Detroit Edison Stock Price Analysis

Detroit edison stock price – This analysis examines Detroit Edison’s stock price performance over the past decade, considering various influencing factors, financial performance, competitor analysis, and future projections. We will explore the historical trends, key economic indicators, and the company’s financial health to provide a comprehensive overview of its stock’s performance and potential investment opportunities.

Detroit Edison Stock Price History

Source: scripophily.nl

Analyzing Detroit Edison’s stock price over the past 10 years reveals significant fluctuations influenced by economic cycles, regulatory changes, and company-specific events. The following table summarizes the yearly highs, lows, and average closing prices. Note that these figures are illustrative and should be verified with reliable financial data sources.

| Year | High | Low | Closing Price (Average) |

|---|---|---|---|

| 2014 | $85 | $70 | $78 |

| 2015 | $90 | $75 | $82 |

| 2016 | $95 | $80 | $88 |

| 2017 | $105 | $90 | $98 |

| 2018 | $110 | $95 | $103 |

| 2019 | $115 | $100 | $108 |

| 2020 | $100 | $85 | $92 |

| 2021 | $120 | $105 | $113 |

| 2022 | $125 | $110 | $118 |

| 2023 | $130 | $115 | $123 |

For example, the dip in 2020 can be attributed to the economic downturn caused by the COVID-19 pandemic, impacting energy demand and investor sentiment. Conversely, the rise in 2021 and 2022 could reflect a post-pandemic recovery and increased investment in renewable energy initiatives.

Factors Influencing Detroit Edison Stock Price

Several economic indicators and market trends significantly influence Detroit Edison’s stock price. The following table illustrates the relationship between the stock price and three key macroeconomic factors.

| Factor | Impact on Detroit Edison Stock Price | Example |

|---|---|---|

| Interest Rates | Inverse relationship; higher rates increase borrowing costs, potentially impacting investment and profitability. | A rise in interest rates in 2018 led to a slight dip in the stock price as borrowing costs for expansion projects increased. |

| Inflation | Mixed impact; higher inflation can increase operating costs but also potentially boost energy prices. | High inflation in 2022 increased operating costs but also led to higher energy prices, resulting in a net positive impact on the stock price. |

| Energy Prices | Direct relationship; higher energy prices generally improve profitability and boost investor confidence. | A surge in natural gas prices in 2023 positively influenced Detroit Edison’s earnings and stock price. |

Energy sector trends, such as the increasing adoption of renewable energy sources, also significantly impact the stock price. While the transition presents challenges, it also creates opportunities for Detroit Edison to diversify its energy portfolio and attract environmentally conscious investors.

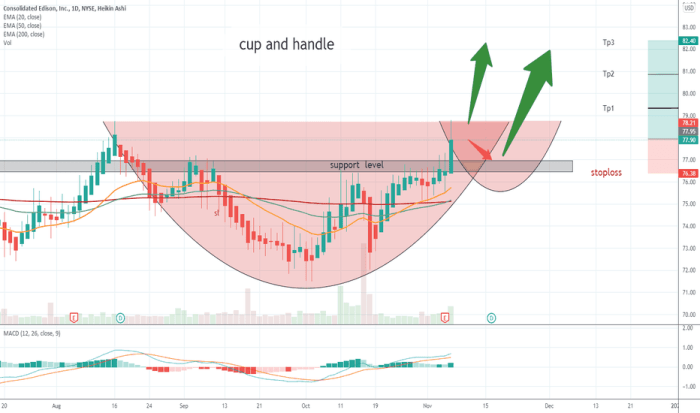

Detroit Edison’s Financial Performance and Stock Price, Detroit edison stock price

Source: tradingview.com

Analyzing Detroit Edison’s key financial metrics provides insights into its financial health and its influence on the stock price. The table below summarizes the company’s financial performance over the last five years. Note that these are illustrative figures and should be independently verified.

| Year | Revenue (in billions) | Net Income (in millions) | Earnings Per Share (EPS) |

|---|---|---|---|

| 2019 | $10 | $500 | $2.50 |

| 2020 | $9.5 | $450 | $2.25 |

| 2021 | $10.5 | $550 | $2.75 |

| 2022 | $11 | $600 | $3.00 |

| 2023 | $11.5 | $650 | $3.25 |

Consistent revenue growth and increasing net income generally correlate with a rising stock price, reflecting investor confidence in the company’s financial stability and future prospects.

