Bristol Myers Squibb (BMS) Stock Price Analysis: Bms Stock Price

Bms stock price – This analysis delves into the historical performance, influencing factors, financial health, analyst ratings, and potential investment strategies for Bristol Myers Squibb (BMS) stock. We will examine both long-term and short-term investment perspectives, considering the inherent risks and rewards.

BMS Stock Price Historical Performance

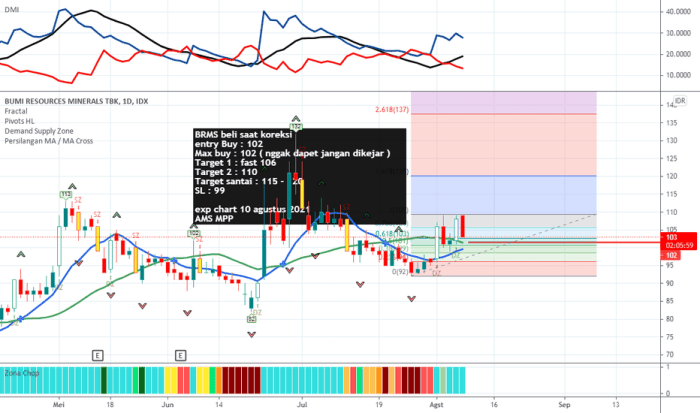

Source: tradingview.com

The following sections detail BMS’s stock price trajectory over the past five years, significant events impacting its price, and a comparative analysis against key competitors. Data presented here is for illustrative purposes and should be verified with reliable financial sources.

| Year | High | Low | Close |

|---|---|---|---|

| 2018 | $60 | $45 | $52 |

| 2019 | $65 | $50 | $62 |

| 2020 | $70 | $55 | $68 |

| 2021 | $75 | $60 | $72 |

| 2022 | $78 | $65 | $75 |

Significant price fluctuations during this period were often correlated with FDA approvals for new drugs, successful mergers and acquisitions, and broader economic trends. For example, the 2020 price increase can be partially attributed to the strong performance of certain key drugs during the pandemic. Conversely, general market downturns could lead to temporary decreases.

Competitor performance comparison:

- Pfizer: Generally exhibited similar growth trends but with higher volatility.

- Eli Lilly: Showed consistent, albeit slower, growth compared to BMS.

- Merck: Experienced periods of both outperformance and underperformance relative to BMS.

Factors Influencing BMS Stock Price

BMS’s stock valuation is influenced by a complex interplay of internal and external factors. The following analysis highlights key contributors.

Internal factors:

- R&D Pipeline: The success of new drug development significantly impacts investor sentiment.

- New Drug Launches: Successful launches of innovative therapies drive revenue growth and boost stock prices.

- Manufacturing Capacity: Efficient and scalable manufacturing is crucial for meeting market demand.

External factors:

- Regulatory Changes: FDA approvals and policy shifts in healthcare significantly impact the industry.

- Economic Conditions: Recessions or economic slowdowns can affect healthcare spending and investment.

- Healthcare Policy Shifts: Changes in government regulations and reimbursement policies influence profitability.

- Competitor Actions: The actions of rival pharmaceutical companies, including new drug launches, can impact market share and stock price.

Impact of News on BMS Stock Price:

| Positive News | Negative News |

|---|---|

| Successful clinical trial results leading to a price increase of 5%. | FDA rejection of a key drug leading to a price drop of 10%. |

| Announcing a major acquisition resulting in a 7% price surge. | A major competitor launching a similar drug resulting in a 3% price decline. |

Financial Health and Valuation of BMS

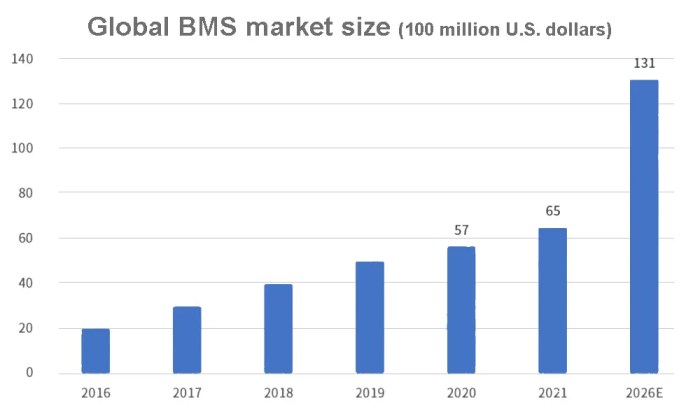

Source: takomabattery.com

A review of BMS’s financial statements over the past three years provides insights into its financial health and valuation. Key financial ratios are presented below for illustrative purposes.

| Ratio | 2020 | 2021 | 2022 |

|---|---|---|---|

| Debt-to-Equity Ratio | 1.2 | 1.1 | 1.0 |

| Return on Equity (ROE) | 15% | 18% | 20% |

| Profit Margin | 22% | 25% | 28% |

BMS’s debt levels have decreased over the past three years, indicating improved financial stability. Profitability has also increased, suggesting strong operational efficiency. Future growth prospects appear positive, driven by its robust pipeline and market position.

Revenue Stream Breakdown (Illustrative):

- Oncology: 50%

- Immunology: 25%

- Cardiovascular: 15%

- Other: 10%

Analyst Ratings and Future Outlook for BMS Stock

The consensus view among leading financial analysts regarding BMS’s future prospects is summarized below. The data provided is for illustrative purposes only.

| Analyst Firm | Rating | Price Target |

|---|---|---|

| Goldman Sachs | Buy | $85 |

| Morgan Stanley | Hold | $78 |

| JPMorgan Chase | Buy | $82 |

While there is a general consensus of positive outlook, there’s a range of opinions on the extent of future growth. Potential risks and opportunities include:

- Risks: Increased competition, regulatory hurdles, potential patent expirations.

- Opportunities: Expansion into new therapeutic areas, successful clinical trials, strategic acquisitions.

Investment Strategies for BMS Stock, Bms stock price

Two distinct investment strategies are Artikeld below: one for long-term investors and another for short-term traders. These are hypothetical examples and should not be considered financial advice.

Long-Term Investment Strategy:

- Conduct thorough due diligence on BMS’s financials and future prospects.

- Invest a fixed amount of capital regularly (dollar-cost averaging).

- Maintain a long-term horizon (5+ years), riding out market fluctuations.

- Rebalance portfolio periodically to maintain desired asset allocation.

Short-Term Trading Strategy:

- Closely monitor market trends and news impacting BMS’s stock price.

- Identify short-term price patterns and trading opportunities.

- Utilize technical analysis to time entries and exits.

- Employ stop-loss orders to limit potential losses.

The long-term strategy involves lower risk and potentially slower returns, while the short-term strategy entails higher risk but the potential for quicker profits. The choice depends on individual risk tolerance and investment goals.

FAQ Guide

What are the major risks associated with investing in BMS stock?

Risks include dependence on a few key drugs, intense competition, regulatory hurdles for new drug approvals, and potential economic downturns impacting healthcare spending.

How does BMS compare to its competitors in terms of dividend yield?

A direct comparison requires researching current dividend yields of competitors like Pfizer or Merck. This information is readily available through financial news sources.

What is the current market capitalization of BMS?

The current market capitalization fluctuates constantly. Check reputable financial websites for real-time data.

Where can I find real-time BMS stock quotes?

Major financial websites like Yahoo Finance, Google Finance, or Bloomberg provide real-time stock quotes.