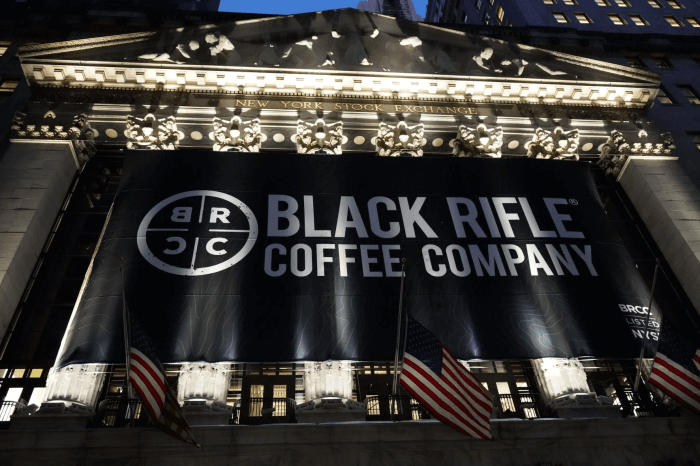

Black Rifle Coffee Company Stock Price Analysis

Black rifle coffee stock price – Black Rifle Coffee Company (BRCC) has experienced a rapid rise in popularity, establishing itself as a prominent player in the specialty coffee market. This analysis delves into BRCC’s history, business model, financial performance, competitive landscape, and future prospects, ultimately examining the factors influencing its stock price.

Black Rifle Coffee Company Overview

Source: capitalism.com

Founded in 2014 by Mat Best, a former US Army Ranger, Black Rifle Coffee Company quickly gained traction by aligning its brand with a patriotic and military-centric ethos. The company’s business model centers on direct-to-consumer sales through its website and retail partnerships, targeting a largely male demographic interested in coffee, firearms, and outdoor activities. Key factors contributing to its growth include strong brand loyalty, effective marketing leveraging social media, and a focus on high-quality coffee.

Challenges include navigating potential controversies related to its branding and maintaining consistent growth in a competitive market.

| Product Category | Product Examples | Description | Target Audience |

|---|---|---|---|

| Whole Bean Coffee | Black Rifle Blend, AK-47 Espresso Blend | Various roasts and blends for home brewing. | Coffee enthusiasts, home brewers. |

| Ground Coffee | Silversmith Blend, Colombian Supremo | Pre-ground coffee for convenience. | Busy individuals, those preferring convenience. |

| Ready-to-Drink Coffee | Cold Brew, Iced Coffee | Pre-made coffee options for on-the-go consumption. | Consumers seeking quick and convenient coffee options. |

| Merchandise | T-shirts, mugs, hats | Branded apparel and accessories. | Brand loyalists, those seeking military-themed merchandise. |

Stock Market Performance

Black Rifle Coffee’s stock performance since its initial public offering (IPO) has been marked by periods of both significant growth and volatility. Specific events such as quarterly earnings reports, broader market trends, and any news related to the company’s brand image have significantly influenced its stock price. Comparing BRCC’s performance to established coffee companies requires considering its relatively shorter history in the public market and its unique brand positioning.

A timeline illustrating key stock price fluctuations and corresponding news events would be beneficial here. For example, a strong earnings report might correlate with a price surge, while negative publicity could lead to a decline. (Note: A detailed timeline would require access to real-time stock data and news archives, which is beyond the scope of this text-based response.)

Financial Analysis of the Company

Black Rifle Coffee’s revenue streams primarily come from direct sales of coffee and merchandise. Profit margins are influenced by factors like production costs, marketing expenses, and the pricing strategy. The company’s debt and equity structure determines its financial leverage and risk profile. Cash flow analysis provides insights into its ability to fund future growth and manage operational expenses.

A graph depicting key financial metrics like revenue, net income, and cash flow over time would be valuable. This graph could be constructed using spreadsheet software or data visualization tools. The x-axis would represent time (e.g., quarters or years), while the y-axis would represent the financial metric. Data points would be plotted, and lines connecting the points would illustrate trends over time.

(Note: Creating the actual graph requires access to BRCC’s financial statements.)

Competitive Landscape

Source: starbmag.com

Black Rifle Coffee faces competition from established coffee giants like Starbucks and Dunkin’, as well as other specialty coffee brands. BRCC differentiates itself through its strong brand identity, emphasizing patriotism and military affiliation. This resonates with a specific target audience but might alienate others. The company’s competitive advantages lie in its brand loyalty and targeted marketing. However, its dependence on a niche market poses a potential disadvantage.

- Black Rifle Coffee: Focuses on a patriotic and military-themed brand, strong direct-to-consumer sales.

- Starbucks: Massive global brand, wide variety of products and locations, diverse target audience.

- Dunkin’: Large national presence, known for its convenience and affordability, broad appeal.

- Death Wish Coffee: Focuses on high-caffeine coffee, appealing to a specific consumer base.

Factors Influencing Stock Price, Black rifle coffee stock price

Source: recoilweb.com

Tracking the Black Rifle Coffee stock price can be interesting, especially when comparing its performance to other companies in the market. For instance, consider the current trajectory of the gtl infra stock price , a completely different sector, to see how varied market trends can be. Understanding these diverse movements helps contextualize Black Rifle Coffee’s own stock price fluctuations and potential future growth.

Several factors can positively or negatively influence BRCC’s stock price. Successful new product launches, expansion into new markets, and positive media coverage can boost investor confidence. Conversely, economic downturns, shifting consumer preferences, negative publicity, and increased competition can lead to price declines. Social media sentiment plays a significant role, as positive or negative online discussions can influence investor perception and market behavior.

Macroeconomic factors, such as inflation and interest rates, also impact consumer spending and overall market sentiment, indirectly affecting BRCC’s stock price.

Future Outlook and Predictions

Black Rifle Coffee’s future growth hinges on its ability to expand its product line, reach new markets, and maintain its brand image. Potential risks include increased competition, changing consumer tastes, and potential brand controversies. Predicting the stock price with certainty is impossible, but based on current market trends and company performance, a reasoned prediction could be made, perhaps by referencing similar companies’ growth trajectories.

This would require extensive market research and financial modeling.

| Scenario | Description | Impact on Stock Price | Probability |

|---|---|---|---|

| Continued Growth | Successful new product launches, expansion into new markets, strong brand loyalty. | Positive, significant price increase. | Medium |

| Stagnant Growth | Slow sales growth, increased competition, negative publicity. | Little to no change or slight decrease. | Medium |

| Declining Growth | Significant economic downturn, major brand crisis, loss of market share. | Significant price decrease. | Low |

Essential FAQs: Black Rifle Coffee Stock Price

What is Black Rifle Coffee’s primary target market?

Primarily, their target market is patriotic Americans, veterans, and those who appreciate their brand’s strong association with military and conservative values.

How does Black Rifle Coffee’s stock price compare to other publicly traded coffee companies?

A direct comparison requires analyzing specific metrics and timeframes. Performance varies greatly depending on company size, market position, and overall financial health. Further research is needed to provide a precise comparison.

What are the major risks associated with investing in Black Rifle Coffee stock?

Risks include competition from established coffee giants, economic downturns impacting consumer spending, and potential negative publicity affecting brand perception.

Does Black Rifle Coffee pay dividends?

Dividend payments are determined by the company’s board of directors and depend on its financial performance. Investors should consult official company announcements for the most up-to-date information.