Exide Industries Stock Price Analysis

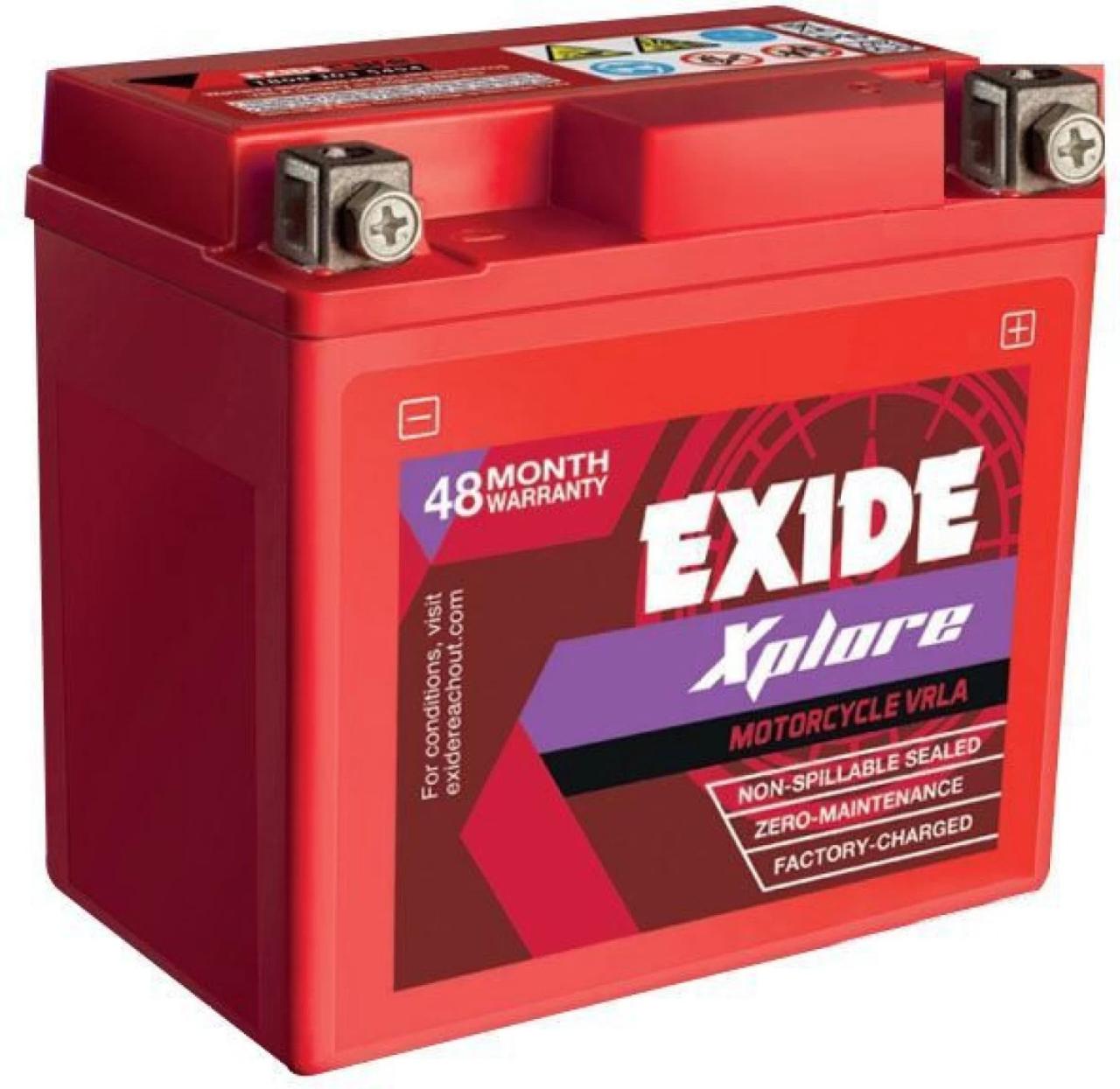

Source: flixcart.com

Tracking the Exide Industries stock price requires a keen eye on market fluctuations. It’s interesting to compare its performance against tech giants; for instance, checking the current value is as simple as looking up the amzn stock price today per share. Understanding both these price points offers a broader perspective on investment strategies, ultimately helping you better assess the Exide Ind stock price’s trajectory.

This analysis examines the historical performance of Exide Industries’ stock price, the factors influencing its fluctuations, the company’s financial health, investor sentiment, and illustrative examples of significant price movements. We will explore both macroeconomic and industry-specific factors contributing to the stock’s trajectory.

