Cronos Group Inc. (CRON) Stock Overview

Cronos stock price – Cronos Group Inc. (CRON) is a global cannabinoid company engaged in the cultivation, extraction, and distribution of cannabis and cannabis-related products. The company operates across multiple jurisdictions, leveraging its diverse portfolio of brands and product offerings to cater to a broad consumer base. Cronos’ market position is significant, though it faces intense competition in a rapidly evolving industry.

Company Business Activities and Market Position

Cronos Group’s core business revolves around the production and sale of cannabis products, including dried flower, oils, and edibles. They also engage in research and development, aiming to innovate within the cannabis space. Their market position is characterized by a global presence, but they are not currently among the largest market share holders compared to some of their more established competitors.

Their strategic partnerships, such as the one with Altria Group, represent a significant element of their market strategy.

Key Financial Highlights

Cronos Group’s financial performance has been characterized by periods of both growth and losses. Revenue figures vary significantly year-to-year, influenced by market conditions and regulatory changes. The company has reported both net losses and profits in different fiscal periods, and its debt levels have fluctuated. Specific figures should be referenced from official financial reports for the most up-to-date information.

Cronos Group vs. Competitors

| Company | Market Cap (USD Billions) | Revenue (USD Millions) | Net Income (USD Millions) |

|---|---|---|---|

| Cronos Group (CRON) | [Insert Data] | [Insert Data] | [Insert Data] |

| [Competitor 1] | [Insert Data] | [Insert Data] | [Insert Data] |

| [Competitor 2] | [Insert Data] | [Insert Data] | [Insert Data] |

| [Competitor 3] | [Insert Data] | [Insert Data] | [Insert Data] |

Note: Data is for illustrative purposes only and should be verified with current financial reports.

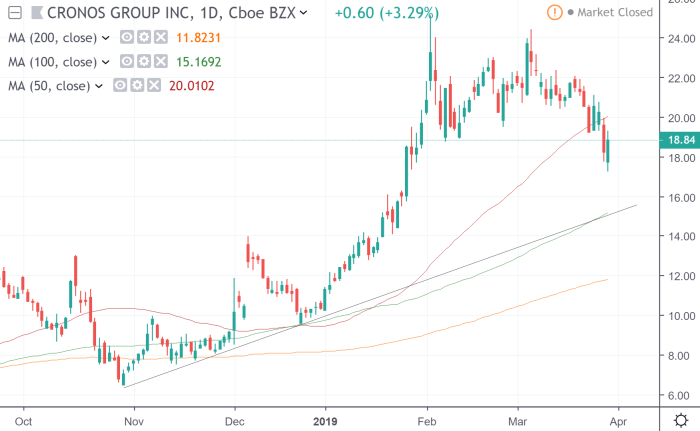

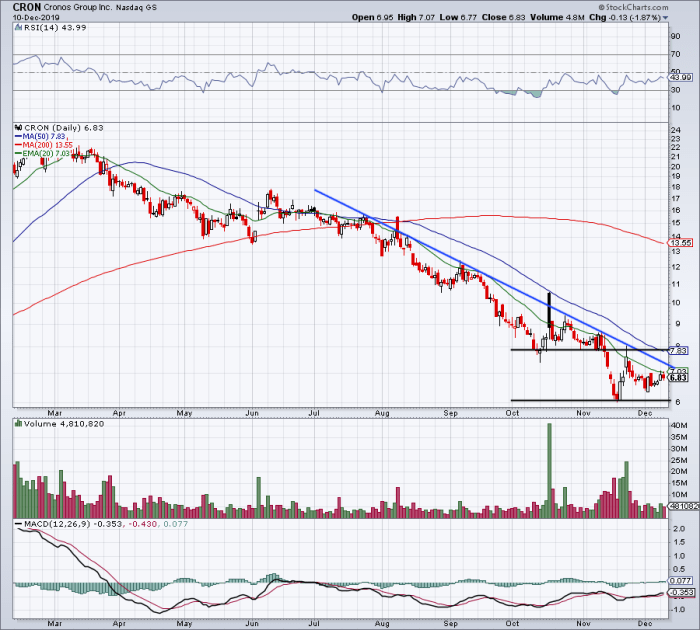

Historical Stock Price Performance

CRON’s stock price has experienced significant volatility since its initial public offering (IPO). Several factors have contributed to these fluctuations, including regulatory changes, investor sentiment, and the overall performance of the cannabis industry. Analyzing these historical trends provides valuable insight into the potential risks and rewards associated with investing in CRON.

Historical Stock Price Trends and Influencing Factors

The historical stock price of CRON has shown periods of substantial growth followed by sharp declines. Major highs and lows correlate with significant events such as regulatory announcements, financial reports, and broader market trends. For example, changes in cannabis legalization policies at both the state and federal levels have had a direct impact on CRON’s valuation.

Timeline of Important Events

Source: tradimo.com

A detailed timeline illustrating key events impacting CRON’s stock price would include dates of significant announcements, regulatory changes, partnerships, and financial results. Each event should be linked to its observed effect on the stock price. For instance, the announcement of a major partnership often resulted in a positive price surge, while disappointing earnings reports led to price drops.

