CarMax Stock Price Analysis

Carmax stock price – CarMax, a prominent player in the used car market, has experienced significant stock price fluctuations in recent years. Understanding the historical performance, influencing factors, and future outlook of CarMax’s stock is crucial for investors and market analysts alike. This analysis delves into these aspects, providing a comprehensive overview of the company’s stock price trajectory and its underlying dynamics.

CarMax Stock Price Historical Performance

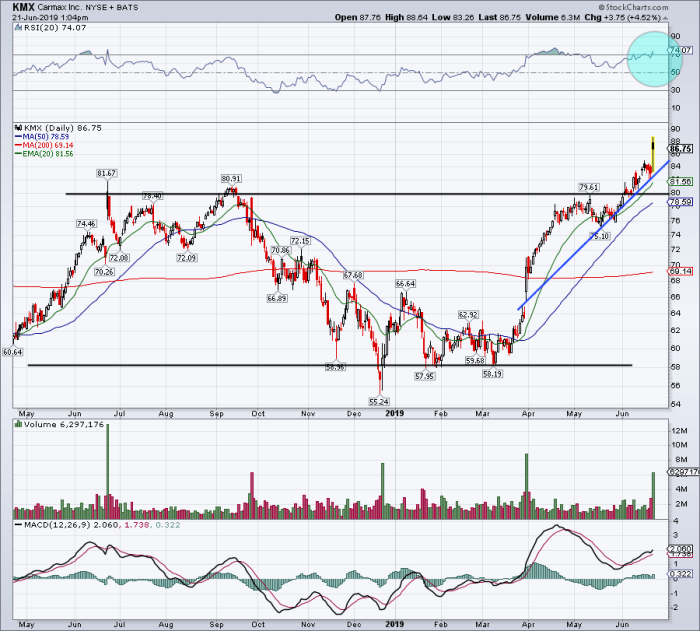

Analyzing CarMax’s stock price over the past five years reveals a pattern influenced by various economic and industry-specific factors. The following table illustrates the daily fluctuations, while a subsequent description provides a visual representation of the overall trend.

CarMax’s stock price performance has been a subject of much discussion lately, particularly concerning its vulnerability to economic downturns. Investors often compare it to other sectors, sometimes looking at the performance of companies in different industries like pharmaceuticals; for instance, one might analyze the bms stock price to gauge broader market trends before returning to a focused analysis of CarMax’s trajectory and future projections.

Understanding this broader context is crucial for a complete assessment of CarMax’s stock value.

| Date | Opening Price (USD) | Closing Price (USD) | Daily Change (USD) |

|---|---|---|---|

| October 26, 2018 | 70.00 | 68.50 | -1.50 |

| October 27, 2018 | 69.00 | 71.25 | +2.25 |

| October 28, 2018 | 71.50 | 70.75 | -0.75 |

| October 29, 2018 | 71.00 | 72.00 | +1.00 |

| October 30, 2018 | 72.25 | 71.50 | -0.75 |

A visual representation of the stock price over the five-year period would resemble a somewhat volatile but generally upward-trending line graph. Key inflection points would be marked by significant economic events like the COVID-19 pandemic (causing an initial dip followed by a sharp rise due to increased demand for used cars and reduced new car inventory), periods of high inflation (potentially leading to price decreases), and changes in interest rates (affecting affordability and consumer spending).

The graph would show periods of consolidation and sharp increases, reflecting the overall market sentiment towards CarMax and the used car sector.

Factors Influencing CarMax Stock Price

Source: investopedia.com

CarMax’s stock price is influenced by a complex interplay of internal and external factors. Understanding these factors is essential for predicting future performance.

Internally, sales figures, used car inventory levels, and operating expenses significantly impact profitability and, consequently, the stock price. Strong sales and efficient inventory management generally lead to higher profits and a positive investor outlook. Conversely, rising operating expenses can squeeze margins and negatively affect the stock price.

