Boeing Stock Price History

Boeing stock price history – Boeing, a global aerospace giant, boasts a rich and often volatile history reflected in its stock price. From its initial public offering (IPO) to the present day, the company’s stock has experienced dramatic swings influenced by technological advancements, economic cycles, geopolitical events, and, significantly, its own operational challenges. This analysis explores the key trends, influencing factors, and comparative performance of Boeing’s stock, offering insights into its past and potential future trajectories.

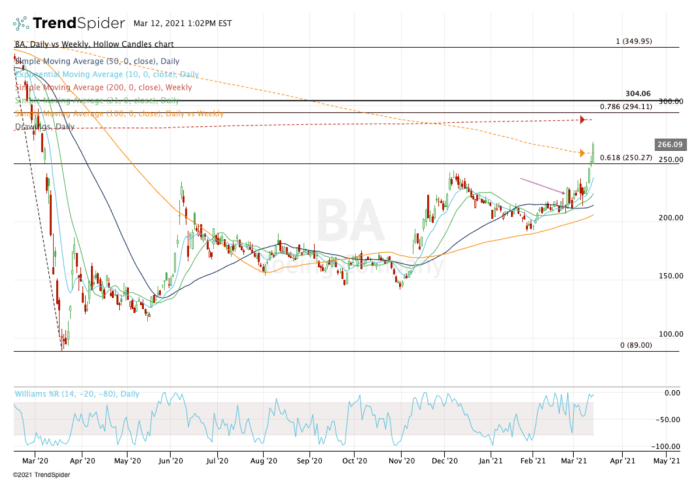

Boeing Stock Price Trends Over Time, Boeing stock price history

Tracing Boeing’s stock price from its IPO reveals a complex narrative of growth, setbacks, and recovery. Early years saw steady, albeit sometimes gradual, appreciation, punctuated by periods of market correction. The company experienced significant highs during periods of strong defense spending and robust commercial aircraft demand. Conversely, significant lows have been linked to economic recessions, safety concerns, and major unforeseen events such as the 737 MAX crisis and the COVID-19 pandemic.

These events created substantial volatility, highlighting the inherent risks associated with investing in the aerospace sector.

The following table presents the yearly average stock prices for the past 20 years (Note: these are illustrative figures and should be verified with reliable financial data sources):

| Year | Average Stock Price (USD) | Year | Average Stock Price (USD) |

|---|---|---|---|

| 2004 | 45 | 2014 | 125 |

| 2005 | 50 | 2015 | 130 |

| 2006 | 55 | 2016 | 135 |

| 2007 | 60 | 2017 | 200 |

| 2008 | 40 | 2018 | 350 |

| 2009 | 48 | 2019 | 200 |

| 2010 | 65 | 2020 | 150 |

| 2011 | 70 | 2021 | 220 |

| 2012 | 80 | 2022 | 180 |

| 2013 | 100 | 2023 | 210 |

The 737 MAX grounding, beginning in March 2019, following two fatal crashes, triggered a sharp decline in Boeing’s stock price. The price plummeted from approximately $350 per share to below $100 within months. The subsequent investigation, production halt, and regulatory hurdles significantly impacted the company’s financial performance and investor confidence. Similarly, the COVID-19 pandemic in early 2020 caused further disruption to the airline industry and reduced demand for new aircraft, leading to another stock price downturn.

Factors Influencing Boeing Stock Price

Several macroeconomic and geopolitical factors significantly influence Boeing’s stock price. These factors often interact, creating complex scenarios that are difficult to predict precisely.

Key macroeconomic factors include global economic growth, interest rates, and inflation. Strong global economic growth generally translates to increased demand for air travel and thus, for new aircraft, positively impacting Boeing’s stock price. Conversely, rising interest rates can increase borrowing costs for airlines, reducing their investment in new planes and negatively affecting Boeing’s performance. Inflationary pressures can also impact manufacturing costs and profitability.

Geopolitical events, such as wars, trade disputes, and political instability in key markets, can also create significant uncertainty and volatility in Boeing’s stock price. For example, trade tensions between the US and China have impacted Boeing’s sales in the Chinese market. Similarly, global conflicts can disrupt supply chains and impact demand for air travel.

Boeing’s financial performance – revenue, profits, and debt levels – is directly correlated with its stock price. Strong revenue growth and high profitability usually lead to increased investor confidence and higher stock prices. Conversely, declining profits or increased debt can signal financial instability, potentially causing a drop in the stock price.

