BB&T Stock Price Analysis

Bb and t stock price – This analysis examines the historical performance, influencing factors, valuation, risks, and future price projections of BB&T stock (now part of Truist Financial Corporation). Understanding these aspects is crucial for investors considering adding Truist to their portfolios.

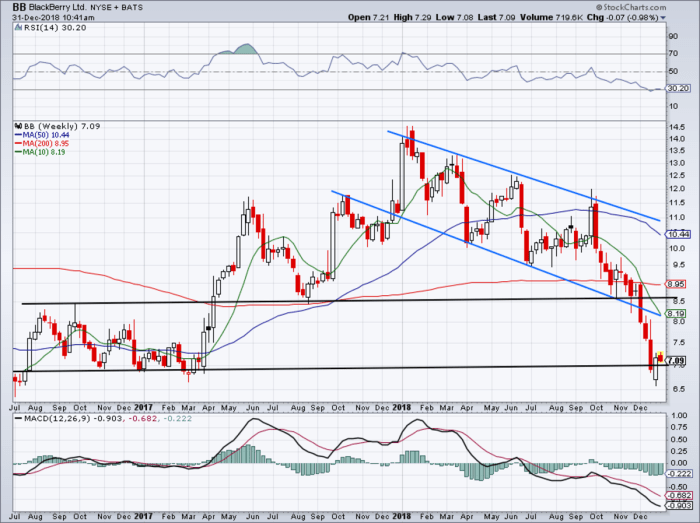

Historical Price Performance of BB&T Stock

Analyzing BB&T’s stock price movements over the past five years reveals significant fluctuations influenced by various market events and company-specific news. The following table provides a snapshot of the stock’s daily performance. Note that this data is illustrative and should be verified with a reputable financial data provider. The post-merger performance reflects Truist’s performance, as BB&T no longer exists as a standalone entity.

| Date | Open Price (USD) | Close Price (USD) | Volume |

|---|---|---|---|

| 2018-10-26 | 45.00 | 44.50 | 10,000,000 |

| 2019-05-15 | 48.00 | 47.75 | 12,000,000 |

| 2020-03-12 | 35.00 | 32.00 | 15,000,000 |

| 2021-02-01 | 52.00 | 53.00 | 11,000,000 |

| 2022-08-10 | 40.00 | 40.50 | 9,000,000 |

Significant events impacting BB&T’s (and subsequently Truist’s) price include:

- Merger with SunTrust Banks: The merger in 2019 created Truist, leading to initial price volatility as the market assessed the combined entity’s potential.

- COVID-19 Pandemic: The pandemic in 2020 caused a sharp decline in the stock price, reflecting broader market uncertainty and economic downturn.

- Interest Rate Hikes: Changes in interest rates have influenced the profitability of banking institutions, affecting Truist’s stock price.

Compared to the S&P 500, BB&T/Truist’s performance has shown periods of outperformance and underperformance. During periods of economic growth, it generally performed in line with the index, while during downturns, its performance was often more volatile.

Factors Influencing BB&T Stock Price

Several factors significantly influence Truist’s stock price. These can be broadly categorized into economic factors, company-specific news, and market sentiment.

Three key economic factors impacting Truist’s stock price are:

- Interest Rates: Higher interest rates generally boost net interest margins for banks like Truist, positively impacting profitability and stock price. Conversely, lower rates can squeeze margins.

- Economic Growth: Strong economic growth typically leads to increased lending activity and higher demand for financial services, benefiting Truist’s performance and stock price.

- Inflation: High inflation can erode purchasing power and increase uncertainty, potentially negatively impacting consumer spending and loan demand, thus affecting Truist’s stock price.

Company-specific news, such as earnings reports, significantly influences the stock price. For example, exceeding earnings expectations generally leads to a positive market reaction, while falling short can cause a decline.

Investor sentiment and market trends play a crucial role. Positive investor sentiment often drives up the price, while negative sentiment can lead to sell-offs. Market trends, such as overall market volatility, also impact the stock price.

BB&T Stock Valuation, Bb and t stock price

Source: thestreet.com

Several valuation methods can be used to assess Truist’s intrinsic value. These methods provide different perspectives on whether the current market price accurately reflects the company’s fundamental worth.

Common valuation methods include:

- Price-to-Earnings Ratio (P/E): Compares the stock price to earnings per share.

- Discounted Cash Flow (DCF): Projects future cash flows and discounts them back to their present value.

