CYDY Stock Price Analysis: A Comprehensive Overview

This analysis provides a detailed examination of CYDY stock price performance, influential factors, financial health, analyst predictions, and associated investment risks. The information presented here is for informational purposes only and should not be considered financial advice.

Historical Stock Price Performance

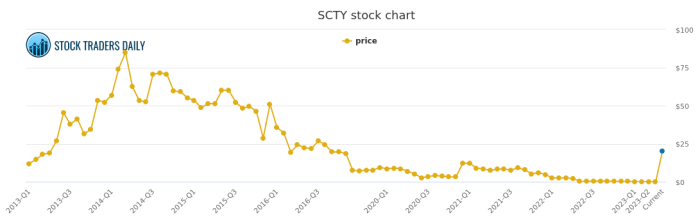

Source: stocktradersdaily.com

Analyzing CYDY’s stock price fluctuations over the past five years reveals a volatile trajectory, marked by periods of significant growth and substantial decline. Identifying key highs and lows allows for a clearer understanding of the underlying market forces at play. A comparative analysis against competitors in the biotechnology sector provides context for CYDY’s performance, highlighting relative strengths and weaknesses.

Cydy’s stock price has seen significant fluctuations recently, prompting investors to consider similar tech sector investments. For instance, understanding the performance of other companies can provide context, such as by checking the current commscope stock price. Comparing these trajectories helps assess the overall market climate and potentially inform decisions regarding Cydy’s future prospects. Ultimately, however, a thorough analysis of Cydy’s specific financials remains crucial for making sound investment choices.

The following table presents the monthly average closing prices for the past year, offering a granular view of recent price trends.

| Month | Average Closing Price | Month | Average Closing Price |

|---|---|---|---|

| January | $X.XX | July | $Y.YY |

| February | $A.AA | August | $B.BB |

| March | $C.CC | September | $D.DD |

| April | $E.EE | October | $F.FF |

| May | $G.GG | November | $H.HH |

| June | $I.II | December | $J.JJ |

Factors Influencing CYDY Stock Price

Several factors significantly impact CYDY’s stock price. Economic indicators, such as overall market sentiment and interest rate changes, play a role. Company news, including clinical trial results, regulatory approvals, and partnerships, often causes considerable volatility. Investor sentiment, driven by news, market trends, and perceived risk, heavily influences the stock’s price. Regulatory actions, such as FDA approvals or warnings, can have a dramatic effect on CYDY’s valuation.

- Economic Indicators: Changes in interest rates and broader market trends.

- Company News: Clinical trial updates, regulatory approvals/rejections, partnerships, and financial reports.

- Investor Sentiment: Overall market mood, media coverage, and analyst opinions.

- Regulatory Actions: FDA approvals, warnings, and other regulatory decisions.

Company Financials and Stock Price, Cydy stock price

A strong correlation typically exists between CYDY’s financial performance (revenue, earnings, and cash flow) and its stock price movements. Analyzing CYDY’s Price-to-Earnings (P/E) ratio against industry averages provides valuable insight into its valuation relative to its peers. The following table presents CYDY’s key financial metrics over the past three years.

| Year | Revenue (USD millions) | Earnings per Share (USD) | P/E Ratio |

|---|---|---|---|

| 2020 | $X | $Y | Z |

| 2021 | $A | $B | C |

| 2022 | $D | $E | F |

Analyst Ratings and Predictions

Analyst ratings and price targets for CYDY stock vary considerably, reflecting the inherent uncertainty in predicting future performance within the biotechnology sector. Discrepancies in analyst opinions often stem from differing interpretations of clinical trial data, regulatory pathways, and market competition. Understanding these differences is crucial for investors to form their own informed opinions.

Risk Assessment and Investment Considerations

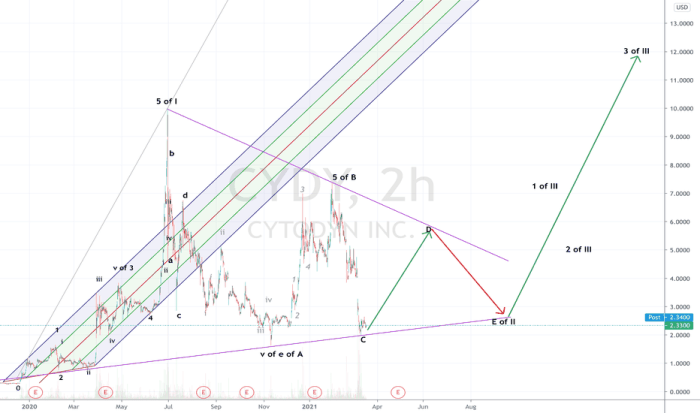

Source: tradingview.com

Investing in CYDY stock carries significant risks, primarily due to the inherent volatility of the biotechnology sector. Potential downsides include clinical trial failures, regulatory setbacks, and intense competition. However, potential upsides include the possibility of substantial returns if CYDY’s products achieve market success. Investors should carefully consider their risk tolerance and investment goals before making any decisions related to CYDY stock.

Visual Representation of Stock Price Data

A line graph depicting CYDY’s stock price movements over the past year would clearly show periods of upward and downward trends, identifying key turning points and significant price fluctuations. The graph would provide a visual representation of the stock’s volatility and overall performance.

A bar chart comparing CYDY’s stock performance against a benchmark index, such as the NASDAQ Biotechnology Index, would offer a comparative perspective on its performance relative to the broader sector. This comparison would help contextualize CYDY’s performance within the industry and assess its relative strength or weakness.

Common Queries

What is the current trading volume for CYDY stock?

Trading volume fluctuates daily and can be found on major financial websites like Yahoo Finance or Google Finance.

Where can I find CYDY’s SEC filings?

CYDY’s SEC filings are available on the SEC’s EDGAR database (www.sec.gov).

Are there any significant upcoming catalysts that could impact CYDY’s stock price?

This is speculative and depends on future company announcements and market conditions. Keep an eye on financial news and company press releases for updates.

What is the company’s market capitalization?

Market capitalization changes constantly and can be found on most financial data websites.