Bombay Stock Exchange (BSE) Overview and Share Price Dynamics

Bse stock exchange share price – The Bombay Stock Exchange (BSE), established in 1875, holds a significant place in India’s financial history. It’s the oldest stock exchange in Asia and plays a crucial role in the nation’s economic growth. This article delves into the BSE’s operations, share price dynamics, and the influence of macroeconomic factors.

BSE History and Significance

Initially operating as a private association of brokers, the BSE was formally recognized in 1957. Its evolution reflects India’s economic liberalization and globalization. The BSE’s significance lies in its role as a primary platform for capital formation, facilitating the growth of Indian businesses through access to equity markets. It provides a barometer of the Indian economy and investor sentiment.

Key BSE Indices

The BSE tracks several key indices, most notably the SENSEX (Sensitive Index), also known as the BSE 30. This index comprises 30 of the largest and most actively traded companies, representing a broad cross-section of the Indian economy. Other important indices include the BSE Midcap and BSE Smallcap, which track the performance of mid-sized and small-sized companies, respectively. These indices offer investors insights into various market segments.

BSE Trading Mechanisms and Regulations

The BSE operates as an electronic trading platform, utilizing a sophisticated order-matching system. Trading is regulated by the Securities and Exchange Board of India (SEBI), ensuring fair practices and investor protection. Regulations cover aspects like listing requirements, trading rules, and disclosure mandates, aiming to maintain market integrity and transparency.

BSE Compared to Global Exchanges

While the BSE is a significant player in Asia, its size and trading volume are comparatively smaller than global giants like the New York Stock Exchange (NYSE) or the Nasdaq. However, the BSE’s influence within the Indian economy is considerable, reflecting its unique position as the primary stock exchange for one of the world’s fastest-growing major economies. The BSE’s increasing integration with global markets also signifies its growing international importance.

Share Price Dynamics on the BSE

BSE share prices are influenced by a complex interplay of factors, ranging from macroeconomic conditions to individual company performance. Understanding these dynamics is crucial for investors.

Factors Influencing BSE Share Prices

Economic indicators like GDP growth, inflation rates, and interest rate changes significantly impact investor sentiment and share prices. Global events, such as geopolitical instability or changes in global commodity prices, also exert influence. Company-specific factors, including earnings reports, new product launches, and management changes, directly affect individual share prices.

Impact of Investor Sentiment

Investor sentiment, a collective reflection of market psychology, plays a crucial role in share price fluctuations. Periods of optimism often lead to price increases, while pessimism can trigger sell-offs. News events, both positive and negative, can dramatically shift investor sentiment and consequently, share prices.

Hypothetical Scenario: News Events and Share Prices

Imagine a scenario where a major pharmaceutical company listed on the BSE announces a breakthrough in cancer treatment. This positive news would likely trigger a surge in investor confidence, leading to a significant increase in the company’s share price, potentially impacting the broader market as well. Conversely, news of a major accounting scandal could cause a sharp decline.

Price Volatility Across BSE Sectors

Different sectors exhibit varying degrees of price volatility. For instance, technology stocks are often considered more volatile than utility stocks due to their higher growth potential and susceptibility to market shifts. Understanding sector-specific volatility is essential for effective portfolio management.

Analyzing BSE Share Price Data

Analyzing historical share price data helps identify trends, patterns, and potential investment opportunities. This involves examining various metrics and indicators.

Historical Share Price Performance (Hypothetical Example)

The following table illustrates the hypothetical five-year performance of “Example Corp,” a BSE-listed company. Note that this data is purely illustrative.

| Date | Open | High | Low | Close | Volume |

|---|---|---|---|---|---|

| 2019-01-01 | 100 | 105 | 98 | 102 | 10000 |

| 2019-01-08 | 102 | 108 | 100 | 106 | 12000 |

| 2019-01-15 | 106 | 110 | 104 | 108 | 15000 |

| 2019-01-22 | 108 | 112 | 106 | 110 | 18000 |

| 2019-01-29 | 110 | 115 | 108 | 112 | 20000 |

Calculating Key Financial Metrics

Moving averages (e.g., 50-day, 200-day) smooth out price fluctuations, revealing underlying trends. The Relative Strength Index (RSI) measures momentum and helps identify overbought or oversold conditions. These metrics, calculated using the historical data, provide insights into price trends and potential turning points.

Identifying Trends and Patterns

By analyzing the historical data and applying technical indicators, potential trends and patterns, such as support and resistance levels, can be identified. These insights can inform investment decisions, although it’s crucial to remember that past performance is not indicative of future results.

Impact of Macroeconomic Factors

Macroeconomic conditions significantly influence the BSE’s performance and share prices. Understanding these influences is vital for informed investment strategies.

Influence of Interest Rate Changes

Interest rate hikes generally lead to higher borrowing costs for companies, potentially slowing down economic activity and impacting corporate earnings. This can negatively affect share prices. Conversely, interest rate cuts can stimulate investment and boost economic growth, leading to higher share prices.