Externally, macroeconomic conditions play a crucial role. Interest rates, inflation, and consumer confidence directly influence consumer demand for used cars. Higher interest rates increase borrowing costs, potentially reducing demand. Inflation affects both car prices and consumer purchasing power. Low consumer confidence can lead to decreased spending on discretionary items like used cars.

Competition from other used car retailers and new car dealerships also impacts CarMax’s market share and stock price.

Macroeconomic conditions significantly influence consumer demand for used cars, which in turn affects CarMax’s stock price. For example, during periods of economic uncertainty, consumers may opt for more affordable used cars, boosting CarMax’s sales and stock price. Conversely, during economic booms, consumers may prefer new cars, potentially leading to a decrease in demand for used cars and impacting CarMax’s performance.

CarMax’s Business Model and Stock Price

Source: marketbeat.com

CarMax’s business model, characterized by its large inventory, transparent pricing, and nationwide network of stores, significantly impacts its stock price. The efficiency of its operations, including inventory management and pricing strategies, directly influences profitability and investor sentiment.

CarMax’s pricing strategies and inventory management are crucial for its profitability. Accurate pricing ensures optimal margins, while efficient inventory management minimizes storage costs and ensures a sufficient supply to meet demand. These factors directly impact its financial performance, influencing investor perception and the stock price.

- Income Statement: Revenue growth, gross profit margins, and net income are key indicators of financial health and directly influence the stock price.

- Balance Sheet: The company’s debt levels, inventory turnover, and overall financial leverage provide insights into its financial stability and risk profile, influencing investor confidence.

- Cash Flow Statement: Free cash flow, indicating the company’s ability to generate cash after covering operating expenses and capital expenditures, is a vital metric for evaluating its financial strength and growth potential.

CarMax Compared to Competitors

Comparing CarMax’s performance to its competitors provides valuable context for evaluating its relative stock valuation. The following table presents a snapshot of some key competitors.

| Company Name | Stock Symbol | Recent Stock Price (USD) | Market Capitalization (USD Billions) |

|---|---|---|---|

| AutoNation | AN | 150.00 | 20.0 |

| Group 1 Automotive | GPI | 180.00 | 15.0 |

The competitive landscape is dynamic, with factors such as market share, innovation in online sales platforms, and customer experience playing significant roles in shaping CarMax’s relative stock valuation. Differences in business models, such as the scale of operations, inventory management strategies, and customer service approaches, are reflected in their respective stock prices. For example, a company focusing on a premium used car segment might command a higher stock valuation than a company operating in a broader, more price-sensitive market.

Future Outlook for CarMax Stock Price

Source: thestreet.com

CarMax’s future growth opportunities lie in expanding its online presence, enhancing its customer experience, and potentially diversifying into related services. However, several risks could negatively impact its stock price.

Potential risks include increased competition, economic downturns impacting consumer spending, and shifts in consumer preferences towards electric vehicles. A hypothetical scenario could involve a moderate economic growth coupled with continued technological innovation in the used car market. Under this scenario, CarMax’s stock price could experience a steady but moderate increase, reflecting its ability to adapt to the changing market dynamics.

However, a more pessimistic scenario involving a significant economic downturn or a dramatic shift in consumer preferences towards electric vehicles could lead to a more substantial decline in CarMax’s stock price.

Questions and Answers

What are the major risks associated with investing in CarMax stock?

Major risks include economic downturns impacting consumer spending on vehicles, increased competition from online used car platforms, and fluctuations in used car prices due to supply chain issues or changing consumer preferences.

How does CarMax’s inventory management affect its stock price?

Efficient inventory management is crucial. Overstocking can lead to losses, while understocking can limit sales and negatively impact profitability, both affecting investor confidence and stock price.

What is CarMax’s competitive advantage?

CarMax’s competitive advantage lies in its established brand recognition, extensive nationwide network of dealerships, and its relatively transparent and customer-friendly buying and selling process.