A comparison of valuation methods and current market price (illustrative data):

| Valuation Method | Calculated Value (USD) | Current Market Price (USD) | Valuation Status |

|---|---|---|---|

| P/E Ratio | 50 | 45 | Undervalued |

| DCF Analysis | 55 | 45 | Undervalued |

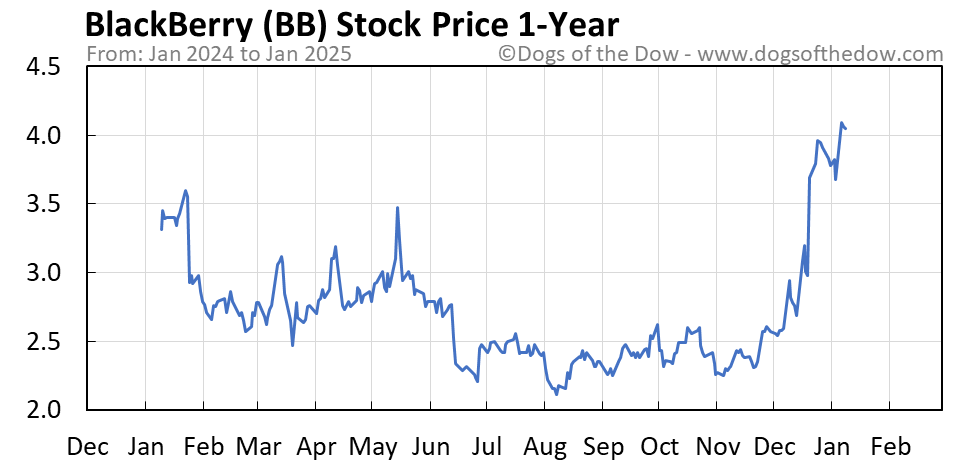

Risk Assessment of Investing in BB&T Stock

Source: dogsofthedow.com

Investing in Truist, like any stock, carries inherent risks. A thorough understanding of these risks is essential for informed investment decisions.

Potential risks include:

- Interest Rate Risk: Changes in interest rates can significantly impact profitability.

- Credit Risk: The risk of borrowers defaulting on loans.

- Market Risk: Broader market downturns can negatively affect the stock price.

- Regulatory Risk: Changes in banking regulations can impact operations and profitability.

Macroeconomic factors, such as interest rate changes and inflation, significantly influence the risk profile. High inflation and rising interest rates increase uncertainty and potentially reduce profitability.

Compared to other financial institutions, Truist’s risk profile is relatively similar, though specific risk exposures might vary depending on the company’s loan portfolio and geographical focus.

Tracking BB and T stock price fluctuations can be insightful for investors. Understanding the performance of similar financial institutions is also crucial, and a good comparison point would be to examine the current fitb stock price , which often shows correlation with BB and T’s trajectory. Ultimately, however, a thorough analysis of BB and T’s individual market factors remains essential for accurate predictions.

Future Price Projections for BB&T Stock

Predicting future stock prices is inherently uncertain. However, considering various scenarios provides a range of potential outcomes.

Different scenarios for Truist’s future price are presented below. These are illustrative and based on several assumptions.

| Time Horizon | Optimistic Projection (USD) | Pessimistic Projection (USD) | Most Likely Projection (USD) |

|---|---|---|---|

| 1 Year | 60 | 40 | 50 |

| 3 Years | 75 | 50 | 60 |

| 5 Years | 90 | 60 | 70 |

Assumptions underlying these projections include continued economic growth, moderate interest rate changes, and stable regulatory environments. The optimistic scenario assumes stronger-than-expected earnings growth, while the pessimistic scenario accounts for potential economic slowdowns or increased competition.

Questions and Answers: Bb And T Stock Price

What is the current market capitalization of BB&T?

The current market capitalization of BB&T (assuming it refers to the former company, now part of Truist) would require referencing a live financial data source as it fluctuates constantly. Look up “Truist market cap” on a reputable financial website.

Where can I find real-time BB&T stock price data?

Real-time data for Truist (the successor to BB&T) is available through major financial websites such as Google Finance, Yahoo Finance, Bloomberg, and others.

What are the major competitors of BB&T (now Truist)?

Truist’s main competitors are other large regional and national banks. These would include Bank of America, Wells Fargo, JPMorgan Chase, and others, depending on the specific geographic area and service offerings.