Impact of Inflation Rates

High inflation erodes purchasing power and can lead to increased uncertainty in the market. Investors may become hesitant to invest, leading to lower share prices. Central banks often respond to high inflation by raising interest rates, further impacting share prices.

Impact of Government Policies and Regulations

Government policies, such as tax reforms, infrastructure spending, and regulatory changes, can have significant effects on the economy and the stock market. Favorable policies generally stimulate economic growth and boost investor confidence, while unfavorable policies can have the opposite effect.

Global Economic Events and their Impact, Bse stock exchange share price

Global economic events, like financial crises or recessions in major economies, can have a significant impact on the BSE. These events often lead to increased market volatility and can trigger substantial price swings.

Individual Company Performance and Share Price

A company’s financial health and performance directly influence its share price. Understanding these factors is crucial for investors.

Impact of Earnings Reports

Earnings reports, which disclose a company’s financial performance, are closely watched by investors. Positive earnings surprises (better-than-expected results) often lead to share price increases, while negative surprises can trigger price declines.

Role of Corporate Announcements

Corporate announcements, such as mergers, acquisitions, new product launches, and expansion plans, can significantly influence share prices. Positive announcements generally boost investor confidence, while negative news can lead to price drops.

Factors Affecting Company Financial Health and Share Price

Factors such as revenue growth, profitability, debt levels, and cash flow directly impact a company’s financial health and, consequently, its share price. Strong financial performance usually leads to higher share prices, while weak performance can result in price declines.

Comparing Share Price Performance of Two Companies

Comparing the share price performance of two companies within the same sector allows for an assessment of relative strength. Differences in share price performance might stem from variations in their financial health, management strategies, market positioning, and investor sentiment.

Risk and Return in BSE Investments

Investing in BSE shares involves both potential returns and risks. Understanding these aspects is essential for making informed investment decisions.

Types of Risks in BSE Investments

Market risk refers to the overall risk of investing in the stock market, influenced by factors like economic conditions and investor sentiment. Company-specific risk relates to the financial health and performance of individual companies. Diversification is crucial to mitigate these risks.

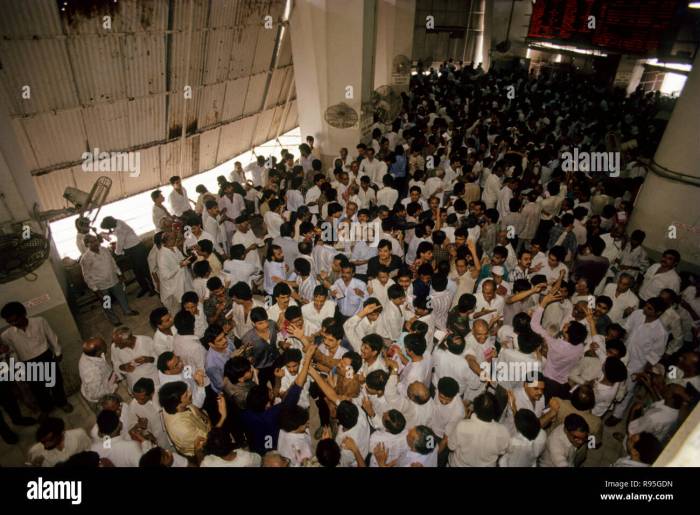

Diversification as a Risk Mitigation Strategy

Source: alamy.com

Diversification, the practice of spreading investments across different assets, reduces risk by preventing overexposure to any single company or sector. A diversified portfolio can cushion the impact of negative events affecting specific investments.

Hypothetical Portfolio and Risk/Return Calculation

Source: co.in

A hypothetical portfolio might include shares of a technology company, a pharmaceutical company, and a consumer goods company. The potential return would depend on the individual share price movements, while the risk would be a function of the volatility of each component. The overall portfolio risk would be lower than investing in just one of these companies.

Relationship Between Risk and Return

Generally, higher potential returns are associated with higher risk. Investors must carefully assess their risk tolerance before making investment decisions. A balanced approach, considering both risk and return, is essential for long-term success in the BSE market.

Frequently Asked Questions: Bse Stock Exchange Share Price

What are the trading hours of the BSE?

The BSE’s trading hours are typically from 9:15 AM to 3:30 PM IST (Indian Standard Time), Monday to Friday, excluding public holidays.

How can I access real-time BSE share price data?

Real-time data is available through various online brokers, financial websites, and dedicated data providers. Many offer free basic data, while advanced features often require subscriptions.

What is the difference between the BSE and the NSE?

Both BSE and NSE are major Indian stock exchanges. While they share many similarities, they differ in their history, trading volumes, and the specific companies listed. The NSE generally has higher trading volumes.

What are the minimum investment requirements for the BSE?

Minimum investment requirements vary depending on the broker and the investment instrument (e.g., shares, derivatives). Some brokers allow investments with minimal amounts, while others may have higher minimums.