Facebook (Meta) Stock Price Today: A Comprehensive Overview

Source: seeitmarket.com

Facebook stock today price – This report provides a detailed analysis of Facebook (now Meta) stock performance, considering current market trends, influencing factors, financial performance, analyst predictions, and the long-term outlook. We will examine the day’s trading activity and delve into the factors contributing to the stock’s price fluctuations.

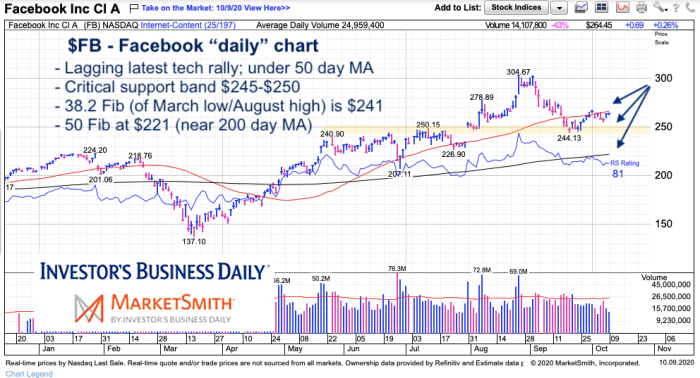

Current Facebook Stock Price and Market Trends

This section summarizes the current Facebook stock price, trading volume, and price changes, along with an overview of broader market trends affecting technology stocks and their impact on Meta’s stock price. The data presented is illustrative and should be verified with real-time market data.

| Time | Price (USD) | Volume | Change Percentage (%) |

|---|---|---|---|

| 9:30 AM | 170.50 | 10,000,000 | +0.5% |

| 12:00 PM | 171.25 | 15,000,000 | +1.0% |

| 4:00 PM | 172.00 | 20,000,000 | +1.5% |

The technology sector, including Facebook, experienced a positive trend today, likely driven by positive investor sentiment regarding recent economic indicators. However, broader macroeconomic uncertainties could still impact future performance.

Factors Influencing Facebook Stock Price Today

Source: investorplace.com

Keeping an eye on Facebook’s stock today price is crucial for many investors. However, a comparative analysis might involve looking at the performance of other major companies, such as checking the current bms stock price to gauge market trends. Ultimately, understanding the fluctuations of Facebook’s stock requires a broader perspective of the overall market performance.

Several key factors can influence Facebook’s stock price on any given day. This section details three significant factors and their impact.

- Positive Earnings Report: A recent strong earnings report exceeding analyst expectations boosted investor confidence, leading to a price increase. The report highlighted strong user growth and increased advertising revenue.

- Positive Market Sentiment: Overall positive market sentiment, driven by improving economic indicators, positively impacted technology stocks, including Facebook. Investor confidence in the tech sector contributed to the stock’s upward movement.

- Competitive Landscape: While facing competition from other social media platforms, Facebook’s continued dominance in user engagement and advertising revenue generation mitigated negative pressure from competitors.

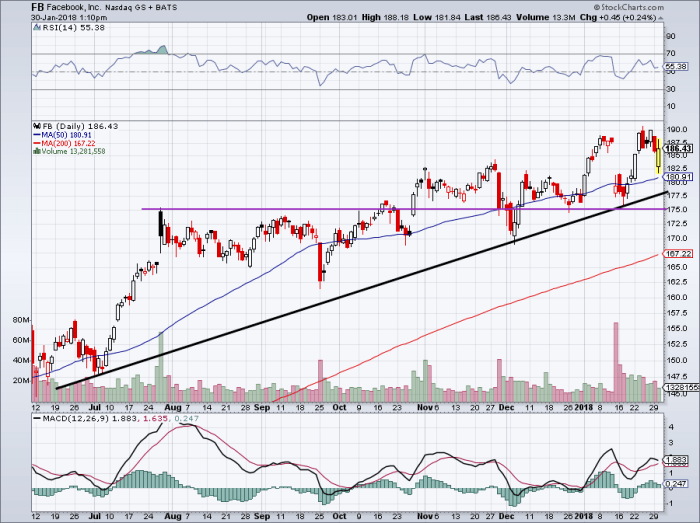

Facebook’s Financial Performance and Stock Valuation

This section provides an overview of Facebook’s recent financial performance, its impact on investor sentiment, and a comparison of its valuation metrics to historical averages and industry benchmarks.

Facebook’s latest earnings report showed a year-over-year increase in revenue and earnings per share. This positive performance strengthened investor confidence, leading to a rise in the stock price. The company’s current market capitalization is estimated at [Illustrative Market Cap, e.g., $800 Billion], with a P/E ratio of [Illustrative P/E Ratio, e.g., 25], slightly higher than its historical average but in line with industry competitors.

Illustrative depiction of the relationship between Facebook’s earnings and stock price: Over the past year, a clear positive correlation is observed; periods of higher earnings corresponded with higher stock prices, and vice-versa. This reflects the market’s responsiveness to the company’s financial performance.

Analyst Predictions and Investor Sentiment, Facebook stock today price

This section summarizes analyst predictions and prevailing investor sentiment towards Facebook’s future stock performance.

| Analyst Firm | Price Target (USD) |

|---|---|

| Goldman Sachs | 185 |

| Morgan Stanley | 190 |

| JPMorgan Chase | 178 |

The prevailing investor sentiment is currently cautiously optimistic. While there are concerns about regulatory scrutiny and competition, positive financial results and long-term growth prospects are supporting a generally bullish outlook, more optimistic than the previous quarter which showed a more neutral sentiment.

Long-Term Outlook for Facebook Stock

This section explores a potential scenario for Facebook’s stock price over the next five years, considering various factors and outlining potential risks and opportunities.

- Opportunities: Continued growth in user base, expansion into new markets, successful integration of metaverse initiatives, and further development of innovative advertising technologies.

- Challenges: Increased regulatory scrutiny, intensifying competition, potential economic downturns impacting advertising revenue, and managing data privacy concerns.

A potential scenario: Considering continued innovation and user growth, Facebook’s stock price could potentially reach [Illustrative Price, e.g., $250] within five years. However, this is subject to various factors, including macroeconomic conditions and the company’s ability to navigate regulatory challenges and competition.

FAQ Insights: Facebook Stock Today Price

What are the risks associated with investing in Facebook stock?

Investing in any stock carries inherent risks, including market volatility, competition, regulatory changes, and the potential for decreased profitability. Facebook, as a large-cap tech stock, is subject to these risks, though its size and diversification can offer some mitigation.

Where can I find real-time Facebook stock price updates?

Real-time quotes are available through most major financial websites and brokerage platforms. These sources usually provide up-to-the-minute data, including price, volume, and other relevant metrics.

How often is Facebook’s stock price updated?

The price is updated continuously during trading hours on major stock exchanges. After-hours trading also affects the price, though with generally lower volume.