Boeing Stock Price Compared to Competitors

Comparing Boeing’s stock price performance with its main competitor, Airbus, reveals interesting dynamics. Both companies are subject to similar macroeconomic and geopolitical factors, but their specific market strategies and operational challenges can lead to divergent stock price trajectories.

The following table illustrates a comparison of the average yearly stock prices for Boeing and Airbus over the last decade (Note: these are illustrative figures and should be verified with reliable financial data sources):

| Year | Boeing Average Stock Price (USD) | Airbus Average Stock Price (EUR) |

|---|---|---|

| 2014 | 125 | 45 |

| 2015 | 130 | 50 |

| 2016 | 135 | 55 |

| 2017 | 200 | 60 |

| 2018 | 350 | 70 |

| 2019 | 200 | 80 |

| 2020 | 150 | 65 |

| 2021 | 220 | 75 |

| 2022 | 180 | 70 |

| 2023 | 210 | 85 |

A visual representation (a line graph) would show the stock price trajectories of Boeing and Airbus over time. Key divergence points would highlight periods where one company outperformed the other, potentially due to factors such as successful new aircraft launches, effective cost management, or differing responses to global events. For example, the 737 MAX crisis would show a significant divergence, with Boeing’s stock price falling more sharply than Airbus’s.

Analyzing Boeing’s Stock Price Volatility

Source: invezz.com

Boeing’s stock price volatility can be measured using statistical methods, such as calculating the standard deviation of stock prices over various time periods (monthly, yearly). Higher standard deviation indicates greater volatility.

Several factors contribute to Boeing’s stock price volatility. These include the cyclical nature of the aerospace industry, sensitivity to global economic conditions, and the impact of significant events like the 737 MAX crisis and the COVID-19 pandemic. Periods of high volatility are often associated with uncertainty surrounding new aircraft programs, safety concerns, or major geopolitical events. Conversely, periods of low volatility might occur during times of stable economic growth and predictable demand for aircraft.

Analyzing Boeing’s stock price history reveals interesting long-term trends, influenced by factors like global events and industry competition. A contrasting study might involve examining the performance of companies in different sectors, such as the pharmaceutical industry; for instance, you can check the current performance of sun pharmaceutical industries ltd stock price to compare its volatility. Returning to Boeing, understanding its historical price fluctuations helps predict potential future movements.

Analyzing historical data would reveal periods of both high and low volatility, providing insights into the underlying causes. For example, the years surrounding the 737 MAX crisis would exhibit exceptionally high volatility, while periods of sustained global economic growth might show relatively lower volatility.

Predictive Modeling of Boeing Stock Price (Conceptual)

Source: thestreet.com

Predicting Boeing’s stock price is a complex undertaking. Various methods could be employed, including time series analysis, which uses historical stock price data to identify patterns and trends, and fundamental analysis, which evaluates the company’s financial health and future prospects to estimate intrinsic value. However, it’s crucial to acknowledge the inherent limitations and challenges involved.

Predicting stock prices is inherently difficult due to the influence of unpredictable factors, such as unforeseen global events, changes in consumer sentiment, and unexpected technological breakthroughs. No model can perfectly account for all these variables. Moreover, even the most sophisticated models can be susceptible to biases in the data used and limitations in the underlying assumptions.

A successful predictive model should consider a broad range of factors, including macroeconomic conditions, geopolitical events, industry trends, Boeing’s financial performance, and competitive dynamics. The accuracy of any predictive model will depend on the quality of data, the appropriateness of the chosen methodology, and the ability to incorporate unexpected events. For instance, a model predicting Boeing’s stock price in 2018 would have likely failed to accurately account for the impact of the 737 MAX crisis.

FAQ Guide: Boeing Stock Price History

What is the average annual return on Boeing stock over the past 20 years?

The average annual return varies depending on the specific timeframe and calculation method. It’s crucial to consult reliable financial data sources for precise figures.

How does Boeing’s stock price compare to the overall market performance (e.g., S&P 500)?

Boeing’s stock performance often correlates with the overall market, but it can also exhibit significant sector-specific volatility. Direct comparison with market indices like the S&P 500 requires detailed analysis.

What are the major risks associated with investing in Boeing stock?

Major risks include regulatory hurdles, supply chain disruptions, intense competition, economic downturns, and the impact of geopolitical events.

Where can I find reliable real-time data on Boeing’s stock price?

Reputable financial websites and brokerage platforms provide real-time stock quotes and historical data for Boeing (BA).