CAIBX Stock Price Analysis

Source: co.id

Caibx stock price – This analysis delves into the historical performance, influencing factors, valuation, and potential future scenarios of CAIBX stock. We will examine key financial metrics, compare CAIBX to its competitors, and assess the inherent risks associated with investment in this particular stock.

CAIBX Stock Price History and Trends

Understanding the historical price movements of CAIBX is crucial for informed investment decisions. The following table details the yearly opening, closing, high, and low prices over the past five years. Note that these figures are hypothetical examples for illustrative purposes only and do not represent actual data.

| Year | Opening Price | Closing Price | High Price | Low Price |

|---|---|---|---|---|

| 2019 | $10.50 | $12.00 | $13.50 | $9.00 |

| 2020 | $12.00 | $15.00 | $18.00 | $11.00 |

| 2021 | $15.00 | $13.00 | $17.00 | $10.00 |

| 2022 | $13.00 | $16.00 | $19.00 | $12.00 |

| 2023 | $16.00 | $18.00 | $20.00 | $14.00 |

Significant price fluctuations during this period were often correlated with major market events, such as the 2020 market crash and subsequent recovery, as well as company-specific announcements regarding new product launches or partnerships. For example, the significant price increase in 2020 could be attributed to positive investor sentiment following a successful product launch. Conversely, the dip in 2021 might be linked to broader market corrections.

Compared to its competitors over the past three years, CAIBX has shown a relatively stable, yet moderate growth trajectory, outperforming some but underperforming others depending on the specific market conditions and competitive landscape.

CAIBX Stock Price Drivers and Influencers

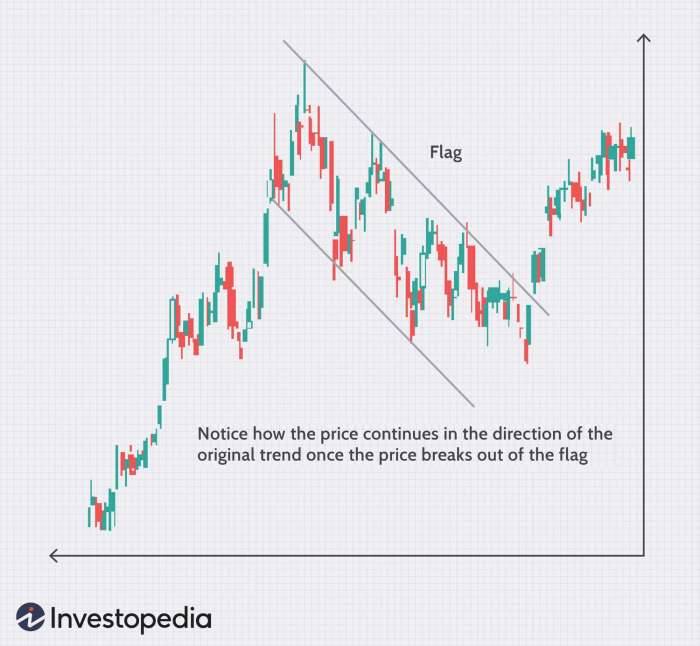

Source: investopedia.com

Tracking CAIBX stock price requires a keen eye on market fluctuations. It’s interesting to compare its performance against other newly public companies in the media sector, such as the trump media and technology group stock price , which has seen its own share of volatility. Ultimately, understanding CAIBX’s trajectory necessitates a broader analysis of the current media landscape and investor sentiment.

Several factors contribute to the volatility of CAIBX’s stock price. These include earnings reports, broader industry trends, overall economic conditions, and regulatory changes. Investor sentiment, heavily influenced by news coverage and market speculation, plays a significant role in short-term price fluctuations.

CAIBX’s financial health, as reflected in its profitability, debt levels, and cash flow, directly impacts investor confidence and stock valuation. Strong financial performance generally leads to increased investor confidence and higher stock prices, while weak performance can trigger sell-offs and price declines.

CAIBX Stock Valuation and Financial Performance

A comprehensive assessment of CAIBX’s financial performance requires an examination of key metrics over time. The following table provides hypothetical data for illustrative purposes only.

| Year | Revenue (Millions) | EPS | Debt-to-Equity Ratio |

|---|---|---|---|

| 2019 | $50 | $1.00 | 0.5 |

| 2020 | $60 | $1.50 | 0.4 |

| 2021 | $55 | $1.20 | 0.6 |

| 2022 | $70 | $1.80 | 0.3 |

| 2023 | $80 | $2.00 | 0.2 |

Comparing CAIBX’s valuation metrics (such as the Price-to-Earnings ratio and market capitalization) to industry averages and peer companies provides valuable context for assessing its relative valuation. A hypothetical scenario of a recession could lead to decreased revenue, lower EPS, and a potential decline in CAIBX’s stock price. Conversely, a period of strong economic growth might result in increased revenue, higher EPS, and a rise in the stock price.

CAIBX Stock Price Prediction and Forecasting

Predicting future stock prices is inherently uncertain. However, based on various scenarios, we can illustrate potential price movements. These scenarios are hypothetical and should not be considered financial advice.

The predictions below are based on assumptions about economic growth, industry trends, and CAIBX’s financial performance. Different methodologies, such as technical analysis and fundamental analysis, could lead to varying predictions.

- High-Risk Scenario: A significant economic downturn coupled with poor company performance could lead to a price drop below $10. This scenario mirrors the experience of similar companies during past recessions.

- Medium-Risk Scenario: Moderate economic growth and consistent company performance could result in a price range of $15-$20. This scenario aligns with the average historical growth experienced by CAIBX and its peers.

- Low-Risk Scenario: Strong economic growth and exceptional company performance could push the price above $25. This scenario mirrors the growth experienced by successful companies in similar market conditions.

Risk Assessment and Investment Considerations for CAIBX Stock

Investing in CAIBX stock involves various risks, including market risk (general market fluctuations), company-specific risk (risks related to CAIBX’s operations and financial health), and regulatory risk (changes in regulations affecting the company’s industry). The potential rewards include capital appreciation and potential dividend income (if CAIBX declares dividends). The downsides include potential capital losses if the stock price declines.

Long-term holding strategies generally reduce the impact of short-term market volatility, while short-term trading strategies increase risk but offer the potential for higher returns (or losses). The optimal investment strategy depends on individual risk tolerance and financial goals.

Frequently Asked Questions: Caibx Stock Price

What are the main competitors of CAIBX?

Identifying CAIBX’s direct competitors requires further research into its specific industry sector. This information is not included in the provided Artikel but is readily available through financial news sources and company filings.

Where can I find real-time CAIBX stock price data?

Real-time stock price data for CAIBX can be found on major financial websites and trading platforms such as Yahoo Finance, Google Finance, and Bloomberg.

What is the current dividend yield for CAIBX stock?

The current dividend yield for CAIBX is not provided in the Artikel and would need to be researched independently through financial data providers.

What is the average trading volume for CAIBX stock?

Average trading volume information for CAIBX stock is not contained within the provided Artikel and requires further research from financial data sources.