Five-Year Stock Price Movement

A line graph illustrating CRON’s stock price movement over the past five years would visually represent the highs, lows, and overall trends. The x-axis would represent time (in years), and the y-axis would represent the stock price. Data points would be connected to create a continuous line, highlighting periods of growth, decline, and volatility. The graph should be generated using reliable financial data sources.

Factors Influencing Cronos Stock Price

Source: investorplace.com

Several interconnected factors significantly influence CRON’s stock price. Understanding these elements is crucial for informed investment decisions. The dynamic nature of the cannabis industry means that these factors are constantly evolving and interacting.

Regulatory Changes and Consumer Demand

Changes in cannabis regulations at both the state and federal levels significantly impact CRON’s stock price. Increased legalization often leads to positive market sentiment and price increases, while setbacks in regulatory frameworks can cause declines. Simultaneously, shifts in consumer demand, driven by factors like changing preferences and market saturation, influence the company’s revenue and profitability, consequently affecting its stock price.

Company Announcements and Key Financial Metrics

Company announcements, including news releases about partnerships, product launches, and financial results, often trigger immediate reactions in CRON’s stock price. Positive news generally leads to price increases, while negative news can result in price drops. Key financial metrics such as revenue growth, profitability, and debt levels are closely monitored by investors and directly impact the company’s valuation.

Investment Considerations and Risk Assessment: Cronos Stock Price

Investing in CRON stock presents both opportunities and risks. A thorough assessment of these aspects is essential before making any investment decisions. The volatile nature of the cannabis industry requires a long-term perspective and careful consideration of potential downsides.

Potential Risks and Growth Prospects

Risks associated with investing in CRON include regulatory uncertainty, competition, fluctuating consumer demand, and the overall volatility of the cannabis market. However, the company’s growth potential lies in its global presence, brand diversification, and ongoing innovation in the cannabis sector. Long-term growth prospects are dependent on successful navigation of these inherent risks and effective execution of its business strategy.

Investment Strategies and Advantages/Disadvantages, Cronos stock price

- Long-term investment: Suitable for investors with a higher risk tolerance and a long-term horizon.

- Short-term trading: High risk, high reward strategy based on short-term price fluctuations.

- Diversification: Including CRON as part of a diversified portfolio to mitigate overall risk.

Advantages: Potential for high returns in a growing industry, global reach, established brand recognition.

Disadvantages: High volatility, regulatory uncertainty, intense competition.

Analyst Ratings and Predictions

Financial analysts provide ratings and price targets for CRON stock, offering insights into market sentiment and future expectations. However, it’s crucial to remember that these are just predictions and should not be considered guaranteed outcomes.

Consensus Ratings and Price Targets

The consensus rating among analysts typically reflects the overall market sentiment towards CRON. This rating, often expressed as a buy, hold, or sell recommendation, is influenced by factors such as the company’s financial performance, growth prospects, and competitive landscape. Individual analysts may set different price targets, reflecting their varying assessments of the company’s future performance. These price targets represent the estimated future value of the stock.

Rationale Behind Varying Analyst Opinions

Differences in analyst opinions arise from variations in their methodologies, assumptions, and interpretations of available data. Factors such as differing views on regulatory developments, competitive dynamics, and the company’s long-term strategy can lead to divergent price targets and recommendations. Understanding the rationale behind these different opinions allows investors to form their own informed perspectives.

Competitive Landscape Analysis

Cronos Group operates in a highly competitive cannabis industry. Analyzing the competitive landscape is crucial to understanding CRON’s market position and future prospects. This analysis involves comparing CRON’s strengths and weaknesses against its main competitors.

Cronos Group vs. Top Competitors

| Company | Strengths | Weaknesses | Market Share |

|---|---|---|---|

| Cronos Group (CRON) | [Insert Data – e.g., Global reach, brand portfolio] | [Insert Data – e.g., Profitability, market share] | [Insert Data] |

| [Competitor 1] | [Insert Data] | [Insert Data] | [Insert Data] |

| [Competitor 2] | [Insert Data] | [Insert Data] | [Insert Data] |

| [Competitor 3] | [Insert Data] | [Insert Data] | [Insert Data] |

Note: Data is for illustrative purposes only and should be verified with current market reports.

Questions Often Asked

What are the main competitors of Cronos Group?

Cronos faces competition from other large cannabis companies, including Canopy Growth, Tilray, and Aurora Cannabis, among others.

Is Cronos Group profitable?

Cronos Group’s profitability has varied over time. Refer to their financial reports for the most up-to-date information on their revenue and earnings.

Where can I find real-time Cronos stock price data?

Real-time stock quotes for CRON are available through major financial websites and brokerage platforms.

What are the long-term prospects for Cronos Group?

Monitoring the Cronos stock price requires a keen eye on market trends. For a comparison, consider checking the performance of other energy sector stocks, such as the bpcl stock price , to gain a broader perspective on industry fluctuations. Ultimately, understanding the factors influencing both Cronos and BPCL will help in better assessing the overall investment landscape.

Long-term prospects depend on various factors including regulatory changes, market acceptance, and the company’s ability to execute its business strategy. Analyst predictions should be viewed with caution.