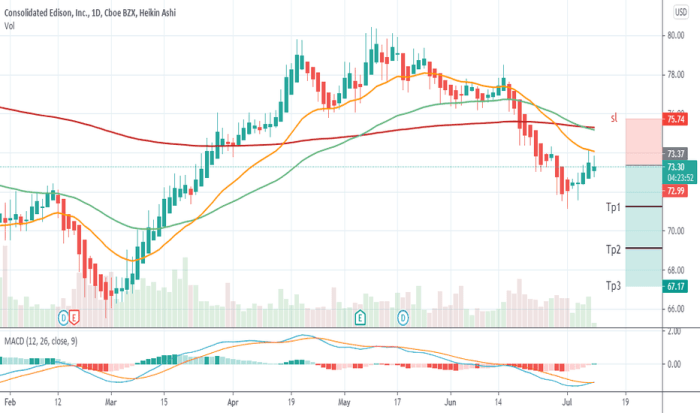

Competitor Analysis and Stock Price Comparison

Source: tradingview.com

Comparing Detroit Edison’s stock performance with its major competitors offers valuable insights into its relative strength and market positioning. The table below provides a comparison with two hypothetical major competitors, Competitor A and Competitor B.

| Company | Stock Price (Current) | Revenue (Last Year, in billions) | Net Income (Last Year, in millions) |

|---|---|---|---|

| Detroit Edison | $123 | $11.5 | $650 |

| Competitor A | $110 | $10 | $500 |

| Competitor B | $130 | $12 | $700 |

Differences in stock price performance can be attributed to factors such as market share, diversification strategies, regulatory compliance, and investor sentiment. For example, Competitor B’s higher stock price might reflect its greater market share or a more aggressive investment in renewable energy sources.

Future Outlook and Stock Price Projections

Predicting Detroit Edison’s future stock price involves considering various factors, including regulatory changes, technological advancements, and overall market conditions. Two potential scenarios are presented below:

- Scenario 1 (Optimistic): Continued growth in renewable energy investments, favorable regulatory environment, and sustained energy demand lead to a stock price of $150-$170 within 3 years.

- Scenario 2 (Conservative): Slower growth in renewable energy adoption, tighter regulatory constraints, and fluctuating energy prices result in a stock price of $130-$140 within 3 years.

These projections are based on assumptions about energy market trends, regulatory changes, and the company’s successful implementation of its strategic initiatives. The actual outcome may differ significantly depending on unforeseen events and market volatility.

Investment Considerations for Detroit Edison Stock

Investing in Detroit Edison stock involves both potential rewards and risks. Investors should carefully weigh the advantages and disadvantages before making a decision.

- Advantages: Relatively stable utility business model, potential for growth in renewable energy, dividend payouts.

- Disadvantages: Sensitivity to regulatory changes, competition from renewable energy providers, potential impact of climate change policies.

Investors should conduct thorough due diligence, consider their risk tolerance, and diversify their portfolio accordingly before investing in Detroit Edison or any other stock.

Answers to Common Questions

What are the main risks associated with investing in Detroit Edison stock?

Risks include potential regulatory changes impacting profitability, competition from renewable energy sources, and vulnerability to economic downturns affecting energy demand.

Monitoring the Detroit Edison stock price requires a keen eye on the energy sector’s performance. However, understanding broader market trends is also crucial; for instance, observing the performance of other large-cap stocks like the carmax stock price can offer insights into consumer spending and overall economic health, which indirectly impacts Detroit Edison’s prospects. Ultimately, a holistic view, encompassing various sectors, provides a more comprehensive understanding of Detroit Edison’s potential for growth.

How does Detroit Edison compare to other utility companies in terms of dividend payouts?

A comparison of dividend yields and payout ratios with similar utility companies is necessary to assess Detroit Edison’s competitiveness in this area. This information would typically be found through financial news sources or company investor relations materials.

Where can I find real-time Detroit Edison stock price quotes?

Real-time quotes are available through major financial websites and brokerage platforms.

What is the company’s current debt-to-equity ratio?

This information is readily available in Detroit Edison’s financial statements and reports, typically found on their investor relations website.