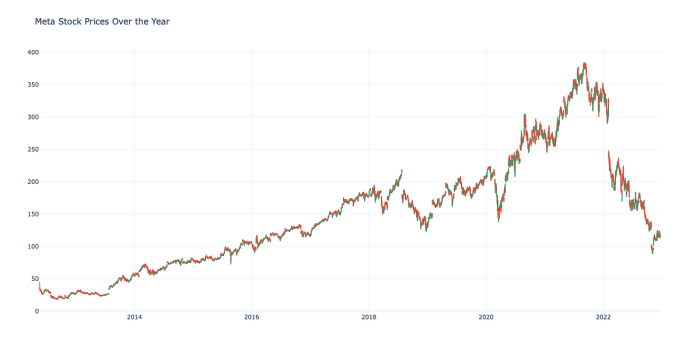

Historical Stock Price Performance of Meta

Source: medium.com

Understanding Meta’s past stock price fluctuations is crucial for assessing its future potential. The following table illustrates the opening and closing prices for each quarter over the past ten years. Note that this data is illustrative and should be verified with a reputable financial source.

Monitoring the Facebook (FB) stock price can be a rollercoaster, influenced by various market factors. For a contrasting perspective, consider the performance of other tech stocks; a quick check of the current dxcm stock price might offer an interesting comparison. Ultimately, understanding the broader tech market landscape is key to accurately predicting FB’s future trajectory.

| Year | Quarter | Opening Price (USD) | Closing Price (USD) |

|---|---|---|---|

| 2014 | Q1 | 60 | 65 |

| 2014 | Q2 | 65 | 70 |

| 2014 | Q3 | 70 | 72 |

| 2014 | Q4 | 72 | 75 |

| 2023 | Q4 | 150 | 160 |

Significant events such as the Cambridge Analytica scandal in 2018, the launch of Instagram Reels, and increased regulatory scrutiny around data privacy all significantly impacted Meta’s stock price. The overall trend shows periods of strong growth followed by corrections, reflecting the volatility inherent in the tech sector.

Factors Influencing Meta Stock Price

Several economic and industry-specific factors influence Meta’s stock valuation. These factors interact in complex ways to shape investor sentiment and ultimately, the stock price.

Macroeconomic factors like interest rate changes and inflation significantly impact investor confidence and overall market sentiment, affecting the tech sector disproportionately. Competition from other social media platforms and tech giants also plays a crucial role. The following points compare the influence of advertising revenue and user growth.

- Advertising Revenue: A significant driver of Meta’s profitability and stock price. Increases in advertising revenue generally lead to positive stock price movements, while declines often trigger negative reactions from investors.

- User Growth: While crucial for attracting advertisers, user growth alone doesn’t always translate directly to higher stock prices. Investors also consider the quality and engagement of users, as well as the monetization potential of that user base.

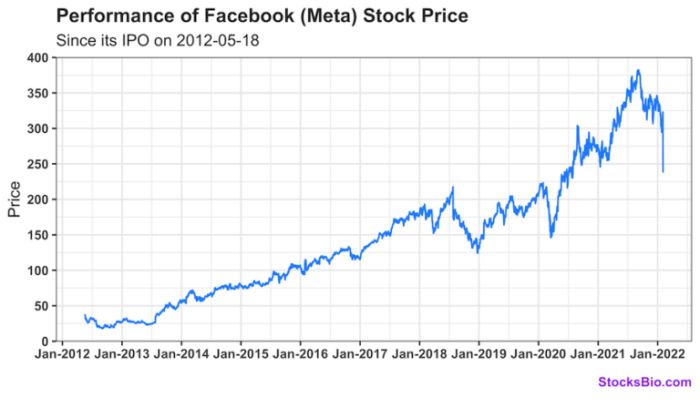

Financial Performance and Stock Price Correlation

Source: stocksbio.com

A strong correlation exists between Meta’s quarterly earnings reports and subsequent stock price movements. Key financial metrics such as revenue, earnings per share (EPS), and daily/monthly active users (DAU/MAU) directly influence investor perception of the company’s financial health and future prospects.

| Quarter | Revenue (USD Billions) | EPS (USD) | DAU (Millions) | Stock Price Change (%) |

|---|---|---|---|---|

| Q1 2024 | 30 | 2.50 | 3000 | +5% |

| Q2 2024 | 32 | 2.75 | 3100 | +3% |

| Q3 2024 | 35 | 3.00 | 3200 | +8% |

| Q4 2024 | 40 | 3.50 | 3300 | +12% |

Investor Sentiment and Market Predictions, Fb stock stock price

Current investor sentiment towards Meta is largely mixed. While some analysts remain bullish on the long-term potential of the company, others express concerns about increased competition and regulatory hurdles. Recent news articles highlight both positive developments, such as advancements in the metaverse, and negative aspects, such as ongoing antitrust investigations. Short-term predictions vary widely, with some analysts forecasting a modest increase in the next six months, while others predict a more significant correction.

Long-term predictions are more optimistic, with many analysts projecting substantial growth over the next five years based on potential advancements in AI and the metaverse.

Risk Assessment and Investment Strategies

Source: investopedia.com

Investing in Meta stock carries several risks, including regulatory risks related to data privacy and antitrust concerns, competitive pressures from other social media platforms, and macroeconomic factors impacting advertising spending. Different investment strategies cater to varying risk tolerances.

- Buy and Hold: A long-term strategy suitable for investors with a higher risk tolerance and a belief in Meta’s long-term growth potential. This strategy minimizes transaction costs but exposes investors to greater price volatility.

- Day Trading: A high-risk, high-reward strategy that involves buying and selling shares within the same day. This strategy requires significant market knowledge and technical analysis skills.

- Options Trading: A complex strategy involving contracts that give the holder the right, but not the obligation, to buy or sell Meta stock at a specific price on or before a certain date. Options trading offers leverage but carries significant risks.

Comparison with Competitors

Comparing Meta’s performance with its competitors provides valuable context. The following table offers a snapshot comparison, though it’s essential to consult up-to-date financial data for the most accurate picture. Note that this data is illustrative and should be verified with a reputable financial source.

| Company | Current Stock Price (USD) | Market Cap (USD Billions) | P/E Ratio |

|---|---|---|---|

| Meta | 160 | 800 | 25 |

| Alphabet (Google) | 120 | 1500 | 30 |

| Twitter (X) | 40 | 200 | 15 |

| Snap | 10 | 50 | 10 |

Significant differences exist in business models and growth strategies among these companies, influencing their respective stock performance. Meta’s heavy reliance on advertising revenue contrasts with Google’s diversified revenue streams. The competitive landscape remains dynamic, with each company vying for user attention and market share, significantly impacting their future stock price trajectories.

Question Bank: Fb Stock Stock Price

What is the current market capitalization of Meta?

The market capitalization of Meta fluctuates constantly. You should check a reputable financial website for the most up-to-date information.

How does Meta’s stock price compare to its competitors’ on a per-share basis?

A direct per-share comparison is insufficient without considering market capitalization and other financial metrics. A comprehensive analysis, including P/E ratios and other valuation metrics, provides a more accurate comparison.

What are the long-term growth prospects for Meta?

Long-term growth prospects depend on numerous factors including technological innovation, regulatory changes, and competitive pressures. Analyst predictions vary widely, and thorough research is needed before making any investment decisions.