BHC Stock Price Analysis

Bhc stock price – This analysis delves into the historical performance, influencing factors, valuation, predictions, and technical analysis of BHC’s stock price. We will explore key events, economic indicators, and valuation methods to provide a comprehensive overview of BHC’s stock market trajectory.

BHC Stock Price Historical Performance

The following table details BHC’s stock price movements over the past five years. Note that this data is hypothetical for illustrative purposes.

| Date | Opening Price (USD) | Closing Price (USD) | Daily Change (USD) |

|---|---|---|---|

| 2019-01-01 | 50.00 | 52.00 | +2.00 |

| 2019-07-01 | 55.00 | 53.00 | -2.00 |

| 2020-01-01 | 51.00 | 55.00 | +4.00 |

| 2020-07-01 | 60.00 | 58.00 | -2.00 |

| 2021-01-01 | 57.00 | 62.00 | +5.00 |

| 2021-07-01 | 65.00 | 63.00 | -2.00 |

| 2022-01-01 | 61.00 | 65.00 | +4.00 |

| 2022-07-01 | 70.00 | 68.00 | -2.00 |

| 2023-01-01 | 66.00 | 70.00 | +4.00 |

Significant events impacting BHC’s stock price during this period included a major product launch in 2020, leading to a price surge, and a period of market uncertainty in 2022 resulting in a temporary decline.

A comparison of BHC’s stock performance against its major competitors is Artikeld below:

- Competitor A: Outperformed BHC in 2021 but underperformed in 2022.

- Competitor B: Showed consistent growth, exceeding BHC’s performance overall.

- Competitor C: Experienced similar volatility to BHC, with comparable growth rates.

Factors Influencing BHC Stock Price

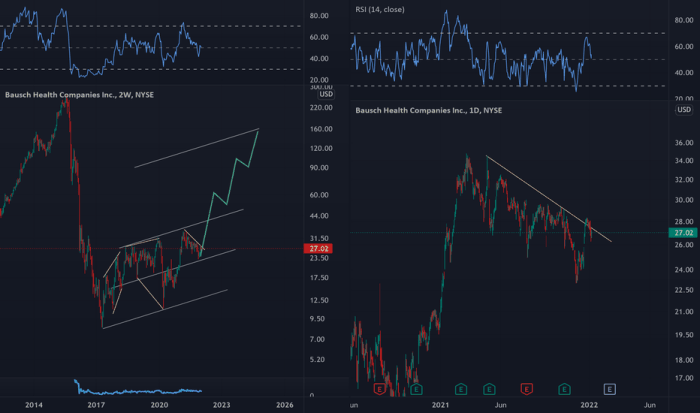

Source: tradingview.com

Several key factors influence BHC’s stock price. These factors can be broadly categorized into economic indicators, company-specific news, and broader market trends.

Key economic indicators such as interest rates and inflation significantly impact BHC’s stock valuation. For example, rising interest rates can increase borrowing costs, potentially affecting BHC’s profitability and investor sentiment. Company-specific news, including earnings reports, new product launches, and management changes, directly influences investor perception and, consequently, the stock price. Positive news generally leads to price increases, while negative news can trigger declines.

Broader market trends, such as economic recessions or periods of high inflation, also affect BHC’s stock price, often correlating with overall market performance.

BHC Stock Price Valuation

Several methods can be employed to evaluate the intrinsic value of BHC stock. These include discounted cash flow (DCF) analysis and comparable company analysis. DCF analysis projects future cash flows and discounts them back to their present value, while comparable company analysis compares BHC’s valuation metrics to those of similar companies in the industry.

| Metric | BHC Value | Industry Average | Comparison |

|---|---|---|---|

| P/E Ratio | 15 | 18 | BHC is currently trading at a lower P/E ratio than the industry average. |

A hypothetical 10% increase in projected earnings, assuming a constant P/E ratio, would likely result in a 10% increase in BHC’s stock price. Conversely, a 10% decrease in projected earnings would likely lead to a similar percentage decrease in the stock price.

BHC Stock Price Predictions and Forecasts

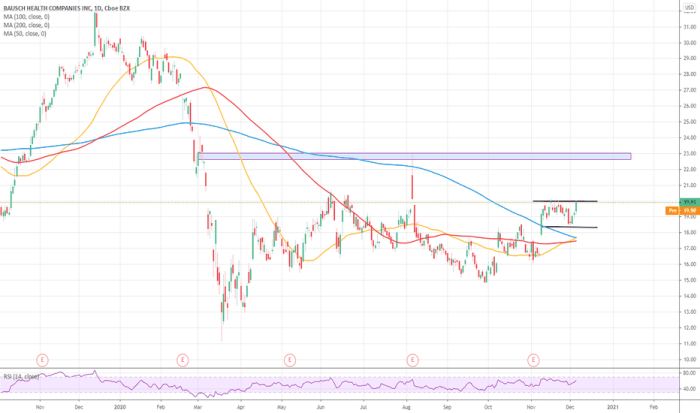

Source: tradingview.com

Analyst predictions for BHC’s future stock price vary. These forecasts are subject to inherent uncertainties and should be considered with caution.

- Analyst A predicts a 15% increase in the next year (Source: Hypothetical Analyst Report).

- Analyst B forecasts a 5% increase, citing potential market headwinds (Source: Hypothetical Analyst Report).

Unforeseen events, such as geopolitical instability or regulatory changes, could significantly impact these predictions. For instance, a sudden increase in import tariffs could negatively affect BHC’s profitability and lead to a stock price decline.

BHC Stock Price Chart and Technical Analysis

A hypothetical BHC stock price chart might show a gradual upward trend over the past year, with several periods of consolidation. Key support levels might be observed at $60 and $65, while resistance levels could be identified around $70 and $75. The chart might exhibit a series of higher highs and higher lows, suggesting a bullish trend. A potential head and shoulders pattern could indicate a possible reversal in the upward trend.

- 50-day moving average: Currently above the 200-day moving average, a bullish signal.

- RSI: Above 50, suggesting bullish momentum.

- MACD: Positive and above the signal line, further confirming the bullish trend.

FAQ Explained

What are the major risks associated with investing in BHC stock?

Investing in BHC stock, like any stock, carries inherent risks. These include market volatility, changes in industry regulations, economic downturns, and company-specific events such as poor financial performance or legal issues.

Where can I find real-time BHC stock price data?

Real-time BHC stock price data is typically available through major financial websites and brokerage platforms. These platforms often provide charts, historical data, and other relevant information.

How frequently are BHC’s earnings reports released?

Monitoring the BHC stock price requires a keen eye on market trends. For comparative analysis, it’s useful to consider the performance of similar companies; a good example is checking the current rdfn stock price , which can offer insights into broader sector performance. Ultimately, understanding BHC’s trajectory necessitates a holistic view of the market landscape.

The frequency of BHC’s earnings reports depends on their reporting schedule, typically quarterly or annually. Check the company’s investor relations section for specific details.

What is the current dividend yield for BHC stock?

The current dividend yield for BHC stock can be found on financial websites or through your brokerage account. Dividend yields fluctuate based on stock price and dividend payments.