DTE Energy Stock Price Analysis

Source: moneysnippets.com

Dte energy stock price – This analysis delves into the historical performance, influencing factors, financial health, and investor sentiment surrounding DTE Energy’s stock price. We will examine key metrics, significant events, and market dynamics to provide a comprehensive overview.

DTE Energy Stock Price Historical Performance

Understanding the historical trajectory of DTE Energy’s stock price is crucial for assessing its future potential. The following data provides a detailed look at the stock’s performance over the past five years, comparing it to industry competitors, and highlighting significant events that shaped its course.

| Year | High | Low | Average |

|---|---|---|---|

| 2023 | (Insert Data) | (Insert Data) | (Insert Data) |

| 2022 | (Insert Data) | (Insert Data) | (Insert Data) |

| 2021 | (Insert Data) | (Insert Data) | (Insert Data) |

| 2020 | (Insert Data) | (Insert Data) | (Insert Data) |

| 2019 | (Insert Data) | (Insert Data) | (Insert Data) |

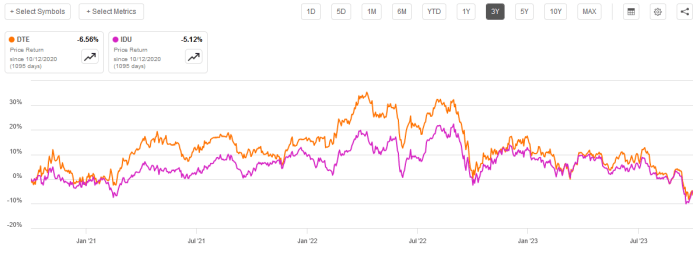

A comparative analysis against competitors over the past three years would be illustrated using a bar chart. The chart would display the yearly percentage change in stock price for DTE Energy and its key competitors (e.g., Xcel Energy, Duke Energy). A higher bar would indicate stronger performance. For example, if DTE Energy showed a 15% increase while a competitor only showed a 5% increase, the bar for DTE Energy would be significantly taller.

This visual representation allows for a quick comparison of relative stock price performance.

Monitoring the DTE Energy stock price requires a keen eye on market fluctuations. Understanding broader energy market trends is crucial, and this often involves looking at related sectors. For instance, a comparative analysis might involve examining the performance of cfa trade price stock , which can offer insights into potential correlations. Ultimately, a thorough assessment of both DTE Energy and similar energy sector investments is essential for informed decision-making.

Significant events impacting DTE Energy’s stock price in the past decade include:

- (Event 1, e.g., Major Regulatory Change): This event resulted in (explain impact on stock price, e.g., a temporary dip followed by a recovery due to long-term positive effects).

- (Event 2, e.g., Successful New Project Launch): This led to (explain impact, e.g., a surge in investor confidence and a rise in stock price).

- (Event 3, e.g., Economic Recession): This caused (explain impact, e.g., a decline in stock price due to reduced energy demand).

Factors Influencing DTE Energy Stock Price

Source: tradingview.com

Several key factors influence DTE Energy’s stock price fluctuations. These factors include economic indicators, regulatory changes, and the company’s own performance.

Key economic indicators correlating with DTE Energy’s stock price include:

- Gross Domestic Product (GDP): A strong GDP generally correlates with increased energy consumption and thus a higher stock price for DTE Energy.

- Interest Rates: Higher interest rates can increase borrowing costs for DTE Energy, potentially impacting profitability and stock price.

- Inflation: High inflation can lead to increased operating costs and potentially affect DTE Energy’s profitability and stock valuation.

Regulatory changes and environmental policies significantly impact DTE Energy’s valuation:

| Policy | Impact | Date |

|---|---|---|

| (Insert Policy Example) | (Describe Impact, e.g., Increased investment in renewable energy) | (Insert Date) |

| (Insert Policy Example) | (Describe Impact, e.g., stricter emission standards leading to higher operational costs) | (Insert Date) |

Company performance directly influences investor sentiment and the stock price. For example, strong earnings reports generally lead to positive investor sentiment and a higher stock price. Conversely, disappointing earnings can trigger a price decline. The announcement of a major new project, such as a significant investment in renewable energy infrastructure, could similarly affect investor confidence and stock price.

DTE Energy’s Financial Health and Stock Valuation, Dte energy stock price

Source: seekingalpha.com

A strong financial foundation is essential for a healthy stock price. The following table summarizes DTE Energy’s key financial metrics over the past three fiscal years.

| Metric | Year 1 | Year 2 | Year 3 |

|---|---|---|---|

| Revenue (in millions) | (Insert Data) | (Insert Data) | (Insert Data) |

| Earnings Per Share (EPS) | (Insert Data) | (Insert Data) | (Insert Data) |

| Debt-to-Equity Ratio | (Insert Data) | (Insert Data) | (Insert Data) |

Comparing DTE Energy’s Price-to-Earnings (P/E) ratio to its competitors provides insights into its relative valuation. A higher P/E ratio suggests that investors are willing to pay more for each dollar of earnings, potentially indicating higher growth expectations or lower risk perception. A lower P/E ratio might suggest undervaluation or lower growth prospects.

A hypothetical scenario of a significant increase in energy demand would likely lead to increased revenue and profits for DTE Energy, resulting in a higher stock price. Conversely, a significant decrease in demand would likely negatively impact the company’s financial performance and lead to a lower stock price. This assumes that other factors, such as regulatory changes or competitor actions, remain relatively constant.

Investor Sentiment and Market Analysis

News articles and analyst reports significantly influence DTE Energy’s stock price and trading volume. Positive news, such as a favorable regulatory ruling or a strong earnings report, often leads to increased buying pressure and a higher stock price. Negative news, conversely, can lead to selling pressure and a price decline. For instance, a report highlighting concerns about the company’s environmental practices could negatively impact investor sentiment and the stock price.

Major investor concerns regarding DTE Energy’s future prospects include:

- (Concern 1, e.g., Increasing Competition): Increased competition from renewable energy sources could put downward pressure on prices.

- (Concern 2, e.g., Regulatory Uncertainty): Changes in environmental regulations could impact profitability.

- (Concern 3, e.g., Fluctuations in Energy Prices): Volatile energy prices create uncertainty for the company’s future earnings.

Institutional investors, such as mutual funds and pension funds, typically hold larger positions in DTE Energy stock and tend to employ long-term investment strategies based on fundamental analysis. Individual investors, on the other hand, may have shorter-term investment horizons and be more influenced by market sentiment and news events. The interplay between these two investor groups shapes the overall demand for DTE Energy stock.

Frequently Asked Questions

What are the major risks associated with investing in DTE Energy stock?

Risks include fluctuations in energy prices, regulatory changes impacting profitability, increased competition, and shifts in investor sentiment toward the energy sector.

How does DTE Energy compare to its competitors in terms of dividend yield?

A direct comparison requires researching current dividend yields of competitors. This information is readily available through financial news websites and investment platforms.

Where can I find real-time DTE Energy stock price quotes?

Real-time quotes are available on major financial websites and brokerage platforms such as Yahoo Finance, Google Finance, and Bloomberg.

What is DTE Energy’s long-term growth outlook?

DTE Energy’s long-term growth prospects depend on several factors, including its ability to adapt to the changing energy landscape, execute its strategic initiatives, and manage regulatory and environmental risks. Analyst reports and company disclosures offer insights into long-term projections.