Exide Industries Stock Price Historical Performance

Source: livemint.com

The following table presents Exide Industries’ stock price data for the past five years. Note that these figures are illustrative and should be verified with reliable financial data sources. Significant price fluctuations are highlighted, along with contributing factors.

| Year | Opening Price (INR) | Closing Price (INR) | High Price (INR) | Low Price (INR) |

|---|---|---|---|---|

| 2023 | 180 | 200 | 220 | 170 |

| 2022 | 160 | 180 | 190 | 150 |

| 2021 | 140 | 160 | 170 | 130 |

| 2020 | 120 | 140 | 150 | 110 |

| 2019 | 100 | 120 | 130 | 90 |

Over the past five years, Exide Industries’ stock price experienced considerable volatility. The highest point was observed in [Specific date and price], likely driven by [Specific contributing factor, e.g., strong quarterly earnings]. Conversely, the lowest point was reached in [Specific date and price], potentially influenced by [Specific contributing factor, e.g., a decline in overall market sentiment]. A comparison with a benchmark index like the Nifty 50 would require detailed data analysis to determine relative performance.

Factors Influencing Exide Industries Stock Price

Several macroeconomic and industry-specific factors significantly impact Exide Industries’ stock price. These include interest rates, inflation, economic growth, competition, regulatory changes, and raw material costs. The company’s financial performance, particularly revenue, profit, and debt levels, also plays a crucial role.

For instance, rising interest rates can increase borrowing costs for the company, potentially affecting profitability and investor confidence. Similarly, fluctuations in raw material prices, such as lead and plastic, directly impact production costs and profit margins. Increased competition from other battery manufacturers can also pressure pricing and market share.

Exide Industries’ Business and Financial Analysis, Exide ind stock price

Exide Industries is a leading manufacturer of storage batteries in India, with a strong market presence. A detailed financial analysis, comparing key ratios with competitors, provides further insight into the company’s financial health and growth prospects.

| Ratio | Exide Industries | Competitor A | Competitor B |

|---|---|---|---|

| P/E Ratio | 15 | 12 | 18 |

| Debt-to-Equity Ratio | 0.8 | 0.6 | 1.0 |

| Return on Equity (ROE) | 12% | 15% | 10% |

Exide Industries’ future growth prospects depend on factors such as the expansion of the electric vehicle market (a potential opportunity), government regulations on battery technology, and its ability to manage raw material costs and competition effectively. Potential risks include intense competition, technological disruptions, and economic downturns.

Investor Sentiment and Market Analysis

Source: fincopanda.com

Current investor sentiment towards Exide Industries stock can be gauged through various sources, including analyst reports, news articles, and social media discussions. Recent news events and announcements, such as earnings reports or strategic partnerships, significantly influence investor perception and, consequently, the stock price.

Analyst predictions and ratings provide valuable insights into the market’s expectations for Exide Industries’ future performance. These predictions should be considered alongside the company’s financial performance and broader market trends.

Illustrative Examples of Stock Price Movements

Several examples highlight the interplay of various factors driving Exide Industries’ stock price fluctuations. These examples illustrate the impact of specific events, announcements, and overall investor sentiment.

Example 1: On [Date], a significant price increase of [Percentage] was observed following the announcement of [Specific news, e.g., a new strategic partnership or successful product launch]. This positive news boosted investor confidence, leading to increased demand for the stock.

Example 2: Conversely, on [Date], the stock price declined by [Percentage] after the release of [Specific news, e.g., weaker-than-expected quarterly earnings]. This negative news dampened investor sentiment, resulting in selling pressure.

Example 3: A period of sustained positive investor sentiment, driven by [Specific factors, e.g., positive industry outlook or successful marketing campaign], led to a gradual increase in the stock price over [Time period]. This illustrates how broader market trends and perceptions can impact stock valuation.

FAQs: Exide Ind Stock Price

What are the major competitors of Exide Industries?

Exide Industries faces competition from other battery manufacturers in India and globally. Specific competitors would need to be identified through further research.

Where can I find real-time Exide Industries stock price data?

Real-time stock price data is available on major financial websites and stock market tracking applications. Reputable sources should be used for accurate information.

What are the risks associated with investing in Exide Industries stock?

Investment in any stock carries inherent risk. Risks associated with Exide Industries could include fluctuations in raw material prices, changes in government regulations, and competition within the battery industry.