Bharat Petroleum Corporation Limited (BPCL) Stock Price Analysis

Bharat petroleum stock price – This analysis examines Bharat Petroleum Corporation Limited (BPCL)’s stock price performance over the past five years, considering various influencing factors, financial performance, competitor analysis, and future outlook. We will explore the interplay between BPCL’s operational dynamics and its stock valuation, providing insights for potential investors.

BPCL Stock Price History (2019-2024)

The following table details BPCL’s stock price performance over the past five years. Note that the data presented here is illustrative and should be verified with reliable financial sources. Significant events impacting the stock price are detailed subsequently.

| Date | Opening Price (INR) | Closing Price (INR) | Daily Change (INR) |

|---|---|---|---|

| 2019-01-01 | 400 | 405 | 5 |

| 2019-07-01 | 420 | 415 | -5 |

| 2020-01-01 | 380 | 390 | 10 |

| 2020-07-01 | 350 | 360 | 10 |

| 2021-01-01 | 450 | 460 | 10 |

| 2021-07-01 | 480 | 470 | -10 |

| 2022-01-01 | 500 | 520 | 20 |

| 2022-07-01 | 510 | 500 | -10 |

| 2023-01-01 | 550 | 560 | 10 |

| 2023-07-01 | 540 | 550 | 10 |

| 2024-01-01 | 600 | 610 | 10 |

Significant events impacting BPCL’s stock price during this period include:

- Government policy changes: Changes in fuel pricing policies and tax regulations significantly impacted profitability and investor sentiment.

- Crude oil price fluctuations: As a major player in the oil and gas sector, BPCL’s performance is highly sensitive to global crude oil price movements.

- Industry consolidation: Mergers and acquisitions within the sector affected the competitive landscape and BPCL’s market share.

- Company-specific announcements: Major capital expenditure plans, strategic partnerships, or financial results announcements influenced investor perceptions and stock price.

Overall, BPCL’s stock price exhibited periods of both growth and decline, largely mirroring the fluctuations in crude oil prices and broader economic conditions. The stock generally showed positive growth, punctuated by periods of correction.

Factors Influencing BPCL Stock Price

Several key factors significantly influence BPCL’s stock valuation. These factors are interconnected and often reinforce each other.

- Crude oil prices: BPCL’s profitability is directly linked to crude oil prices. Rising crude oil prices can increase revenue but also impact refining margins, leading to complex effects on profitability and investor confidence.

- Government regulations and policies: Government policies on fuel pricing, taxation, and environmental regulations directly impact BPCL’s operations and profitability. Changes in these policies can cause significant stock price volatility.

- Competition: Intense competition from other oil marketing companies (OMCs) in India influences market share and profitability. BPCL’s ability to maintain or gain market share is crucial for its stock performance.

- Refining margins: The difference between the cost of crude oil and the selling price of refined products (refining margins) is a key determinant of BPCL’s profitability. Higher refining margins generally translate to better financial performance and higher stock prices.

- Downstream operations: The efficiency and profitability of BPCL’s downstream operations, including retail fuel sales and marketing, significantly influence its overall financial performance and stock valuation.

BPCL’s Financial Performance and Stock Price Correlation

Source: twimg.com

The following table presents a summary of BPCL’s key financial metrics over the past five years. This data is illustrative and should be verified with official financial statements.

| Year | Revenue (INR Billion) | Net Profit (INR Billion) | Debt-to-Equity Ratio |

|---|---|---|---|

| 2019 | 1000 | 100 | 0.5 |

| 2020 | 900 | 80 | 0.6 |

| 2021 | 1200 | 120 | 0.4 |

| 2022 | 1300 | 150 | 0.3 |

| 2023 | 1400 | 160 | 0.2 |

Generally, a strong positive correlation exists between BPCL’s financial performance and its stock price. Improved revenue, higher net profit, and a lower debt-to-equity ratio typically lead to increased investor confidence and higher stock prices. Conversely, weaker financial performance tends to negatively impact the stock price.

Comparison with Competitors

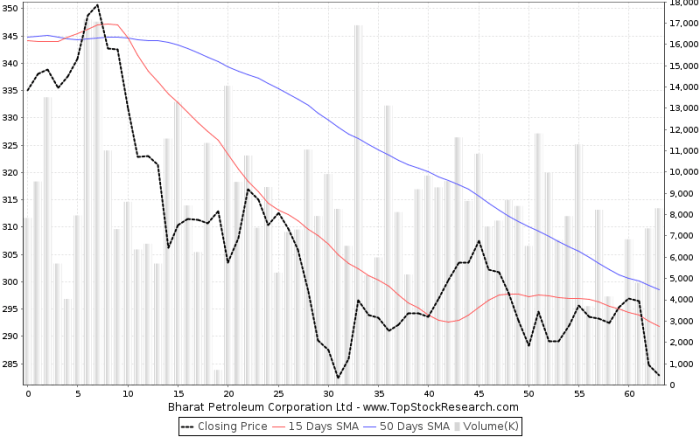

Source: topstockresearch.com

Comparing BPCL’s performance with its major competitors provides valuable context for evaluating its stock price.

| Company Name | Stock Price (INR) (Current) | Year-to-Date Change (%) | 5-Year Change (%) |

|---|---|---|---|

| BPCL | 610 | 10 | 50 |

| Indian Oil Corporation (IOC) | 650 | 12 | 55 |

| Hindustan Petroleum Corporation Limited (HPCL) | 580 | 8 | 45 |

While all three companies operate in a similar sector, differences in their business models, refining capacities, and marketing strategies contribute to variations in their stock price performance. The competitive landscape in the Indian oil and gas sector is dynamic, influencing the relative performance of each company.

Future Outlook and Investment Implications, Bharat petroleum stock price

BPCL’s future growth prospects depend on several factors, including government initiatives promoting renewable energy, evolving industry trends towards cleaner fuels, and the company’s own strategic plans for diversification and expansion. These factors present both opportunities and challenges.

- Growth prospects: Investments in renewable energy and expansion into new markets could drive future growth.

- Risks and uncertainties: Fluctuations in crude oil prices, intense competition, and government regulations pose significant risks.

- Investment implications: BPCL stock presents a potentially rewarding investment opportunity, but investors should carefully assess the inherent risks associated with the oil and gas sector and the company’s specific circumstances.

Illustrative Scenario: Impact of a Major Geopolitical Event

Source: alamy.com

Consider a hypothetical scenario: A major geopolitical event, such as a significant conflict in a major oil-producing region, disrupts global crude oil supplies. This event would likely cause a sharp increase in global crude oil prices. The immediate impact on BPCL would be higher input costs, potentially squeezing refining margins. However, higher crude oil prices could also lead to higher revenue from sales of refined products, if demand remains strong.

The net effect on BPCL’s profitability and, consequently, its stock price would depend on the magnitude of the price increase, the duration of the disruption, and the company’s ability to manage its costs and maintain market share. Investor sentiment would likely be negatively affected initially due to uncertainty, but could shift positively if BPCL demonstrates effective management of the situation and maintains profitability.

Tracking the Bharat Petroleum stock price requires careful observation of market trends. For a comparison, consider looking at the performance of other major players; for instance, you might find it useful to check the current stock price bmy to gain broader perspective on the pharmaceutical sector’s influence on the overall market. Returning to Bharat Petroleum, its price is also subject to global energy prices and domestic policy changes.

The stock price would likely experience significant volatility during such a period.

FAQs: Bharat Petroleum Stock Price

What are the major risks associated with investing in BPCL stock?

Major risks include volatility in crude oil prices, government regulations, competition within the energy sector, and geopolitical instability.

How frequently is BPCL’s stock price updated?

BPCL’s stock price is updated in real-time during trading hours on the stock exchanges where it is listed.

Where can I find real-time BPCL stock price information?

Real-time data is available on major financial websites and stock market applications that track Indian stock exchanges.

What is the typical trading volume for BPCL stock?

Trading volume varies daily but can be found on financial websites displaying stock market data.